- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Why Investors Shouldn't Be Surprised By Zai Lab Limited's (NASDAQ:ZLAB) Low P/S

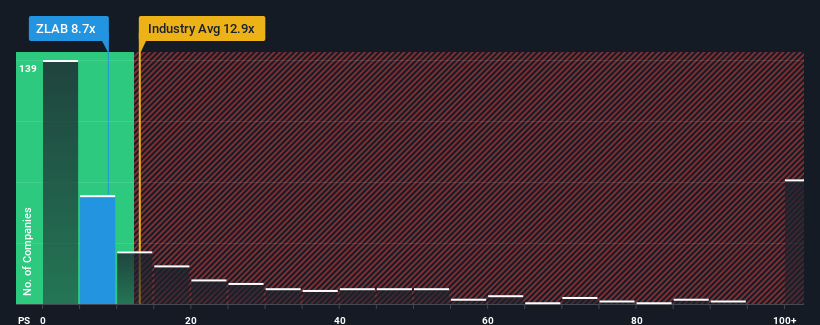

With a price-to-sales (or "P/S") ratio of 8.7x Zai Lab Limited (NASDAQ:ZLAB) may be sending bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 12.9x and even P/S higher than 51x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Zai Lab

How Zai Lab Has Been Performing

With revenue growth that's superior to most other companies of late, Zai Lab has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Zai Lab will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Zai Lab's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 57% each year as estimated by the twelve analysts watching the company. With the industry predicted to deliver 239% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Zai Lab's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Zai Lab's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zai Lab that you need to be mindful of.

If these risks are making you reconsider your opinion on Zai Lab, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives