- United States

- /

- Pharma

- /

- NYSE:BHC

Is Steven Lee’s Executive Appointment Altering The Investment Case For Bausch Health (BHC)?

Reviewed by Simply Wall St

- Earlier this month, Bausch Health Companies appointed Steven Lee as Senior Vice President, Controller and Chief Accounting Officer, effective July 14, 2025, marking a significant addition to its executive leadership team.

- With more than two decades of experience in financial transformation and operational execution, Mr. Lee is expected to help strengthen Bausch Health’s financial leadership and support its ongoing business initiatives.

- We'll examine how Steven Lee's extensive background in financial operations could influence Bausch Health's ongoing focus on financial flexibility and value creation.

Bausch Health Companies Investment Narrative Recap

To be a shareholder in Bausch Health Companies, you need to believe in the company’s ability to maintain financial flexibility while managing a complex range of products and geographies. The appointment of Steven Lee as Senior Vice President, Controller, and Chief Accounting Officer, adds depth to the finance leadership, but is not expected to make a material difference to the most important short-term catalyst: effective cash flow management amid high debt levels. The biggest risk remains elevated interest expenses potentially pressuring net margins and operating cash flow. Among recent announcements, Bausch Health’s $7.9 billion refinancing effort stands out as particularly relevant. This foundational move aimed at prolonging debt maturities is tightly aligned with the ongoing push for greater financial flexibility, which remains at the core of the company’s value proposition and will be front of mind for the incoming finance executive. In contrast, investors should stay alert to how rising interest expenses may impact Bausch Health’s profitability and future performance, as...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies' narrative projects $10.3 billion revenue and $1.4 billion earnings by 2028. This requires 1.8% yearly revenue growth and an earnings increase of $1.44 billion from current earnings of -$40 million.

Exploring Other Perspectives

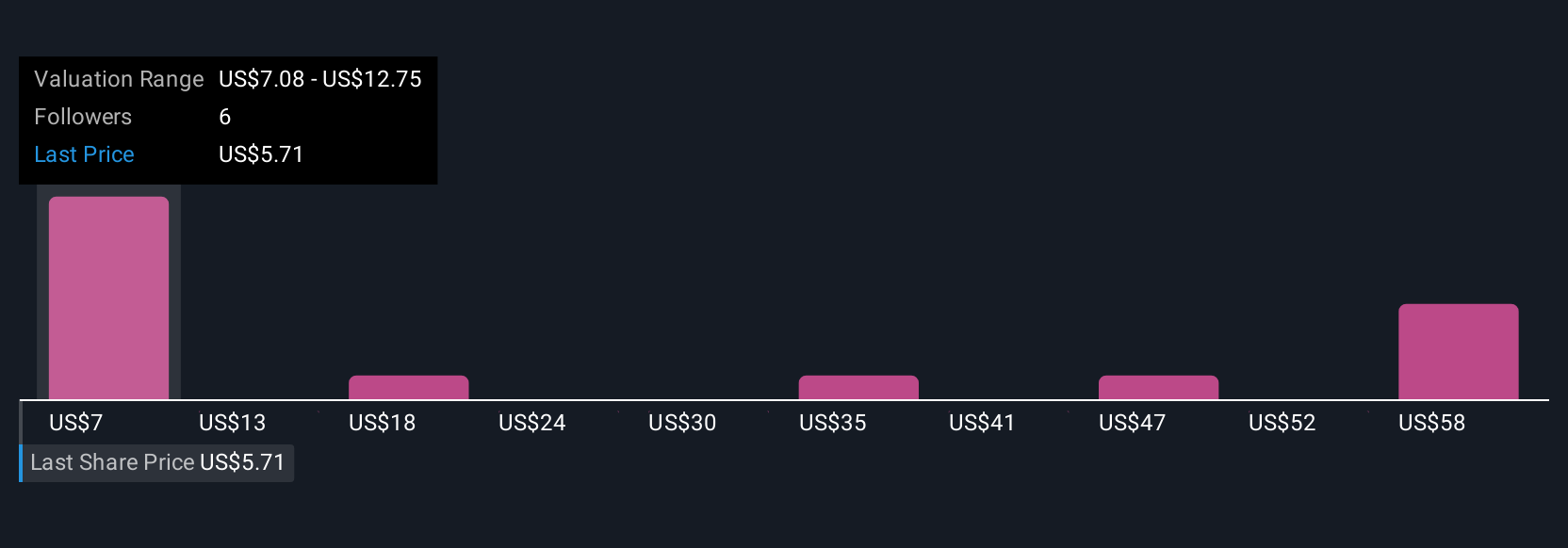

Four fair value estimates from the Simply Wall St Community span from US$7.08 to US$63.80 per share. While community views sharply diverge, broad debt refinancing and upcoming cash flow needs remain crucial considerations for anyone evaluating Bausch Health’s outlook.

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives