- United States

- /

- Biotech

- /

- NYSE:ABBV

Assessing AbbVie’s Valuation After 25% Gain and Immunology Drug Rollout in 2025

Reviewed by Bailey Pemberton

- Thinking about investing in AbbVie and wondering if now is the right time for value? Let’s break it down together, especially if you want more than just the usual analyst chatter.

- AbbVie's stock has delivered an impressive 25.5% gain so far this year, adding to a five-year climb of 189.5%. However, it has dipped 1.5% in the last week, which could mean fresh opportunity or shifting investor sentiment.

- Recent news has highlighted AbbVie's strategic acquisitions and the ongoing rollout of new immunology treatments, fueling both optimism and debate about how sustainable their trajectory is. Headlines about regulatory approvals and expanded market access have played a big part in recent price moves.

- On our valuation scorecard, AbbVie currently scores 2 out of 6 for being undervalued across key financial checks. Next, we’ll dig into the numbers using some common valuation approaches. I will also share what may be an even better way to look at value at the end of the article.

AbbVie scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

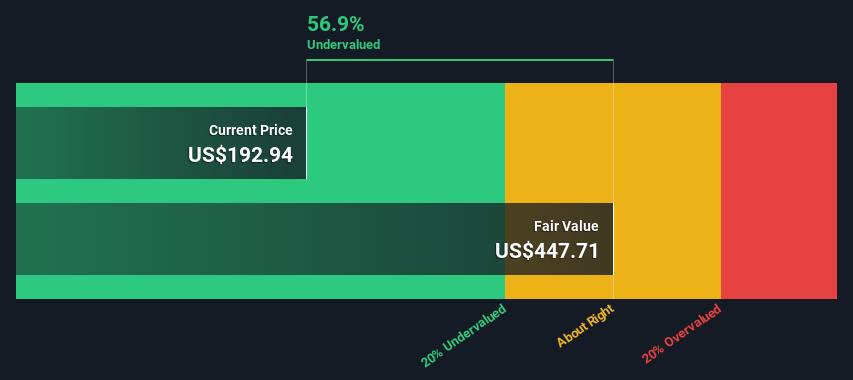

A Discounted Cash Flow (DCF) model works by estimating the future cash that a company will generate and then adjusting those figures back to today’s value using a discount rate. This approach aims to determine what AbbVie is really worth based on its expected cash flow, rather than just its current market price.

Currently, AbbVie produces an impressive Free Cash Flow (FCF) of $18.37 billion. Analyst projections show FCF rising steadily, reaching $31.41 billion by 2029. The outlook beyond 2029 is based on growth estimates, with Simply Wall St extrapolating numbers when analyst coverage ends. These projections indicate consistent free cash flow increases over the next decade, reflecting confidence in AbbVie's business operations and market position.

The DCF model calculates AbbVie’s intrinsic value at $406.14 per share, which is 44.6% above the current market price. According to this analysis, AbbVie is trading at a significant discount to its underlying cash flow value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 44.6%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

Approach 2: AbbVie Price vs Earnings (PE)

