- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (NYSE:ABBV) Expands Eye Care Portfolio with Ripple Therapeutics Collaboration, Boosts Growth Potential

Reviewed by Simply Wall St

Get an in-depth perspective on AbbVie's performance by reading our analysis here.

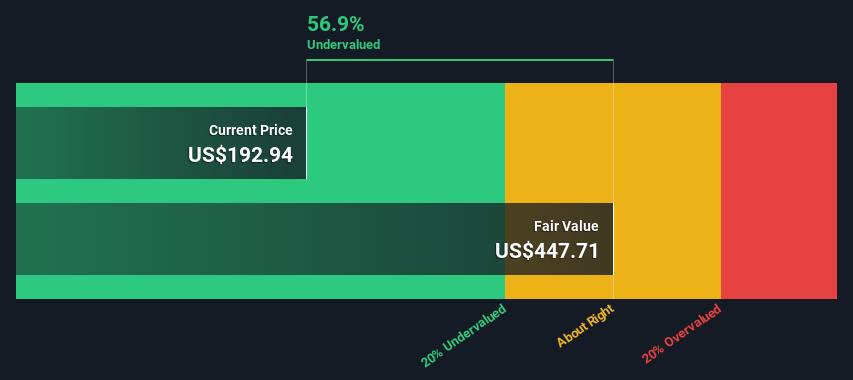

Strengths: Core Advantages Driving Sustained Success For AbbVie

AbbVie has demonstrated robust growth and revenue performance, with operational sales up nearly 4% through the first half of this year, as highlighted by CEO Robert Michael in the latest earnings call. This growth is driven by a diversified portfolio, particularly in immunology, where products like Skyrizi are performing above expectations. Additionally, the company has executed nearly a dozen early-stage deals to advance its pipeline in immunology, oncology, and neuroscience, reflecting strong innovation capabilities. Financially, AbbVie raised its full-year adjusted earnings per share guidance to between $10.71 and $10.91, showcasing its financial health and stability. Notably, AbbVie is currently considered expensive based on its Price-To-Earnings Ratio (64.5x) compared to both its peers and the US Biotechs industry averages, despite trading below the estimated fair value of $448.86.

Weaknesses: Critical Issues Affecting AbbVie's Performance and Areas For Growth

Despite its strengths, AbbVie faces several challenges. The company’s current net profit margins of 9.6% are significantly lower than last year's 15.4%, indicating a decline in profitability. Additionally, AbbVie's earnings have grown by only 5.5% per year over the past five years, which is modest compared to industry standards. The company also reported a large one-off loss of $8.9 billion impacting its last 12 months of financial results, further straining its financial position. Moreover, AbbVie's Price-To-Earnings Ratio of 64.5x indicates it is expensive compared to the peer average of 52.2x and the US Biotechs industry average of 22.9x, which may deter potential investors. For a more comprehensive look at how these weaknesses could impact AbbVie's financial stability, explore our section on AbbVie's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

AbbVie has several strategic opportunities to enhance its market position. The pending acquisition of Cerevel will augment its neuroscience pipeline, potentially driving future growth. Furthermore, the company received FDA approval for Skyrizi in ulcerative colitis, marking its second inflammatory bowel disease indication, which could significantly boost revenue. Regulatory changes and approvals, such as the European Commission's conditional marketing authorization for TEPKINLY, present additional growth avenues. AbbVie’s strategic alliances, like the collaboration with Ripple Therapeutics for RTC-620, also position it well to capitalize on emerging market opportunities. Learn more about how these opportunities could impact AbbVie's future growth by reviewing our analysis of AbbVie's Future Performance.

Threats: Key Risks and Challenges That Could Impact AbbVie's Success

AbbVie faces several external threats that could impact its growth and market share. Competitive pressures are evident, as seen with Imbruvica's global revenues declining by 8.2% due to competitive dynamics in CLL. Economic factors, such as sustained economic headwinds and challenging comparisons to last year's performance, continue to impact sales growth. Regulatory issues also pose risks; CEO Robert Michael expressed concerns about provisions harmful to long-term patient care in the U.S., which could affect the company's operations. Additionally, significant insider selling over the past three months and a high level of debt further exacerbate these threats. These factors collectively pose substantial risks to AbbVie's sustained success.

Conclusion

AbbVie exhibits strong growth potential driven by its diversified portfolio and innovative pipeline, particularly in immunology, oncology, and neuroscience. However, challenges such as declining profit margins, modest earnings growth, and a significant one-off loss highlight areas needing improvement. Strategic opportunities, including acquisitions and regulatory approvals, offer avenues for future growth but are tempered by competitive pressures and economic headwinds. Despite being priced higher than peers with a Price-To-Earnings Ratio of 64.5x, AbbVie trades below its estimated fair value of $448.86, suggesting potential for long-term appreciation if it can navigate its financial and operational challenges effectively.

Summing It All Up

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ABBV

AbbVie

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals worldwide.

Moderate with reasonable growth potential and pays a dividend.