- United States

- /

- Biotech

- /

- NYSE:ABBV

What AbbVie’s Bretisilocin Acquisition Means for Its Share Price in 2025

Reviewed by Bailey Pemberton

If you are staring at AbbVie's share price and wondering whether now is the right time to buy or hold, you are definitely not alone. AbbVie has been making plenty of moves lately both on the market and in the news, with something for almost every kind of investor to consider. Over the past year, the stock has put up a strong 23.6% gain, and if you zoom out to five years, AbbVie has more than tripled, rising 230.5%. Even year-to-date, it is up an impressive 27.7%. That kind of return is hard to ignore, especially when much of the S&P 500 has been much bumpier.

Of course, these results have not come in a perfectly straight line. Over the last month, AbbVie gained 4.9% but dipped 1.6% in just the past week. These short-term swings partly reflect excitement around AbbVie’s continued expansion in neurotherapeutics, new AI-driven collaborations in drug discovery, and rumors of major acquisitions in the mental health space. For example, Wall Street responded positively to AbbVie's deal for Bretisilocin and its ongoing talks to scoop up Gilgamesh Pharmaceuticals, seeing these as signals the company is serious about building up its long-term growth engine, even if some investors are pausing to see how the details play out.

With the stock’s last close at $229.13 and momentum bouncing between healthy optimism and mild caution, valuation naturally comes front and center. Our scorecard gives AbbVie a valuation score of 2, meaning it is undervalued on 2 out of 6 key metrics. But what exactly goes into this score, and how reliable is it in capturing the real value of AbbVie’s future opportunities? Let’s break down the most common valuation methods and why they might only show part of the picture, before diving into an approach that could offer an even deeper insight.

AbbVie scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This approach helps investors understand what a business is truly worth based on the money it is expected to generate in the future.

For AbbVie, the current Free Cash Flow (FCF) over the last twelve months stands at $18.4 Billion. Analysts expect AbbVie's FCF to continue growing, forecasting around $25.8 Billion by 2026 and rising to $32.3 Billion by 2029. Looking even further ahead, through a combination of analyst estimates and Simply Wall St's own projections, AbbVie's annual FCF could reach roughly $40.8 Billion by 2035. This solid growth trajectory reflects confidence in the company’s pipeline and its ongoing ability to convert innovative therapies into cash flow.

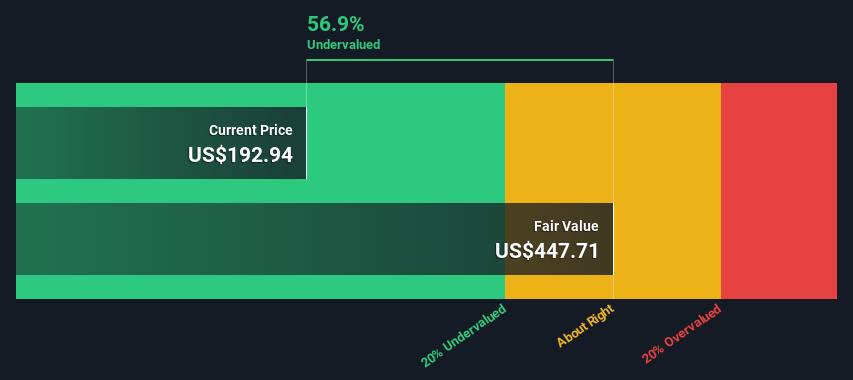

The DCF analysis gives AbbVie an intrinsic value of $431.06 per share. With the stock recently closing at $229.13, the DCF indicates the stock is currently about 46.8% undervalued. This suggests a meaningful margin of safety for prospective investors who have conviction in AbbVie's long-term outlook and who can look past short-term market noise.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AbbVie Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely-used metric for valuing profitable companies like AbbVie. It helps investors understand how much they are paying for every dollar of earnings, making it easy to compare companies across the same industry.

Growth expectations and risk both play an important role in determining what constitutes a "normal" or "fair" PE ratio. Higher growth rates or lower risk profiles generally justify higher multiples. In contrast, slower-growing or riskier companies usually deserve lower ratios. Benchmarking AbbVie's current PE against its industry and peers is a helpful first step, but does not tell the full story by itself.

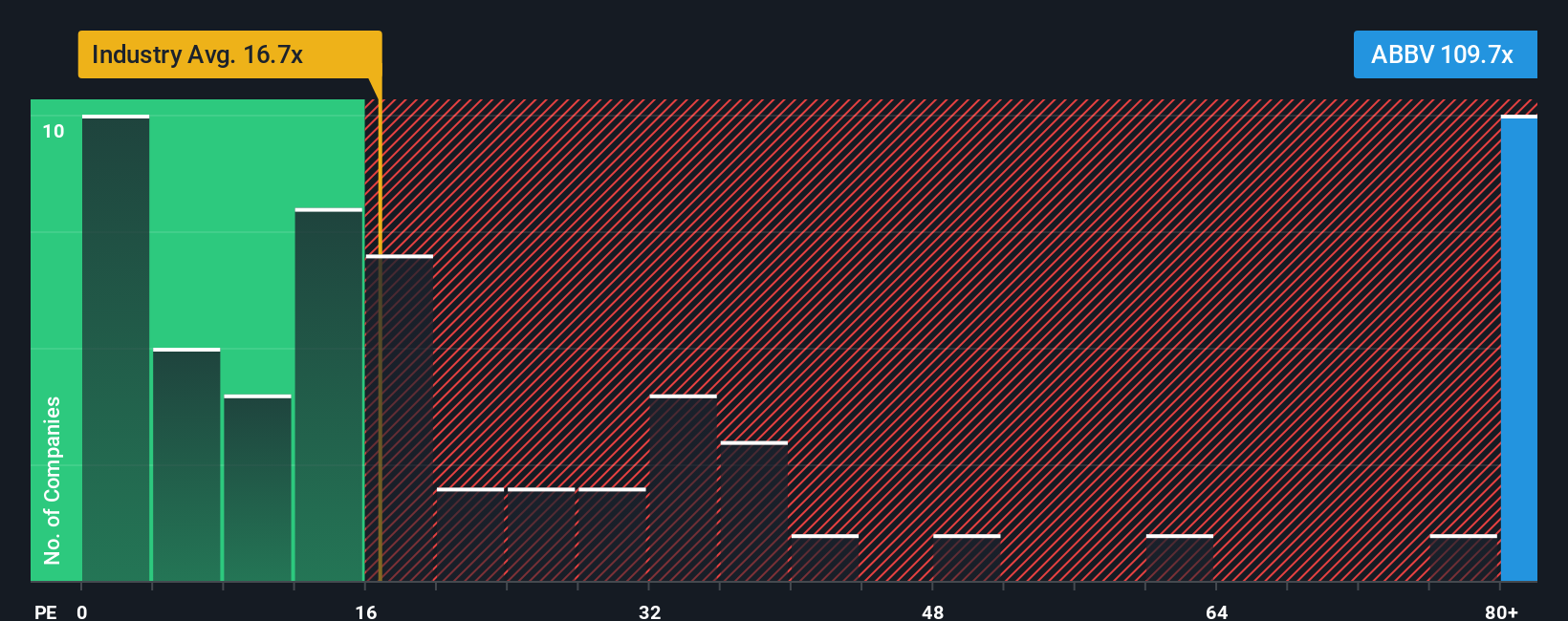

Currently, AbbVie trades at a PE ratio of 108.7x, which is significantly higher than both the average for peer companies at 22.4x and the biotech industry average of 16.6x. This headline figure may raise eyebrows, but it is important to dig deeper. Simply Wall St's proprietary “Fair Ratio” for AbbVie stands at 37.6x. This reflects a more nuanced assessment based on the company’s future earnings growth, profit margins, industry, market cap, and risk factors.