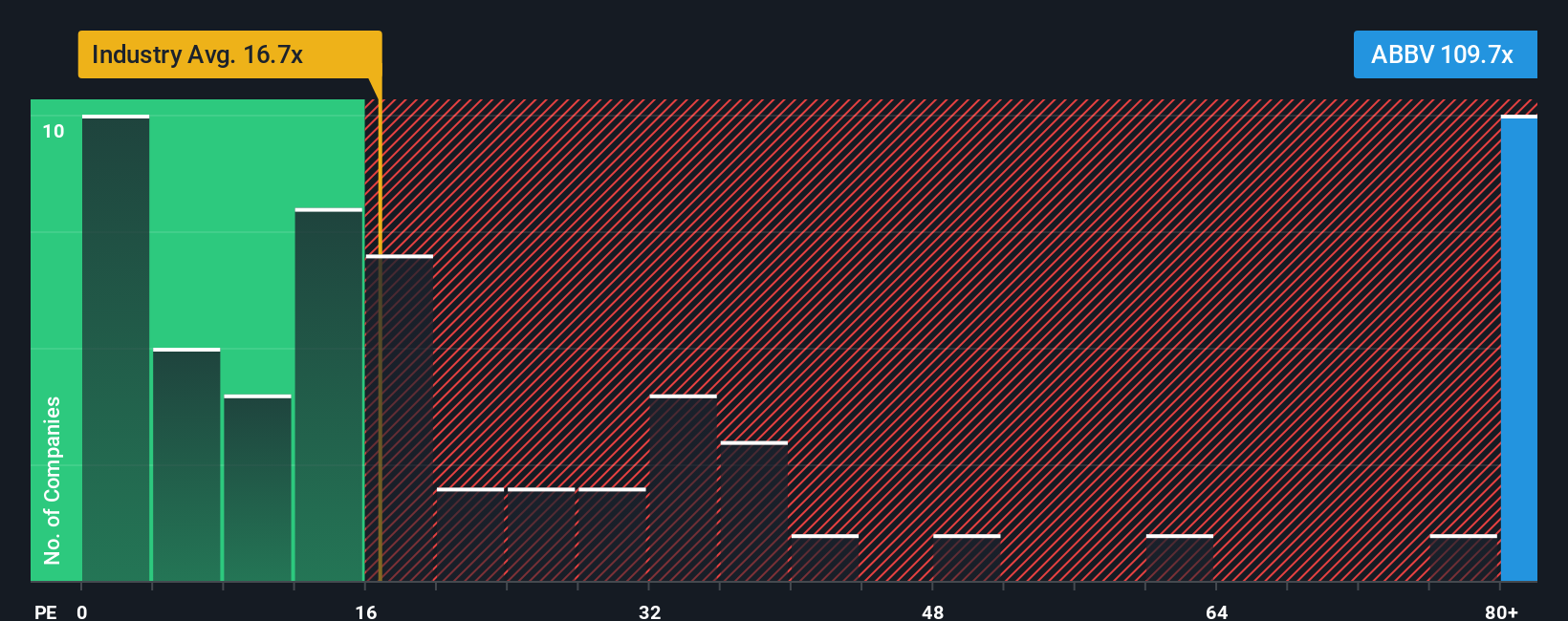

For profitable companies like AbbVie, the Price-to-Earnings (PE) ratio is a widely used valuation measure. PE helps investors gauge how much they are paying for each dollar of current earnings. It is especially useful for established businesses with consistent profits, providing insight into both what the market expects for future growth and how the company’s risk profile compares.

A higher PE ratio usually reflects higher growth expectations or lower perceived risk, while a lower PE can signal more risk or lower future growth. As a reference, AbbVie’s current PE is an elevated 106.83x. This is well above the biotech industry average of 17.91x and the peer average of 22.77x, suggesting the market is placing a significant premium on AbbVie’s earnings at this time.

However, Simply Wall St’s proprietary “Fair Ratio” model sets AbbVie’s fair PE at 37.63x, based on a deeper analysis that includes not only industry factors and profits but also the company’s earning growth potential, margins, market cap, and risk profile. Unlike simple peer or industry comparisons, the Fair Ratio provides a more rounded view by weighing all these elements together.

Compared to this fair PE, AbbVie's actual PE of 106.83x is much higher than what would be considered justified by its underlying fundamentals. This indicates AbbVie’s stock is currently overvalued when assessed with the PE measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

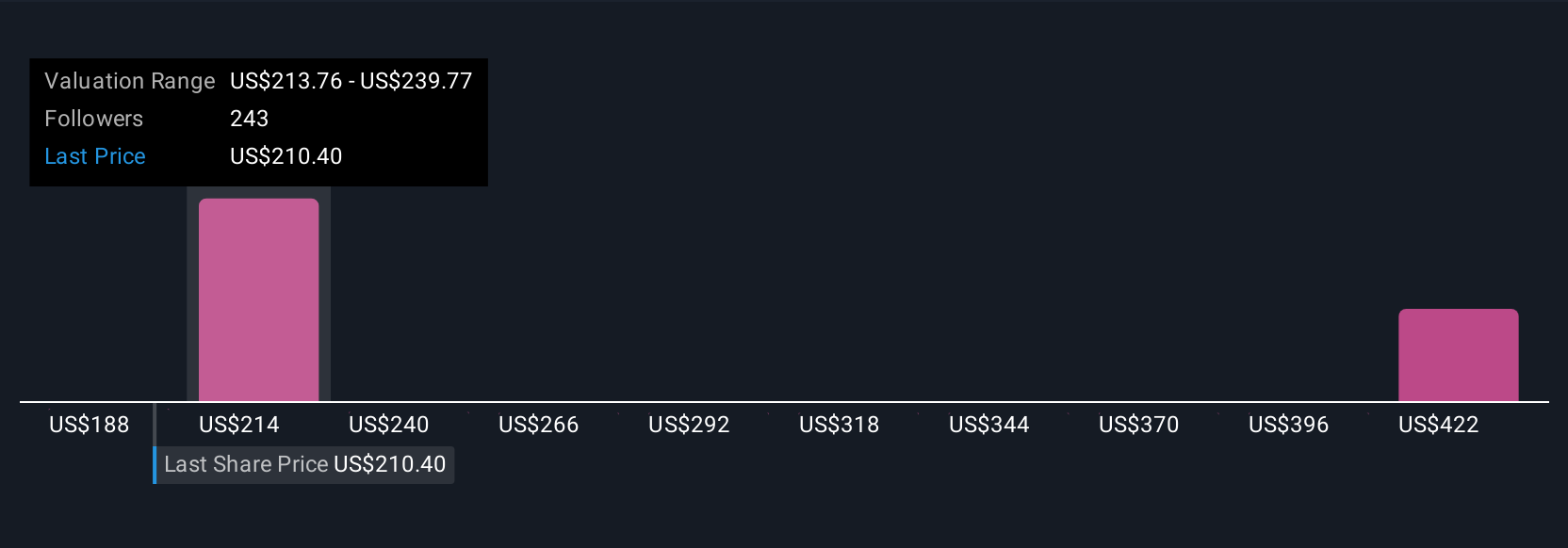

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company; it’s how you explain what you believe about AbbVie’s business outlook, growth drivers, risks, and how those factors turn into future earnings and value. Narratives allow you to link what’s happening in the real world to your own financial forecast and, ultimately, your estimated fair value for the stock.

On Simply Wall St’s Community page, millions of investors are already using Narratives to clarify their thinking and compare their outlook with others. Narratives are easy to create and update, helping you decide if AbbVie is a buy or sell by showing the gap between your Fair Value and the stock’s current price. What is powerful is that Narratives are not static; they automatically adjust when key news, earnings, or company developments are reported, so your perspective stays fresh and informed.

For example, some investors who expect AbbVie’s immunology drugs and new neuroscience launches to drive sustained double-digit earnings growth see a Fair Value as high as $255 per share, while more cautious investors anticipating competitive and regulatory headwinds have set targets closer to $170. Narratives let you capture your own view in a structured way, making your investment decision both more transparent and dynamic.

Do you think there's more to the story for AbbVie? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Medium-low risk with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives