- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Avantor (AVTR): Valuation in Focus After p-Chip Tech Partnership for Precision Medicine Expansion

Reviewed by Simply Wall St

Avantor (NYSE:AVTR) just announced a new partnership with p-Chip Corporation to bring microtransponder tech into lab consumables. The aim is to boost secure traceability, an area gaining momentum as personalized medicine expands.

See our latest analysis for Avantor.

Avantor’s recent moves, including the partnership with p-Chip and new board appointments, have arrived as the company rebounds from a tough stretch. After tumbling earlier in the year, shares have surged with a 26% 1-month share price return, reflecting renewed optimism around its transformation efforts, even as the 1-year total shareholder return remains down 34%. Momentum is building as investors eye the company’s push into digital healthcare solutions and operational changes.

If the wave of digital innovation in life sciences has your attention, it might be the perfect moment to discover See the full list for free.

But with shares climbing sharply in recent weeks, investors now face a key question: Is Avantor presenting an undervalued entry point, or has the market already priced in expectations of a turnaround and future growth?

Most Popular Narrative: 7.4% Overvalued

Avantor’s current fair value narrative points to a share price ($14.40) that sits below its recent close at $15.46. This suggests the market is pricing in a steeper rebound than consensus expectations. With investors reacting quickly to short-term optimism, the dominant storyline centers on the sustainability of Avantor’s long-term growth levers as margin pressures linger.

The continued acceleration of biologics, gene therapies, and personalized medicine creates an increasing need for specialized and single-use solutions. This is an area where Avantor is investing in market-leading platforms and expanding innovation, positioning the company to benefit from secular end-market growth and product mix shift toward higher-margin segments, supporting margin and earnings growth.

Want to know what’s fueling this seemingly aggressive premium? The explanation lies in bold revenue ambitions and a future profit multiple that is rarely seen outside high-growth sectors. Curious what financial leaps the narrative expects as new medical trends shape the landscape? Dive in and uncover the detailed forecasts behind that valuation.

Result: Fair Value of $14.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin compression from competitive pricing and persistent weakness in the bioprocessing business could undermine the company's recovery narrative.

Find out about the key risks to this Avantor narrative.

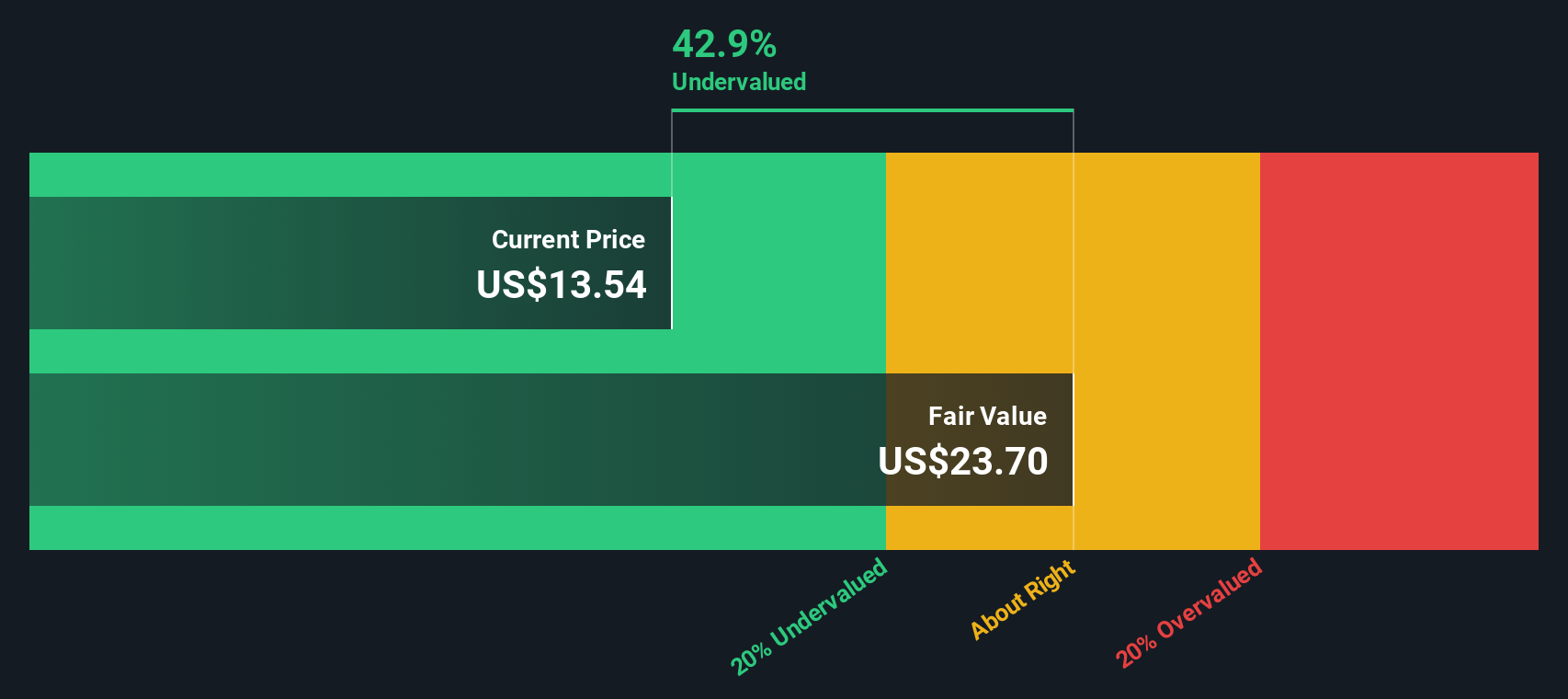

Another View: Discounted Cash Flow Suggests Undervaluation

Switching gears, our DCF model paints a very different picture. It estimates Avantor's fair value at $24.05 per share, which is well above the current price of $15.46. This suggests the market might be overlooking recovery potential or taking a more cautious view than our model. Which story is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Avantor Narrative

If you see the story differently or want to dig into the numbers firsthand, you can build your own take on Avantor in just a few minutes using Do it your way

A great starting point for your Avantor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly scan the market for the next edge. Don’t wait for opportunities to pass you by. Use the tools that help top investors stay ahead. Unearth new stocks with explosive upside or income, so your portfolio never misses a beat.

- Unlock fresh growth by scouting these 876 undervalued stocks based on cash flows that could be flying under Wall Street’s radar and poised for a breakout.

- Supercharge your watchlist and target tomorrow’s disruptors with these 27 AI penny stocks packed with innovation and artificial intelligence potential.

- Capture a stream of consistent returns by zeroing in on these 17 dividend stocks with yields > 3% offering strong yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives