- United States

- /

- Biotech

- /

- NYSE:ADCT

Investors Don't See Light At End Of ADC Therapeutics SA's (NYSE:ADCT) Tunnel And Push Stock Down 26%

Unfortunately for some shareholders, the ADC Therapeutics SA (NYSE:ADCT) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

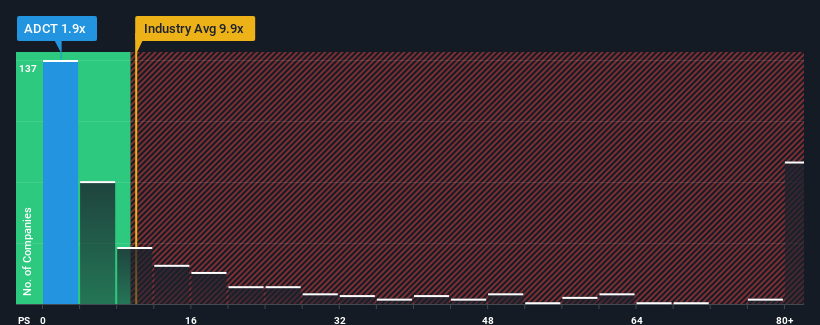

After such a large drop in price, ADC Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.9x and even P/S higher than 57x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for ADC Therapeutics

What Does ADC Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, ADC Therapeutics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ADC Therapeutics will help you uncover what's on the horizon.How Is ADC Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as ADC Therapeutics' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 30% each year during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 141% each year growth forecast for the broader industry.

With this in consideration, its clear as to why ADC Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

ADC Therapeutics' P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of ADC Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - ADC Therapeutics has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ADCT

ADC Therapeutics

Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives