- United States

- /

- Biotech

- /

- NYSE:BHVN

Why Biohaven (BHVN) Is Down 5.3% After $175M Equity Raise and Pipeline Reprioritization

Reviewed by Sasha Jovanovic

- Biohaven Ltd. has completed a follow-on equity offering of approximately US$175 million, issuing over 23 million common shares at US$7.50 each alongside leadership changes in its underwriting team.

- The capital raise comes just days after a regulatory setback for its VYGLXIA program, prompting Biohaven to reprioritize its R&D pipeline and implement a substantial reduction in research spending.

- We'll explore how Biohaven's swift capital raise following the FDA's Complete Response Letter impacts its investment narrative and future priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Biohaven's Investment Narrative?

To believe in Biohaven right now, you need confidence in the company's ability to reposition quickly after setbacks and execute on its pipeline with discipline. The recent US$175 million equity raise, coming just after the setback on VYGLXIA and accompanied by a sharp reduction in R&D spending, is a clear pivot, allowing Biohaven to extend its cash runway and shift focus to clinical assets with potentially clearer regulatory paths. For investors, the biggest near-term catalyst has shifted away from VYGLXIA approval and towards progress in BHV-1400, BHV-1300, and trials in epilepsy and obesity. At the same time, the risks also evolve: dilution has increased substantially and so has near-term reliance on unproven assets in earlier stages. Recent share price declines, and the clear urgency seen in this capital raise, reflect that risk, suggesting the funding and pipeline reprioritization are indeed material, not just a footnote.

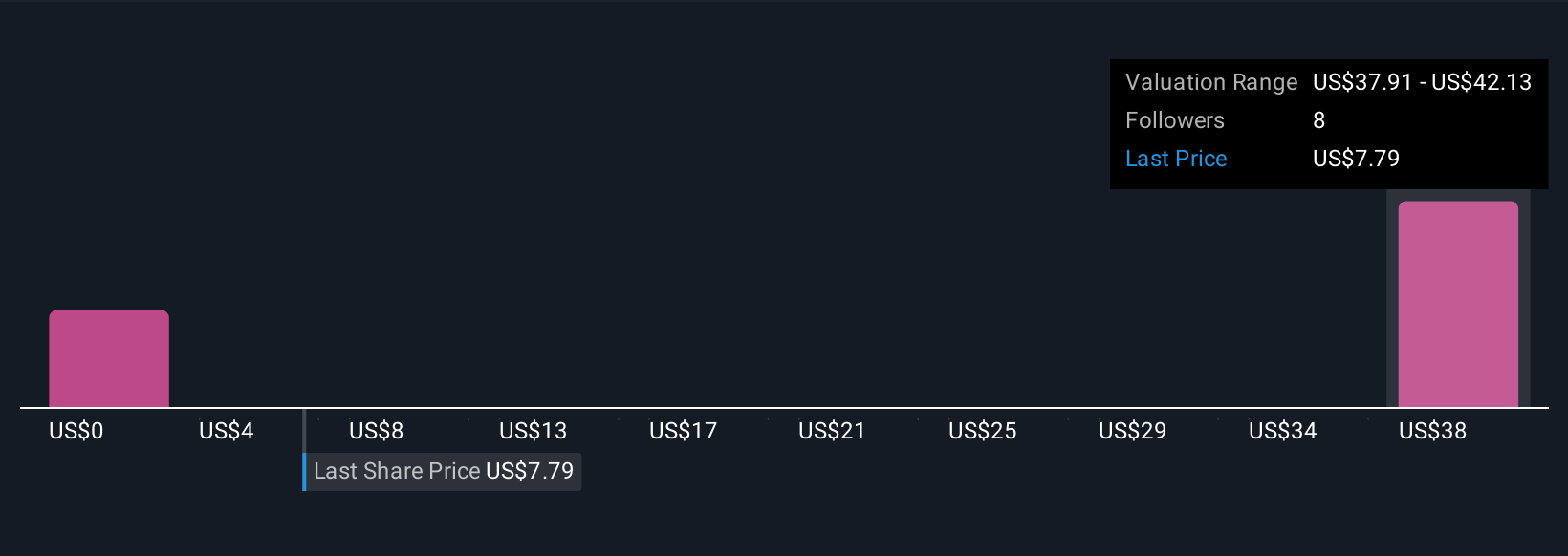

But, uncertainty around diluted share value and delayed programs now matters more than ever. Upon reviewing our latest valuation report, Biohaven's share price might be too optimistic.Exploring Other Perspectives

Explore 5 other fair value estimates on Biohaven - why the stock might be worth over 4x more than the current price!

Build Your Own Biohaven Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Biohaven research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Biohaven research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Biohaven's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biohaven might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHVN

Biohaven

Biohaven Ltd. discovers, develops, and commercializes therapies for immunology, neuroscience, and oncology worldwide.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives