- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

A Look at Zymeworks (ZYME) Valuation Following $125M Buyback and Positive Zanidatamab Phase 3 Results

Reviewed by Simply Wall St

Zymeworks (ZYME) just grabbed investors’ attention with a $125 million share repurchase plan, following strong Phase 3 results for its lead drug, zanidatamab. Leadership updates also contribute to the positive momentum.

See our latest analysis for Zymeworks.

Backed by positive trial results and big strategic moves, Zymeworks’ momentum has really caught fire. Its 30-day share price return is a remarkable 47.6%, and the one-year total shareholder return stands at a robust 83%. That kind of outsized performance is fueling investor optimism for what’s ahead.

With biotech stocks often responding sharply to clinical milestones and management updates, now is a smart time to see what other healthcare innovators are making waves. Check out See the full list for free..

With shares already surging on clinical wins and a major buyback, investors face a key question: Is Zymeworks still undervalued, or has the market already priced in its future growth prospects?

Most Popular Narrative: 23.5% Undervalued

Zymeworks' most popular narrative estimates its fair value at $34.20, which is well above the recent close of $26.18. This gap is fueling bullishness as the narrative suggests a re-rating upside is still on the table for investors following recent strategic successes.

The advancing acceptance of personalized and precision medicine is accelerating investment and deal activity in antibody engineering, directly aligning with Zymeworks' core platforms (Azymetric and EFECT), which have already attracted multiple high-value partnerships. This trend increases the probability of further milestone and royalty revenue, providing upside to earnings and supporting healthier net margins via a capital-light partnership model.

Want to know what powers that ambitious fair value? The calculation leans on bold projections for sales growth, significant margin improvement, and a profit outlook many biotech insiders aim for. Get the inside track on just how Zymeworks' evolving business model could deliver exponential upside, or why it might be tougher than it looks.

Result: Fair Value of $34.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if milestone deals fall through or pipeline setbacks stall future royalty revenue. This could quickly dampen the bullish narrative.

Find out about the key risks to this Zymeworks narrative.

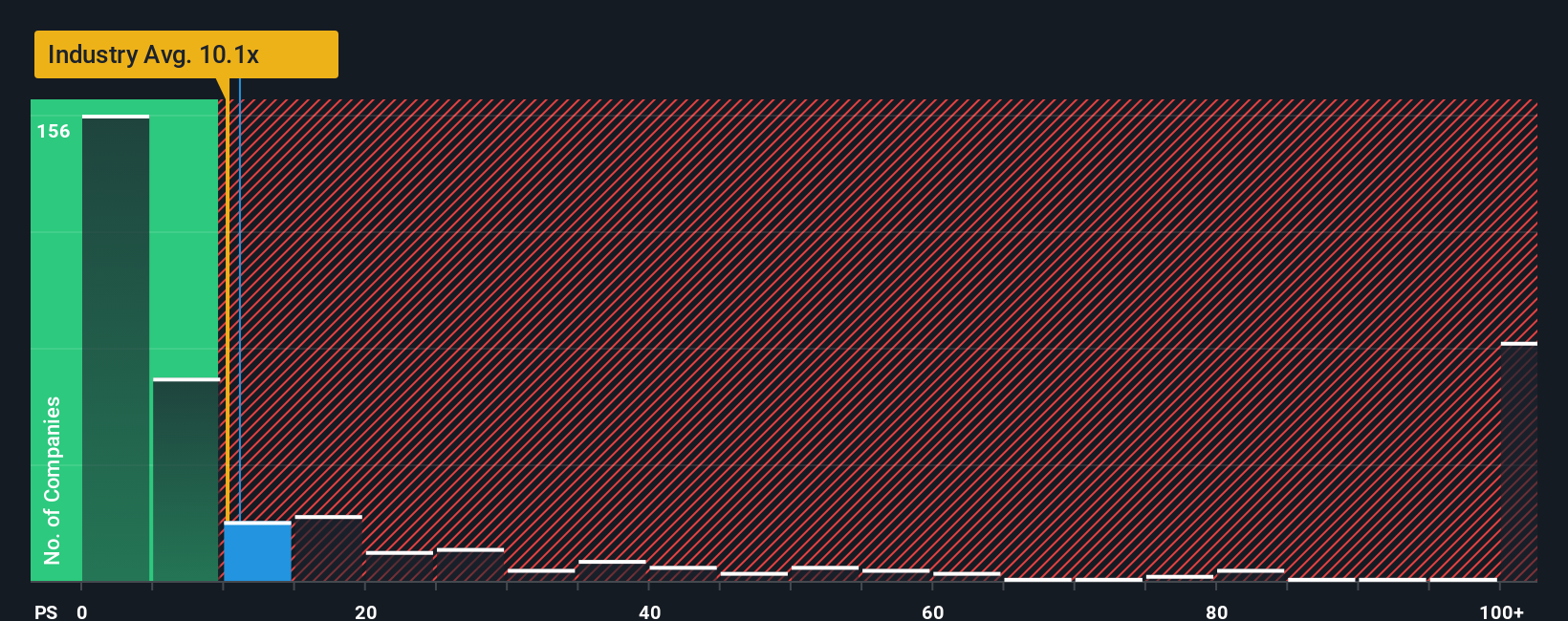

Another View: Market Multiples Signal Caution

While analysts are optimistic about Zymeworks’ growth, the stock is currently trading at a price-to-sales ratio of 14.6x. This is above the US Biotech industry average of 11.8x, but still below its peers at 17.5x. The fair ratio the market could move toward is just 2.3x, suggesting the current price builds in a lot of future success. Does this imply more risk than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zymeworks Narrative

If you see the story differently or want to dig into the data yourself, you can craft your own perspective in just a few minutes by using the following tool: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zymeworks.

Looking for more investment ideas?

Turn your curiosity into action with curated stock lists built to match your ambitions. Seize your edge now before others catch on.

- Unlock opportunities for long-term income and stability by evaluating these 14 dividend stocks with yields > 3%, which consistently deliver yields above 3%.

- Capitalize on artificial intelligence trends by seeking out innovation among these 26 AI penny stocks, driving transformation in every industry.

- Take advantage of undervalued growth by reviewing these 924 undervalued stocks based on cash flows, which are poised for outsized returns based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success