The Fair Ratio takes into account more personalized characteristics than broad benchmarks. This enables a more accurate sense of value for AbbVie specifically. Comparing the Fair Ratio of 37.6x to the actual PE of 108.7x suggests that the shares are trading above what would be expected given all relevant factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

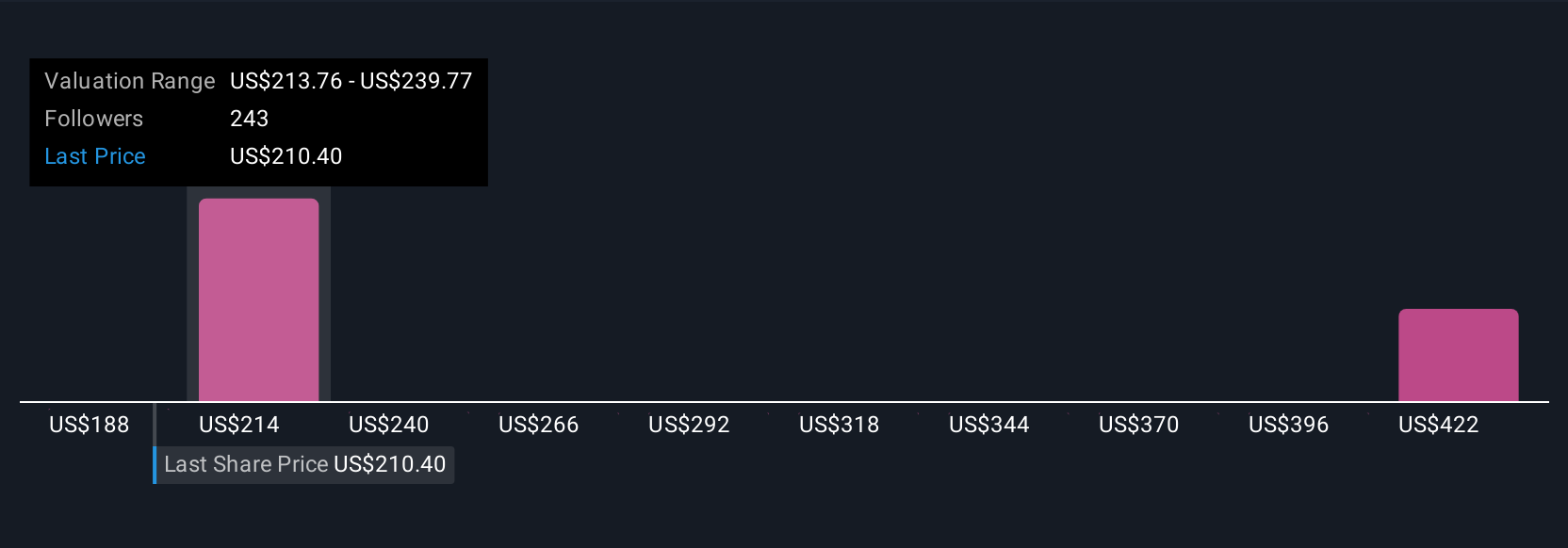

Earlier we mentioned a better way to understand valuation, so let's introduce you to Narratives, a powerful but approachable tool that connects a company’s story with your own financial forecast and calculates a personalized fair value based on your expectations.

Simply put, a Narrative is your perspective or thesis about a company, bringing together your assumptions for future revenue, profit margins, and valuation multiples. These are all backed by your understanding of the business and the industry trends that matter most. Instead of just looking at numbers in isolation, Narratives let you connect the dots between AbbVie’s latest innovations, its competitive landscape, and your confidence in their future earnings. You can then see what that means for today's fair value compared to the current price.

On Simply Wall St’s Community page, Narratives are designed to be user-friendly and dynamic. Whenever big news breaks or new earnings are released, your forecast and fair value are automatically updated, helping you make buy, hold, or sell decisions with the latest data.

For example, some investors might believe AbbVie’s expanding immunology and neuroscience pipeline justifies a high price target of $255, while others focus on competitive risks and prefer a more cautious view at $170. This shows how Narratives express different opinions through numbers.

Do you think there's more to the story for AbbVie? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026