- United States

- /

- Pharma

- /

- NYSE:BMY

Is Bristol-Myers Squibb Set for a Turnaround After 13% Bounce and New Drug Approval News?

Reviewed by Bailey Pemberton

- Wondering if Bristol-Myers Squibb is currently undervalued or just flying under the radar? You are not alone; plenty of curious investors are trying to gauge what this moment means for the stock's long-term potential.

- After several months of declines, Bristol-Myers Squibb shares have bounced 5.6% over the last week and 12.7% over the past month. This hints at renewed interest or shifting market perceptions.

- Recently, headlines around new drug approvals and speculation about potential mergers have set the stage for the latest moves in the share price. This news adds fresh context to investors' views and might be driving some of the volatility we have seen.

- Based on our valuation checks, Bristol-Myers Squibb scores a 5 out of 6 on our undervaluation scorecard. This suggests there could be upside if the market is missing something. We will break down those valuation approaches next, and introduce a perspective that goes beyond the numbers at the end of the article.

Find out why Bristol-Myers Squibb's -11.8% return over the last year is lagging behind its peers.

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

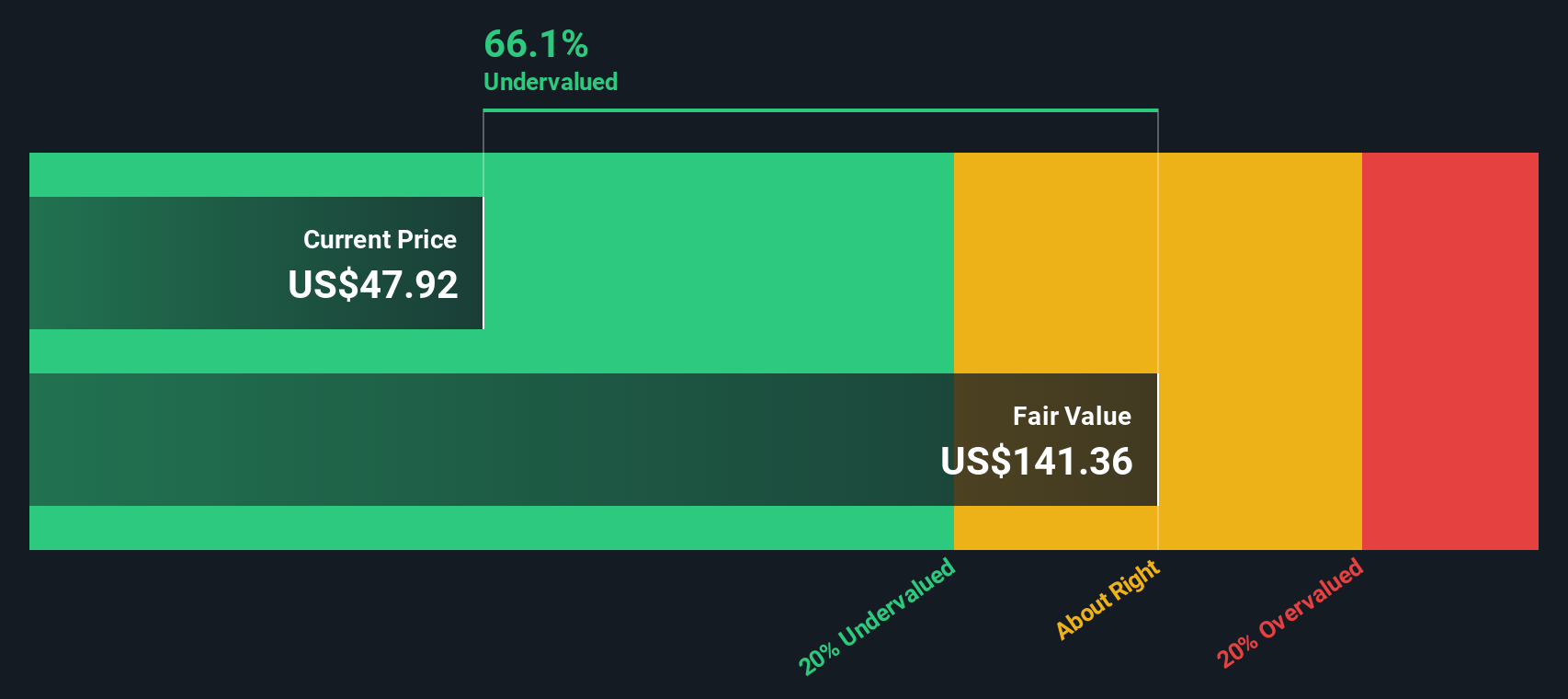

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to their present value. This approach aims to determine what Bristol-Myers Squibb is truly worth today based on expectations for future performance.

Bristol-Myers Squibb currently generates Free Cash Flow of $15.34 billion. Analyst projections forecast annual FCF to remain in the range of $13.46 billion to $13.64 billion over the next several years. Further estimates are extrapolated by Simply Wall St. By the year 2029, Free Cash Flow is expected to reach approximately $11.76 billion.

Using a two-stage Free Cash Flow to Equity model, the DCF approach values Bristol-Myers Squibb shares at about $127.44. Compared to the current market price, this valuation implies the stock is trading at a 61.5 percent discount. In other words, the DCF analysis suggests that Bristol-Myers Squibb may be significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 61.5%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

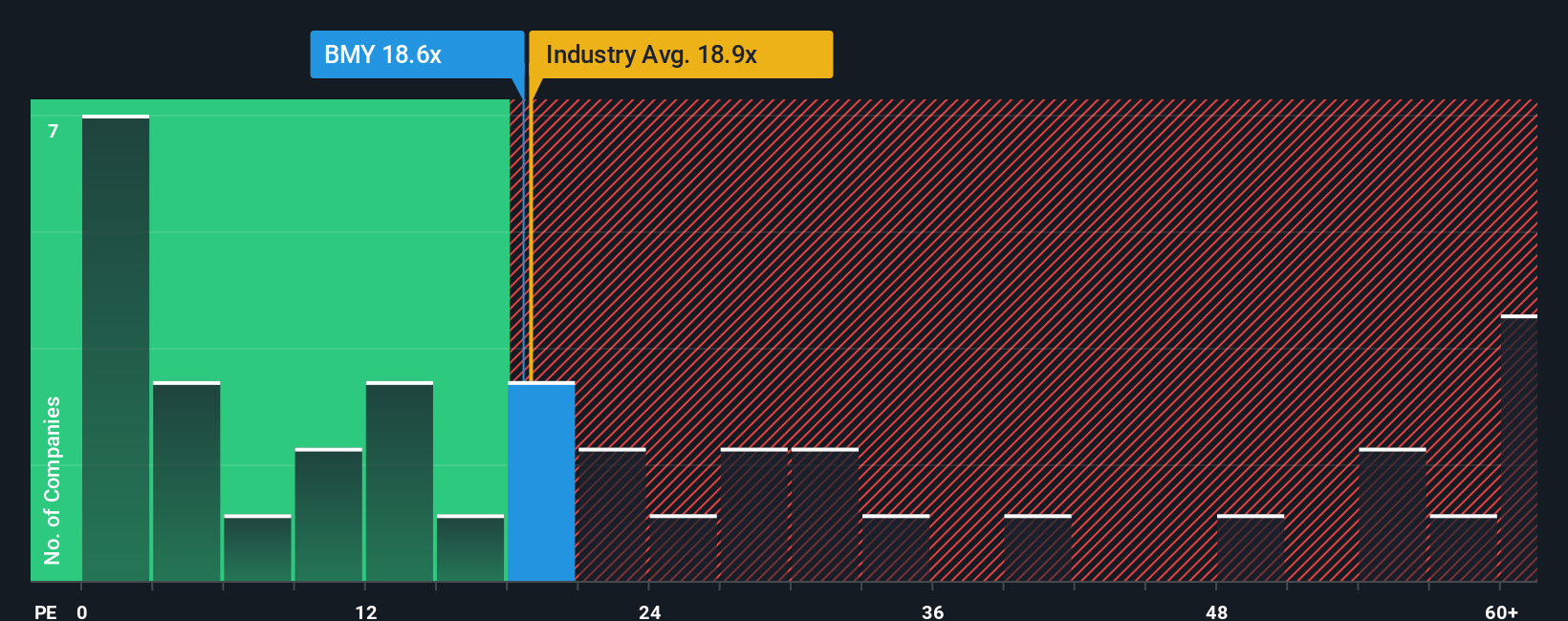

Approach 2: Bristol-Myers Squibb Price vs Earnings

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation because it directly measures how much investors are willing to pay for each dollar of reported profits. The PE ratio works well as it factors in not just current earnings, but, implicitly, market expectations for growth and risk.

In Bristol-Myers Squibb's case, the current PE ratio stands at 16.54x. This is noticeably lower than the Pharmaceuticals industry average of 18.14x and even further below the peer average of 22.16x. A lower PE might signal that the market expects less growth, or it could indicate that the stock is trading at a discount compared to its peers.

To get a clearer picture, Simply Wall St calculates a tailored "Fair Ratio." This proprietary multiple takes into account not only industry trends and earnings growth but also factors like profit margins, market cap, and company-specific risks. By considering these elements, the Fair Ratio provides a more precise benchmark than a simple peer or industry average.

For Bristol-Myers Squibb, the Fair Ratio is 24.16x. This is substantially higher than the current PE of 16.54x, suggesting that, given its fundamentals, the market may be undervaluing the stock relative to what would be considered "fair" for its profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

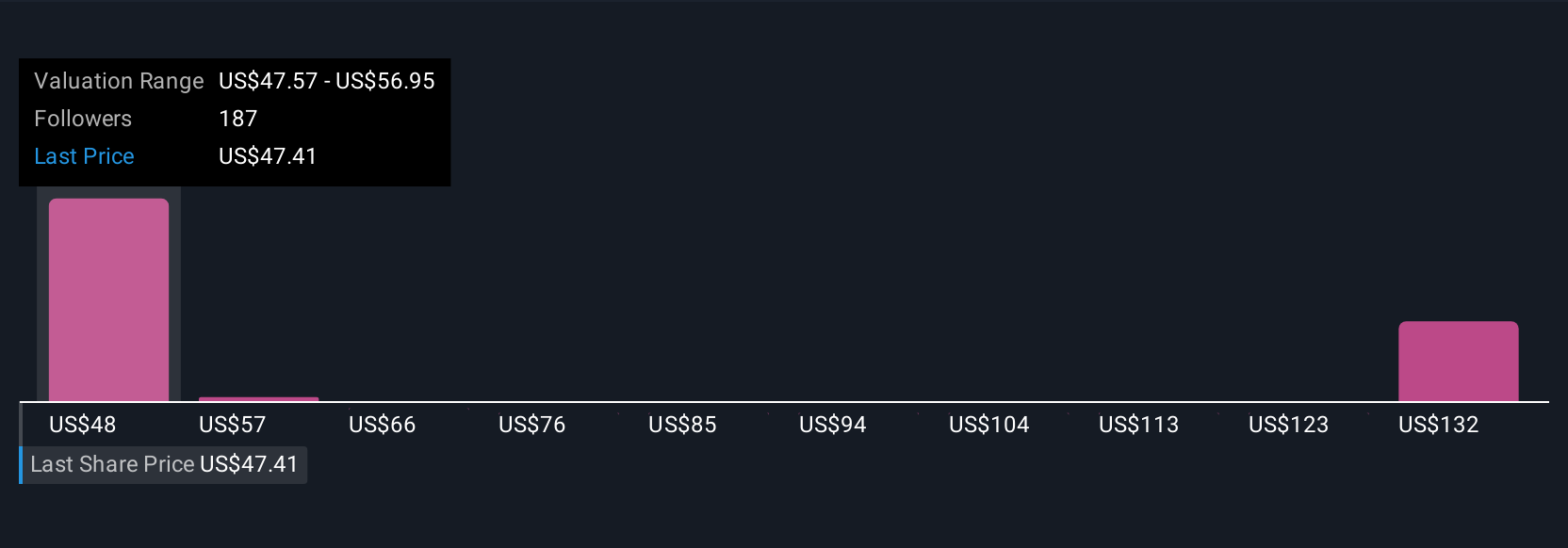

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives—a smarter and more dynamic way to help investors go beyond the numbers. A Narrative is simply your own story or perspective about a company, tying together your opinions about its future with financial forecasts such as fair value, estimated revenue, and projected earnings or profit margins.

Instead of just relying on static models, Narratives connect Bristol-Myers Squibb’s business story, such as progress on new drugs, patent risks, or changes in the healthcare landscape, directly to financial outcomes and a personalized fair value. On Simply Wall St’s popular Community page, Narratives let you quickly frame your buy or sell decision by comparing your own Fair Value with today’s share price, and visually see how your outlook stacks up against other investors. The best part? Narratives update automatically as the latest news or earnings come in, so your views stay relevant and informed.

For example, some investors believe Bristol-Myers Squibb, with a bullish price target of $68, will outperform as new therapies gain momentum. More cautious investors see potential downside to $34 if key drugs face competition or pipeline launches disappoint. Narratives make it easy to understand and act on both views in real time.

Do you think there's more to the story for Bristol-Myers Squibb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives