- United States

- /

- Pharma

- /

- NYSE:BHC

Debt Exchange Offer Might Change the Case for Investing in Bausch Health Companies (BHC)

Reviewed by Sasha Jovanovic

- Bausch Health Companies recently commenced exchange offers to swap up to US$1.6 billion in its 4.875% and 11.00% Senior Secured Notes due 2028 for new 10.00% Senior Secured Notes due 2032, with approximately 46% of holders entering into support agreements.

- This debt exchange initiative represents a major step in extending the company's debt maturities while securing the participation of a significant portion of noteholders.

- We'll examine how Bausch Health's substantial debt restructuring could influence its investment narrative, especially regarding financial flexibility and risk outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Bausch Health Companies Investment Narrative Recap

To be a shareholder in Bausch Health Companies, you need to believe in the company's ability to expand its market presence in gastroenterology and specialty pharmaceuticals, while also managing significant regulatory and debt-related risks. The recent US$1.6 billion debt exchange may have a positive effect on near-term financial flexibility by pushing out maturities, but it does not fully address the most pressing short-term risk: exposure to potential price cuts for Xifaxan under upcoming U.S. Medicare negotiations. This action could strengthen the ability to fund operations but does not remove the critical challenge facing Bausch’s largest revenue driver.

The most relevant recent announcement tied to this event is Bausch Health’s offering of US$4.4 billion in senior secured notes due 2032 back in March 2025. Together, these moves highlight an ongoing effort to manage the company’s heavy debt load and cash interest requirements, which remains central to its investment case, especially as upcoming revenue headwinds from regulatory decisions could impact debt service capacity.

In contrast, it’s important for investors to be aware that even while the company extends maturities and refinances, risks remain around...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies is projected to generate $10.1 billion in revenue and $264.4 million in earnings by 2028. This forecast reflects a 0.9% annual revenue decline and a $166.4 million increase in earnings from the current $98.0 million.

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, a 13% upside to its current price.

Exploring Other Perspectives

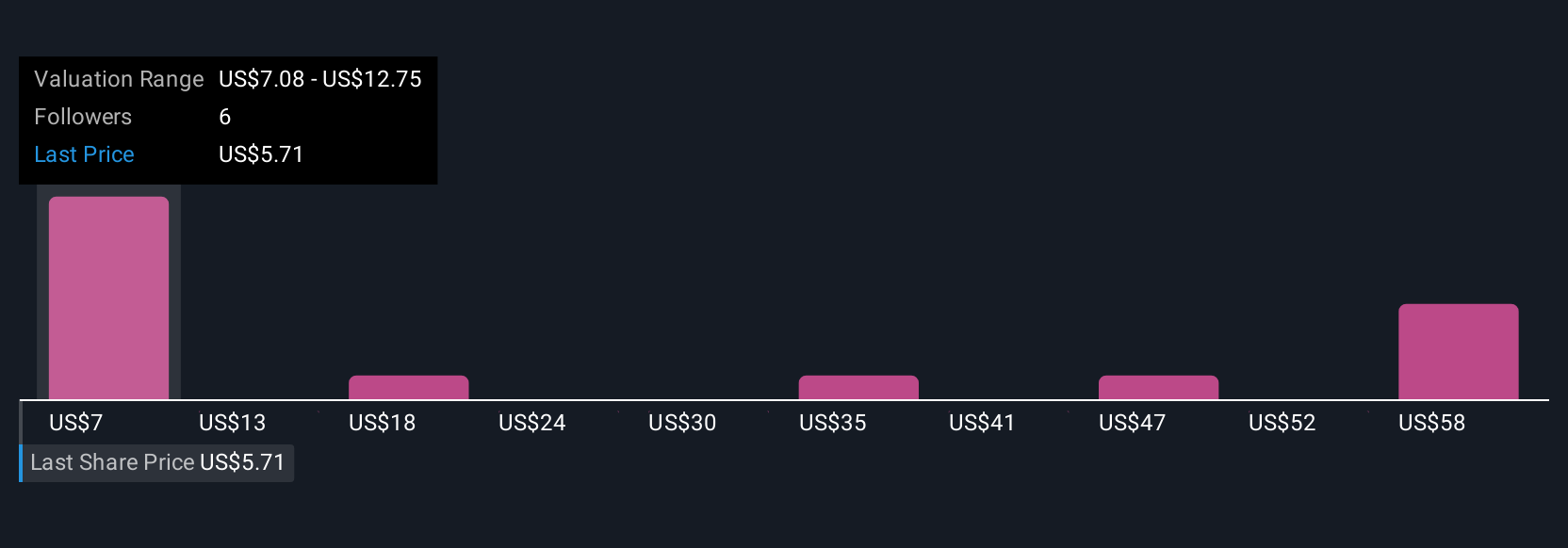

Five members of the Simply Wall St Community estimate Bausch Health’s fair value ranging from US$7.08 to US$68.71 per share. As financial risks tied to elevated debt persist, you may want to compare these diverse viewpoints as you consider how policy decisions and future refinancing could shape the company’s path.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth just $7.08!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success