- United States

- /

- Life Sciences

- /

- NYSE:BIO

Bio-Rad Laboratories (BIO): Evaluating Valuation After Major Oncology Diagnostics Partnership Expansion with Biodesix

Reviewed by Simply Wall St

Bio-Rad Laboratories and Biodesix are expanding their partnership to develop and clinically validate new in vitro diagnostic assays targeting oncology applications. They are leveraging Bio-Rad's Droplet Digital PCR technology for more precise cancer detection.

See our latest analysis for Bio-Rad Laboratories.

Bio-Rad’s share price has gathered impressive momentum lately, jumping 22.8% over the past month and 28.6% in the last quarter. The total shareholder return over five years remains deeply negative. This recent surge follows a wave of innovation milestones, including regulatory advances for its diagnostic products and the new partnership with Biodesix. These developments suggest that investors may be re-evaluating its long-term growth prospects as the landscape for precision healthcare evolves.

If these biotech breakthroughs have you thinking about what else is possible in the sector, it’s a great time to check out opportunities with our See the full list for free.

With shares rebounding but five-year returns still lagging, the real question for investors now is whether Bio-Rad’s future growth is fully reflected in the current price or if there is a genuine buying opportunity ahead.

Most Popular Narrative: 10% Overvalued

Bio-Rad’s latest price tag sits noticeably higher than the consensus narrative’s fair value. With shares at $339.75 and the most-followed view estimating fair value near $310, the divergence in expectations highlights some bold forward assumptions.

Recent launch and expansion of the QX Continuum and QX700 Series ddPCR platforms, alongside the acquisition of Stilla Technologies, positions Bio-Rad to accelerate its share capture as demand grows for advanced molecular diagnostics and precision medicine tools. This is expected to drive ddPCR revenue growth and improve margins through higher consumable pull-through and broader assay adoption.

Curious why analysts expect declining margins and still see upside? The narrative relies on ambitious product adoption, resilient recurring revenues, and a future multiple that demands closer scrutiny. Uncover which precise projections are fueling such a premium valuation for a mature life sciences player. The details just might surprise you.

Result: Fair Value of $310 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weak instrument demand or sudden shifts in public funding could undermine the upbeat outlook. This may challenge both revenue stability and future margin assumptions.

Find out about the key risks to this Bio-Rad Laboratories narrative.

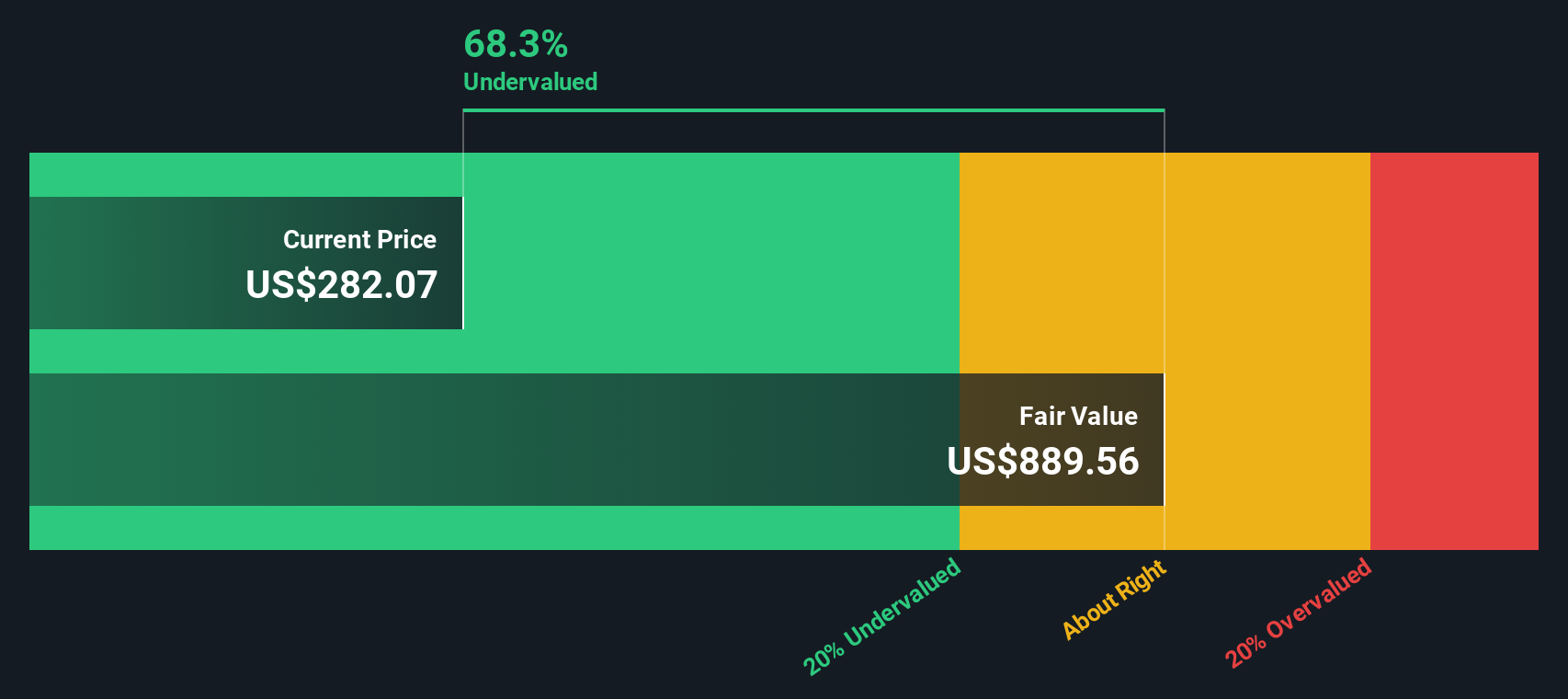

Another View: Discounted Cash Flow Model

While the consensus targets suggest Bio-Rad is overvalued based on earnings multiples, our DCF model presents a notably different perspective. The SWS DCF model estimates Bio-Rad’s fair value at an impressive $883.20 per share, which is significantly above the current market price. Could the market be missing long-term cash flow potential, or is there something in the risk profile holding shares back?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bio-Rad Laboratories Narrative

If you see the numbers differently or want to dig deeper on your own, it’s easy to construct your personalized view in just a few minutes with our Do it your way.

A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors scan beyond the headlines for tomorrow’s opportunities. Don’t miss your chance to find the next great pick in rapidly growing, overlooked, or future-focused sectors with the Simply Wall Street Screener.

- Capture growth potential by checking out these 870 undervalued stocks based on cash flows that are priced below their intrinsic value and could offer attractive long-term returns.

- Multiply your yield with these 17 dividend stocks with yields > 3% featuring companies offering robust dividend payments, ideal for building steady income into your portfolio.

- Take a front row seat to innovation through these 27 quantum computing stocks with firms paving the way in quantum computing and reshaping the tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives