- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (A): Reassessing Valuation Following Strong Earnings and Upgraded 2025 Outlook

Reviewed by Simply Wall St

If you’ve been watching Agilent Technologies (A) lately, the most recent quarter probably grabbed your attention. The company just posted earnings that came in ahead of forecasts, with both revenue and net income up compared to last year’s third quarter. In addition, Agilent raised its guidance for the rest of fiscal 2025, highlighting stronger than expected business trends and a more confident growth outlook. Investors are now left wondering if this is a signal to reconsider where the company sits in their portfolio.

This upbeat announcement follows a period of ups and downs for the stock. Agilent’s shares climbed over 12% in the past month, reversing some of the weakness from earlier in the year, but still sit roughly 6% lower year-over-year. The news around raised guidance and earnings momentum has injected fresh energy into the stock, especially after a longer stretch where performance had been lagging broader indexes. The question now is whether this turn in momentum signals a new phase for Agilent’s valuation, or if the market is already factoring in these improvements.

Is there genuine value still on the table for new investors, or have recent gains already priced in future growth for Agilent Technologies?

Most Popular Narrative: 6.8% Undervalued

The narrative sees Agilent Technologies as undervalued, with analyst expectations indicating upside potential based on future earnings and margin expansion.

Global momentum for stricter food safety and environmental regulations (for example, PFAS testing, greenfield investments, and regional capacity expansion) continues to drive demand for Agilent's analytical instruments and recurring solutions. This expands the company's addressable market and provides a robust foundation for recurring revenues.

Curious how analysts are backing up their bullish view? There is a financial forecast hidden in this consensus that hinges on world-changing regulation, margin shifts, and a blueprint for earnings growth that rivals the industry’s biggest names. Want to uncover which assumptions are setting the stage for Agilent’s next act? The real details driving this fair value might surprise you.

Result: Fair Value of $138.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, tightening government research budgets and rising global tariffs could cloud Agilent’s outlook. These factors have the potential to pressure both future growth and profitability if trends worsen.

Find out about the key risks to this Agilent Technologies narrative.Another View: What Does Our DCF Model Say?

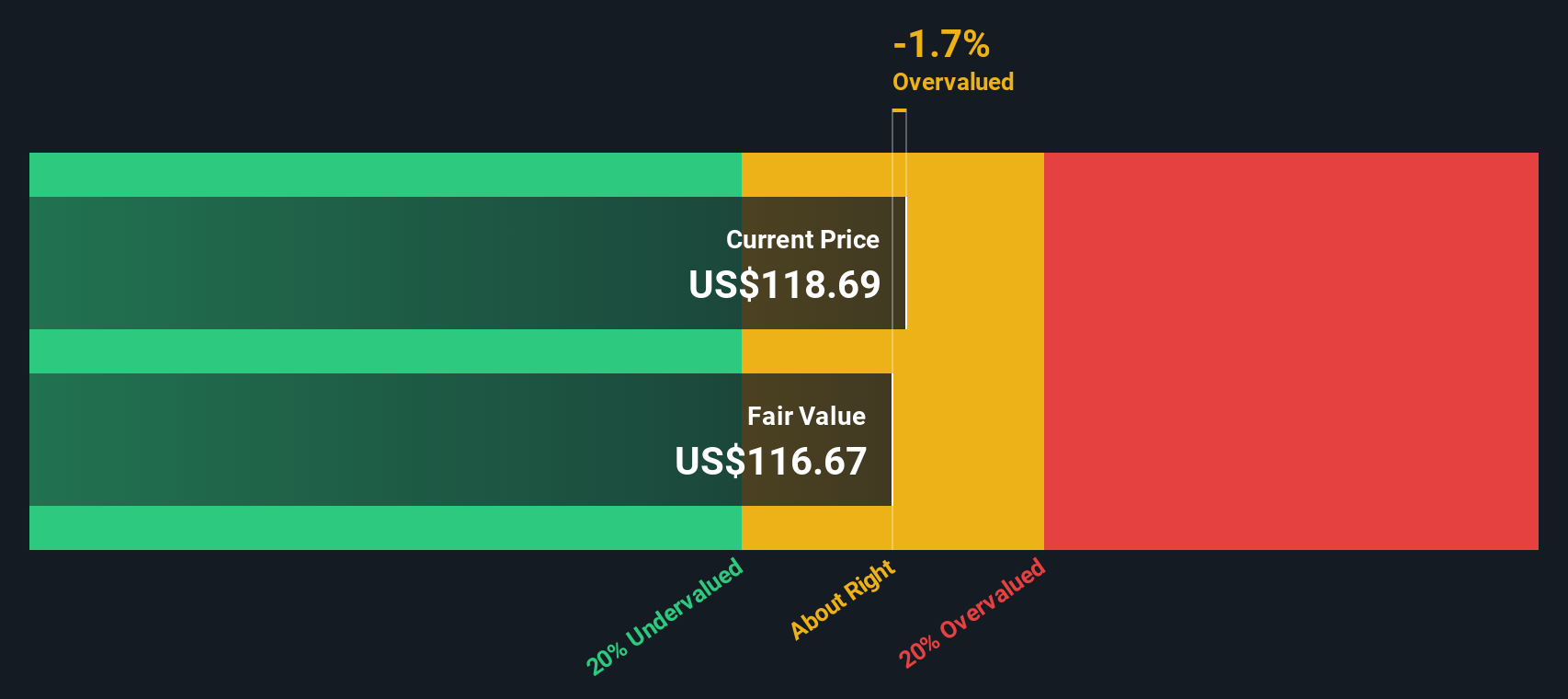

Looking at Agilent through our DCF model provides a different perspective. This method suggests the shares may not be as cheap as the analyst price target implies. Does this challenge the current optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agilent Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agilent Technologies Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can assemble your own Agilent Technologies story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Agilent Technologies.

Ready for Your Next Smart Move?

Don’t just watch from the sidelines. Take action and spot the next promising stocks before the market does. The right screener could put your next winning idea within reach.

- Capture strong yields and reliable payouts with investments highlighted in our list of dividend stocks with yields > 3%.

- Uncover tomorrow’s tech leaders by searching for AI penny stocks riding the surge in artificial intelligence innovation.

- Hunt for overlooked gems trading below fair value and see potential in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives