- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (ABBV): Valuation Insights After Earnings Beat, Raised Guidance, and New Patent Protection

Reviewed by Simply Wall St

AbbVie (ABBV) is making headlines after posting strong third quarter earnings, raising its 2025 guidance, and securing additional years of patent protection through a fresh legal settlement with generic rivals.

See our latest analysis for AbbVie.

Momentum is clearly building around AbbVie as bullish news and confident earnings have fueled a 12.5% gain in its share price over the past 90 days, with the stock up an impressive 29.5% year-to-date. When you factor in reinvested dividends, the total shareholder return over the past year tops 45%, reflecting broad investor enthusiasm for both AbbVie’s financial strength and future pipeline.

If AbbVie's strong finish to the year has you thinking about other opportunities, consider exploring companies with robust pipelines and reliable dividends in our pharma growth and income screener. See the full list for free.

With shares surging on a string of upbeat results and analyst upgrades, investors naturally wonder whether AbbVie's future gains are already reflected in the current price or if there is still a buying opportunity ahead.

Most Popular Narrative: 3.7% Undervalued

AbbVie's widely followed narrative places its fair value above the latest close, suggesting continued upside potential as recent developments bolster confidence in long-term growth. This narrative takes into account the balance between emerging strengths in the portfolio and looming risks from matured products.

Advancements and strategic investments in neuroscience, including strong uptake of Vraylar, QULIPTA, Ubrelvy, and the emerging Parkinson's portfolio (for example, VYALEV), align with growing demand for therapies addressing chronic neurological diseases in an aging population. These developments support both revenue and long-term earnings stability.

Curious what financial projections justify this premium? There is an aggressive earnings trajectory and margin expansion in play, aimed at reshaping expectations. Dive deeper to uncover the ambitious assumptions and find out what could send valuation soaring even higher.

Result: Fair Value of $241.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure on older drugs like Humira and potential setbacks in AbbVie's aesthetics business could still challenge bullish assumptions as the company moves forward.

Find out about the key risks to this AbbVie narrative.

Another View: Comparing Sales Ratios

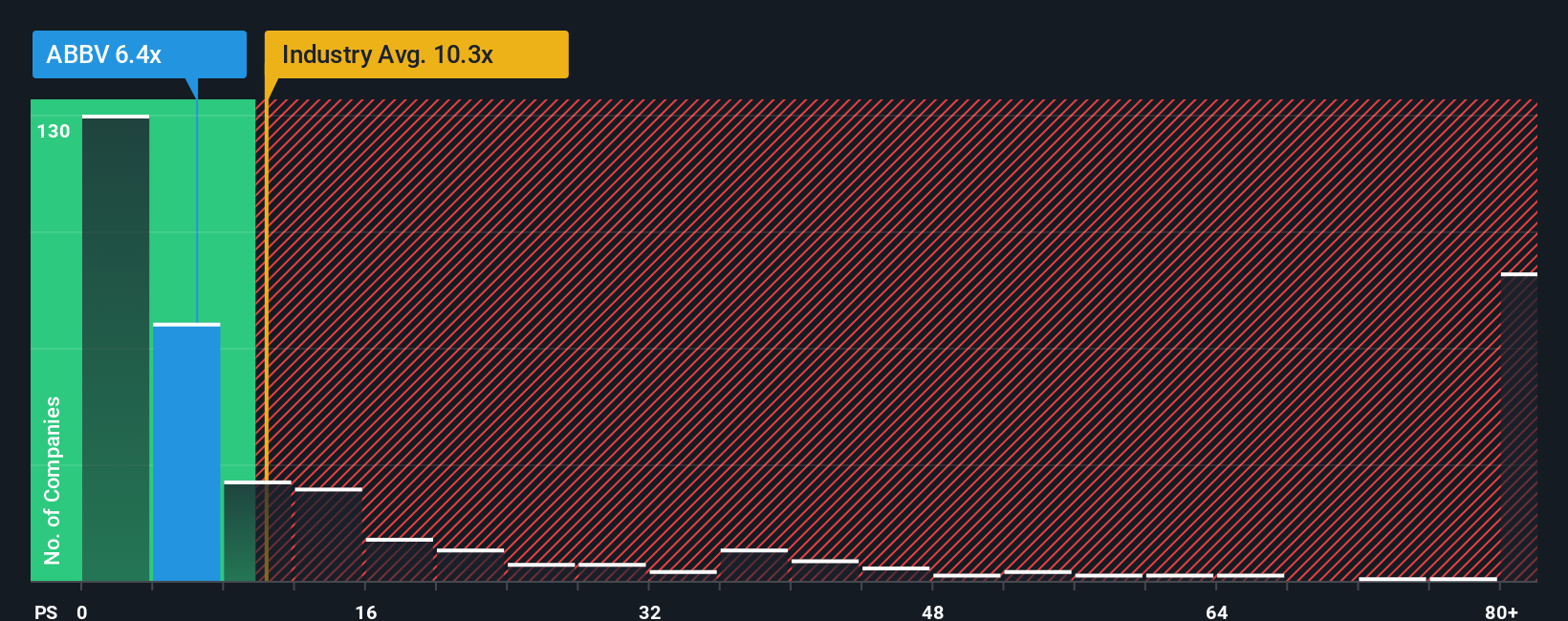

Looking at valuation through price-to-sales, AbbVie trades at 6.9 times sales. That is higher than its direct peer average of 6.2 times, but well below the US Biotechs industry at 11 times. Interestingly, our fair ratio analysis suggests the market could shift towards a figure as high as 11.5 times sales. Does this gap mean AbbVie is priced for opportunity, or is there risk if sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbbVie Narrative

If you have a different take or want to dig into the numbers on your own terms, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

If you are eager for your next big win, use Simply Wall Street’s powerful Screener to hand-pick stocks tailored to your strategy. Don’t let today’s ideas pass you by. See which investments truly deserve a closer look.

- Uncover hidden value by tracking these 897 undervalued stocks based on cash flows that are priced well below their intrinsic worth. This could give you a head start on tomorrow's top performers.

- Position yourself for growth in the digital age by targeting these 25 AI penny stocks backed by breakthrough artificial intelligence and automation trends.

- Boost your portfolio’s income potential when you filter for these 16 dividend stocks with yields > 3% that offer strong yields and reliable payouts other investors might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives