- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (ABBV) Files sNDA For Oral VENCLEXTA Combo Regimen In CLL Treatment

Reviewed by Simply Wall St

AbbVie (ABBV) recently submitted a Supplemental New Drug Application to the FDA for a new combination regimen targeting chronic lymphocytic leukemia, which accompanies positive Phase 3 trial outcomes. This development aligns with AbbVie's broader strategy of expanding its oncology pipeline, potentially influencing investor perception positively. Over the past month, AbbVie's share price rose by 3.4%, bolstered by the positive trial results and submission news. This move aligns with broader market optimism, as the S&P 500 maintained its upward momentum and hit record highs. Although AbbVie was removed from major Russell indices recently, its growth initiatives seem to have countered any potential negative impact.

AbbVie has 4 possible red flags we think you should know about.

The recent submission of a Supplemental New Drug Application by AbbVie aligns with its strategy of expanding its oncology pipeline. This move could strengthen the narrative surrounding AbbVie’s future revenue and earnings potential, particularly in the oncology sector. Positive results from Phase 3 trials support this development, potentially enhancing investor optimism about AbbVie's revenue growth from new treatments. Analysts have already noted the company's focus on pipeline expansion and strategic acquisitions as key drivers for future revenue, which is now further supported by this regulatory step.

Over the past five years, AbbVie’s total return, including share price appreciation and dividends, was 140.31%. This performance provides context to evaluate the recent 3.4% share price rise, supported by the latest clinical and regulatory developments.

Compared to the broader market, AbbVie exceeded the US Biotechs industry performance over the past year, where the industry saw a 12% decline. However, over this longer horizon, AbbVie's consistent returns highlight its resilience and capability to navigate market fluctuations effectively.

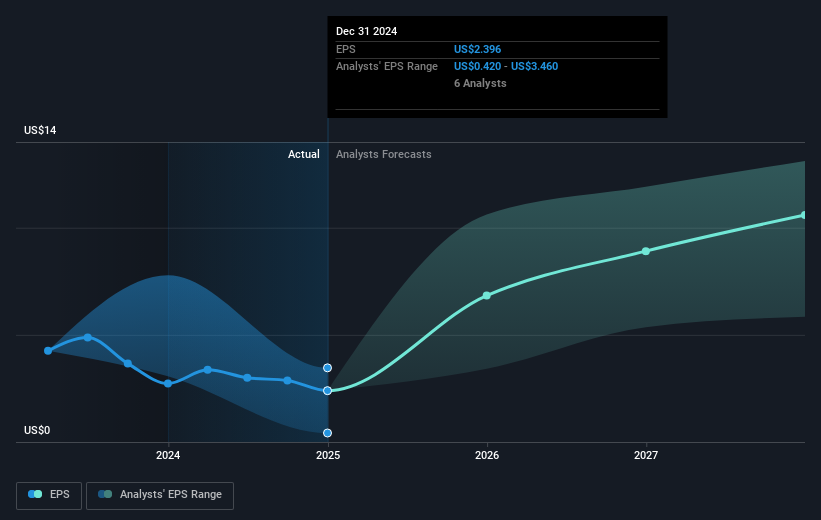

The recent news could potentially affect revenue and earnings forecasts positively by bolstering confidence in AbbVie’s pipeline effectiveness. With analysts targeting a price of US$210.08, the current share price of US$188.52 suggests approximately an 11% discount to this target. This reflects some market hesitance but also indicates potential upside for investors should AbbVie's developments result in revenue growth and improved margins.

Gain insights into AbbVie's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives