- United States

- /

- Life Sciences

- /

- NYSE:A

How Agilent Technologies' (A) Appointment of Amgen Veteran as CFO Has Shaped Its Leadership Story

Reviewed by Sasha Jovanovic

- Agilent Technologies has named Adam S. Elinoff as its new Chief Financial Officer, effective November 17, 2025, succeeding interim CFO Rodney Gonsalves, who will remain as Vice President, Corporate Controller and Principal Accounting Officer.

- Elinoff brings over 19 years of finance leadership from Amgen and other global firms, with a background in driving operational efficiency and leading multi-billion dollar regional finance operations.

- We'll examine how the appointment of an experienced CFO from Amgen could shape Agilent's investment narrative and leadership direction.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Agilent Technologies Investment Narrative Recap

To be a shareholder in Agilent Technologies, you need to believe that demand for advanced life sciences and analytical solutions will continue powering growth, supported by robust pharmaceutical and chemical end markets and recurring revenue streams. The appointment of Adam S. Elinoff as CFO brings seasoned financial expertise but is not expected to materially shift the company’s most important near-term catalyst, integration of operational efficiencies to offset elevated tariff-driven costs, or alter the principal risk from ongoing supply chain and margin pressures at this time.

Among Agilent’s recent announcements, the company raised its 2025 full-year revenue guidance to between US$6.91 billion and US$6.93 billion, reflecting a positive outlook despite recent leadership changes. This guidance and Q3 results position the company to focus on operational execution, especially as it seeks to streamline global supply chains and defend margins while new management settles in.

On the other hand, investors should be aware that if supply chain mitigation measures are delayed or less effective...

Read the full narrative on Agilent Technologies (it's free!)

Agilent Technologies' narrative projects $8.0 billion in revenue and $1.7 billion in earnings by 2028. This requires 5.8% yearly revenue growth and a $0.5 billion earnings increase from $1.2 billion currently.

Uncover how Agilent Technologies' forecasts yield a $148.57 fair value, in line with its current price.

Exploring Other Perspectives

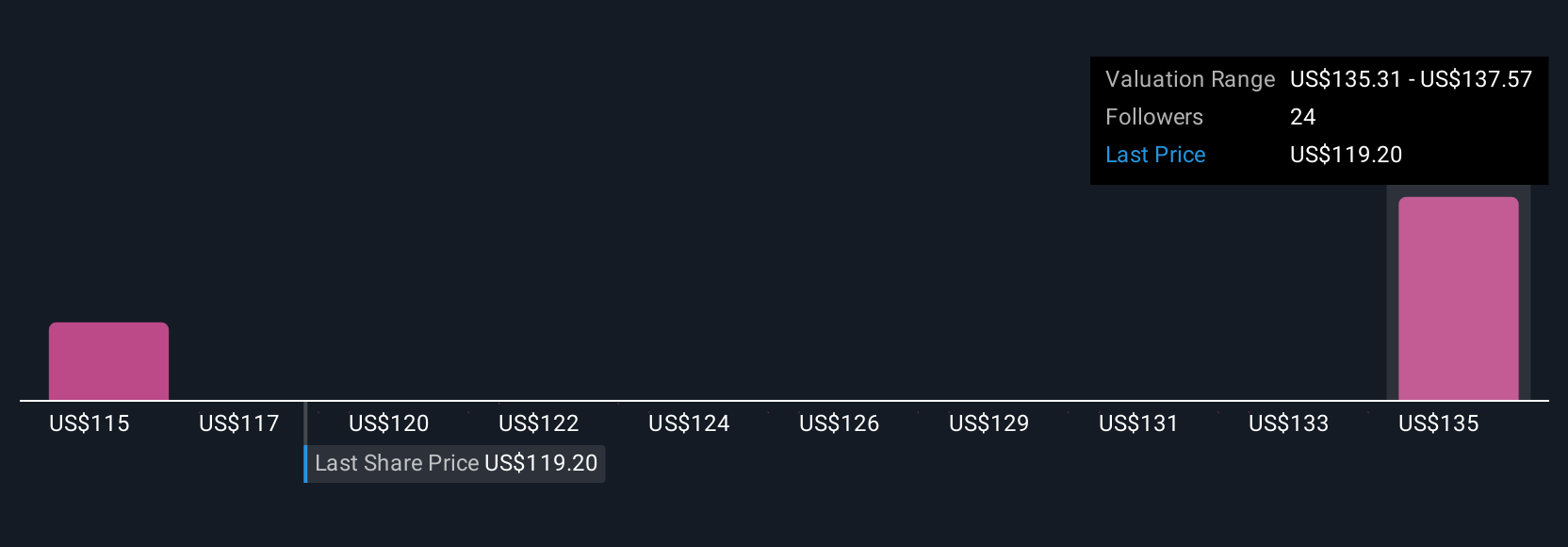

Simply Wall St Community members have posted five fair value estimates for Agilent Technologies, ranging from US$96.86 to US$150.54 per share. These widely varied views highlight how opinions can differ, especially as many are watching to see if recent leadership changes will actually help Agilent offset tariff and supply chain risks over the next year.

Explore 5 other fair value estimates on Agilent Technologies - why the stock might be worth as much as $150.54!

Build Your Own Agilent Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilent Technologies research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Agilent Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilent Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives