- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Will Avantor's (AVTR) Service Expansion Reinforce Its Competitive Edge Amid Legal Scrutiny?

Reviewed by Sasha Jovanovic

- In November 2025, Avantor, Inc. announced the opening of a new Centralized Service Center in Watertown, Massachusetts, designed to help research organizations maximize lab space and streamline essential services for R&D operations.

- This expansion highlights Avantor’s efforts to address key infrastructure bottlenecks for Greater Boston’s scientific community, while enhancing its service model with digital tools and specialized logistical support.

- We’ll now assess how recent securities class action lawsuits alleging misrepresentation of competition may impact Avantor’s overall investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Avantor Investment Narrative Recap

To invest in Avantor, one has to believe in the company’s ability to capture greater market share in a growing life sciences industry, despite ongoing pressures on profitability. While the class action lawsuits regarding alleged misrepresentation of competitive threats remain a headline risk, their short-term impact on business fundamentals and catalysts appears limited, with ongoing end-market recovery and contract wins likely to be of greater consequence in the near term.

The recent launch of Avantor’s Centralized Service Center in Watertown is most relevant here, as it directly supports a core growth catalyst, expanding high-value services for research organizations and pharmaceutical clients that could help drive customer retention and operational leverage even as sector competition intensifies.

However, against this, investors should be aware that compressing gross and EBITDA margins due to competitive pricing actions could ...

Read the full narrative on Avantor (it's free!)

Avantor's narrative projects $7.2 billion revenue and $461.3 million earnings by 2028. This requires 2.5% yearly revenue growth and a $226.1 million decrease in earnings from $687.4 million today.

Uncover how Avantor's forecasts yield a $13.64 fair value, a 16% upside to its current price.

Exploring Other Perspectives

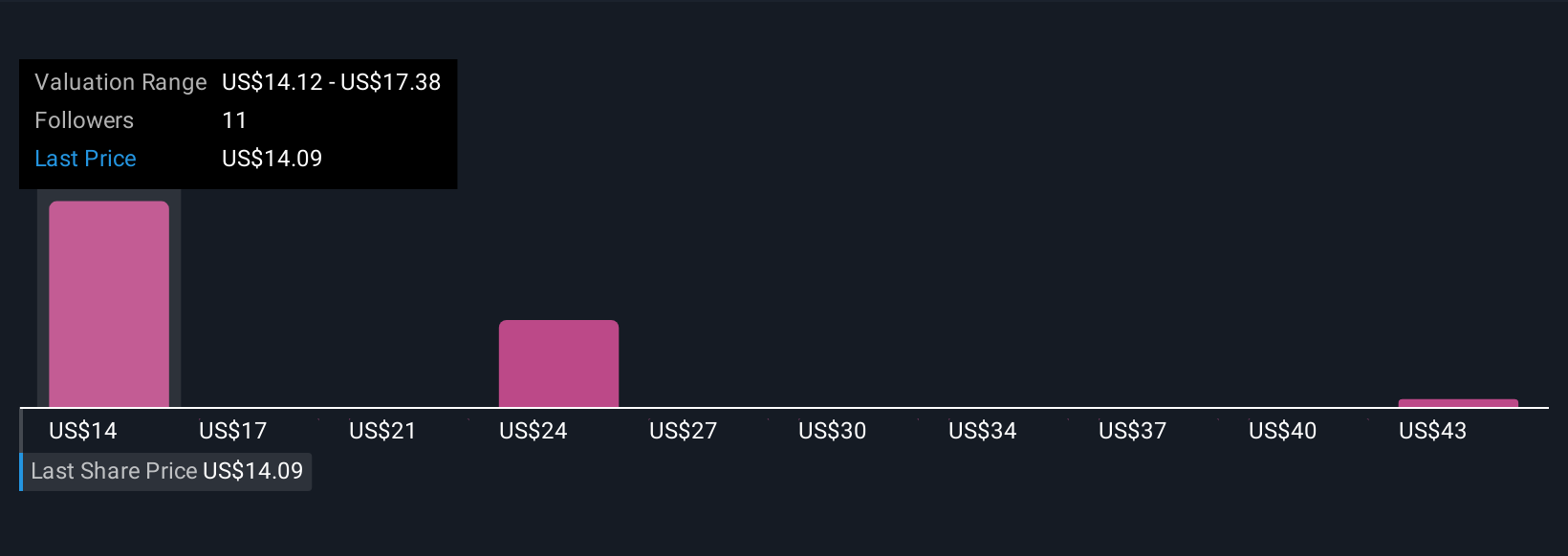

Simply Wall St Community members shared three fair value estimates for Avantor stock, ranging from US$12.55 up to US$46.76 per share. This diversity of opinion frames the latest competition-driven margin risks and invites readers to consider how widely outlooks can differ as they weigh their own view on the company’s future.

Explore 3 other fair value estimates on Avantor - why the stock might be worth just $12.55!

Build Your Own Avantor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avantor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avantor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avantor's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026