- United States

- /

- Pharma

- /

- NYSE:BHC

Is Bausch Health Stock a Bargain After Recent Strategic Realignments and Volatile Price Moves?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Bausch Health Companies is undervalued or primed for a turnaround, you are not alone. Let us cut through the market noise for you.

- Bausch’s stock price has been on a wild ride recently, down 5.6% over the last week, yet up 4.3% over the past month. This hints at shifting investor sentiment and potential volatility.

- News around Bausch Health has centered on industry partnerships and strategic realignments, with increased attention on its product pipeline and new licensing deals. These updates have sparked fresh debates on the company’s long-term outlook and what the future holds for its valuation.

- According to our analysis, Bausch Health Companies scores a 5 out of 6 on our valuation checks. This suggests it might be a good value pick. Now, let’s break down how different valuation approaches assess the stock before revealing an even better way to judge its real worth by the end of this article.

Find out why Bausch Health Companies's -25.9% return over the last year is lagging behind its peers.

Approach 1: Bausch Health Companies Discounted Cash Flow (DCF) Analysis

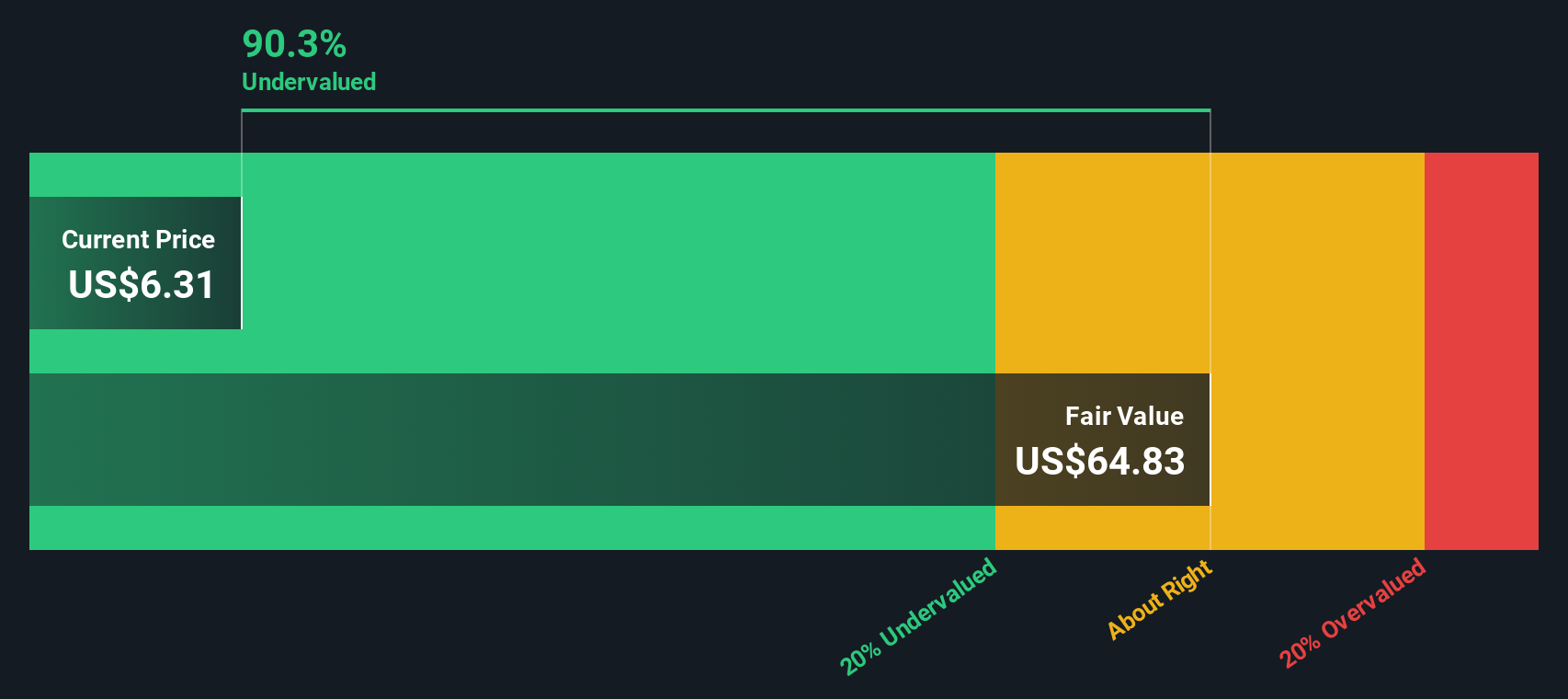

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its expected future cash flows and then discounting them back to today’s value. This approach aims to calculate an intrinsic valuation based on a company’s ability to generate cash over time.

Bausch Health Companies currently reports Free Cash Flow of $1.14 billion. While analysts provide detailed forecasts for the next five years, the model also extrapolates beyond that using estimates to capture potential long-term trends. For example, projections show Free Cash Flow could reach $2.39 billion by 2029, based on both analyst inputs and trend-based extrapolations.

After accounting for these cash flows and discounting them appropriately, the DCF analysis values Bausch Health Companies at $68.71 per share. This is a substantial increase compared with the current trading price. According to this model, the stock is 90.9% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bausch Health Companies is undervalued by 90.9%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

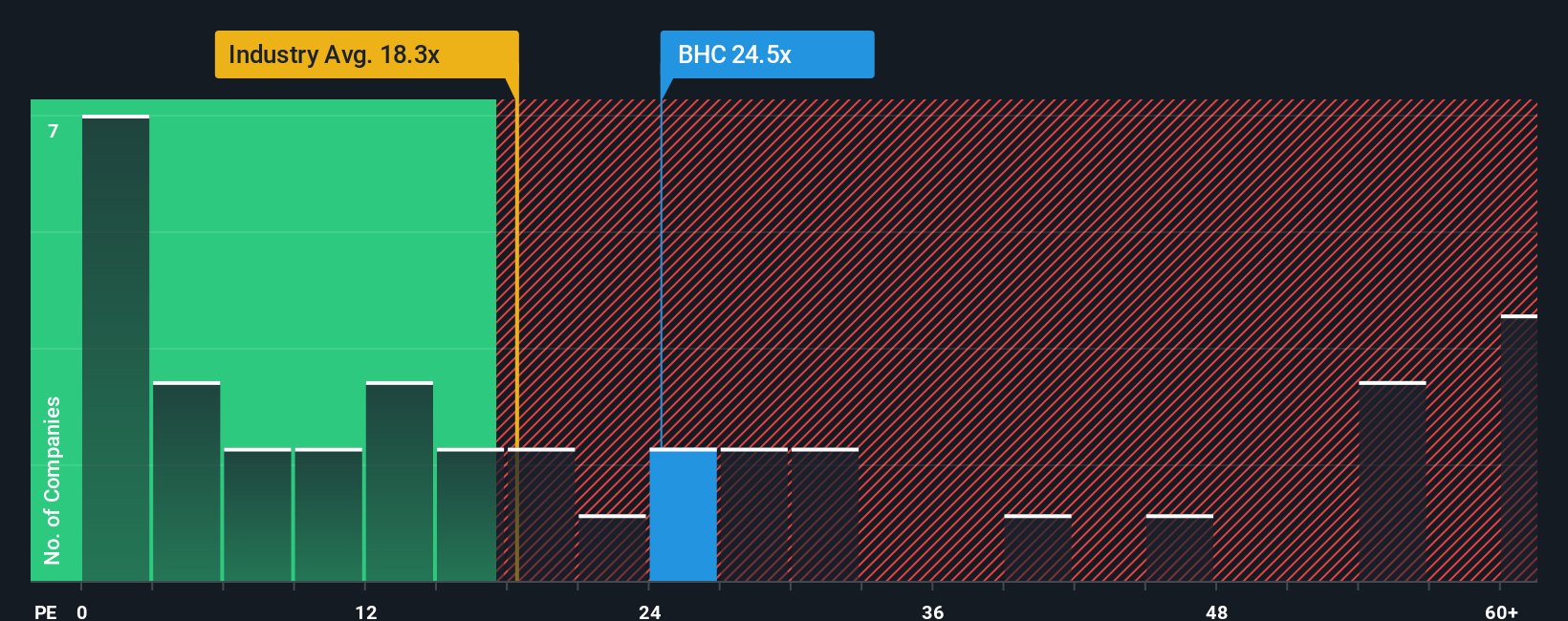

Approach 2: Bausch Health Companies Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is widely used to value profitable companies because it connects a firm's market price to its actual earnings, offering investors a clear perspective on how much they are paying per dollar of profit. This makes the P/E ratio especially relevant for Bausch Health Companies, given its ability to generate positive earnings.

What counts as a "normal" P/E ratio can depend on factors like how quickly a company is expected to grow and the risks it faces. Fast-growing, stable firms typically deserve higher P/E multiples, while slower or riskier companies command lower ones. It is important to put any P/E in context by comparing against the industry, the market, and similar peers.

Bausch Health Companies trades at a P/E of 6.4x. The Pharmaceuticals industry average is 18.0x and its peer group average is 24.1x, indicating that Bausch is priced at a sizable discount relative to its sector and competitors. However, raw comparisons do not always address company-specific factors that can dramatically alter fair valuation.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio, calculated at 19.1x for Bausch, blends together the company’s growth outlook, risk profile, margins, market cap and its place in the industry. Unlike a generic peer or sector average, the Fair Ratio gives a more tailored and arguably more reliable sense of fair value.

Bausch Health Companies is currently valued well below its Fair Ratio, suggesting that the market may be discounting the stock more than its fundamentals justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

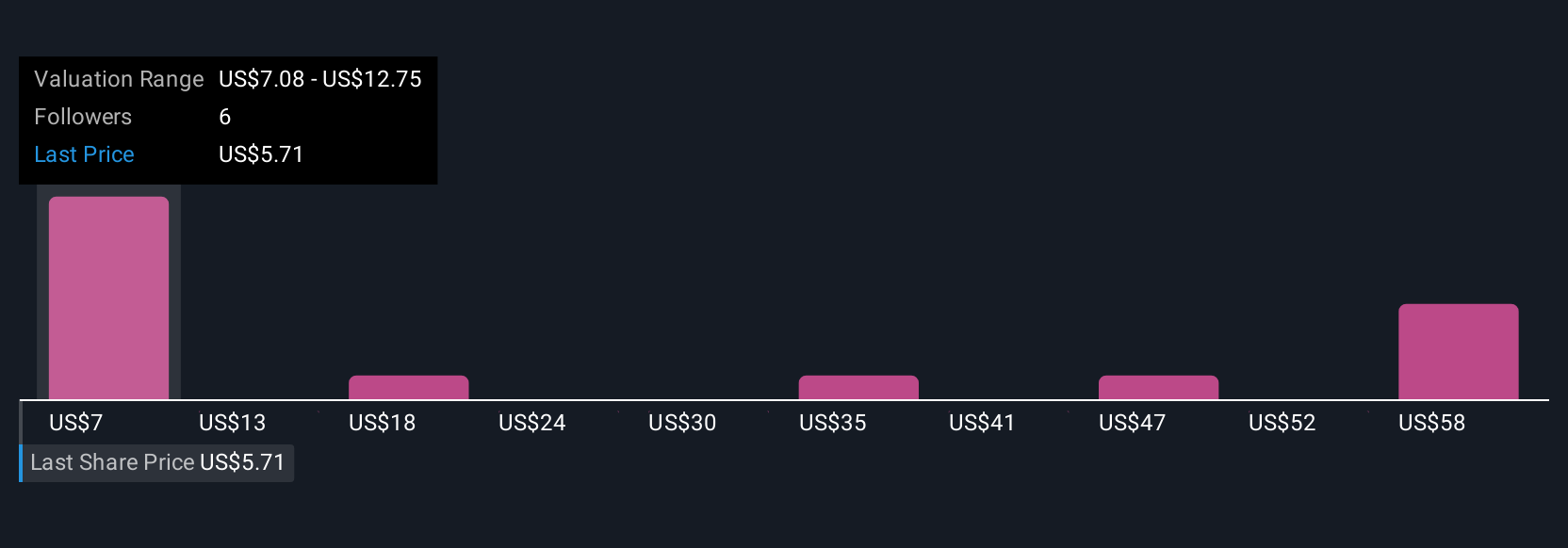

Upgrade Your Decision Making: Choose your Bausch Health Companies Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story about a company, where you link your own expectations and knowledge with numbers such as future revenue, earnings, and what you believe is a fair value.

Rather than relying solely on ratios or analyst targets, Narratives let you bridge what you know about Bausch Health Companies, such as industry shifts, new drug launches, or risks, with a dynamic, transparent forecast that leads directly to an estimated fair value.

On Simply Wall St’s Community page, millions of investors are using Narratives to see the link between a company’s fundamentals and what those facts mean for price, so you can easily compare your Fair Value to the current market price and decide whether to buy or sell.

Narratives update automatically every time new information, such as earnings results or regulatory news, is released, ensuring your outlook always reflects the latest facts.

For example, some investors see Bausch’s upcoming product launches and global diversification as drivers for a high price target of $10.00. Others focus on regulatory risks and forecast a more cautious $5.00. Your own Narrative empowers you to decide what matters most and set your own course.

Do you think there's more to the story for Bausch Health Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives