Stock Analysis

- United States

- /

- Software

- /

- NYSE:ENFN

High Growth Tech Stocks In The United States To Watch

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 3.4%, but it has risen by 20% in the last year with earnings forecast to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.72% | 68.41% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

XOMA Royalty (NasdaqGM:XOMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XOMA Royalty Corporation operates as a biotech royalty aggregator in the United States and the Asia Pacific, with a market cap of $319.30 million.

Operations: XOMA Royalty Corporation generates revenue primarily from its biotechnology segment, which amounted to $15.24 million. The company focuses on aggregating biotech royalties in the U.S. and Asia Pacific regions.

XOMA Royalty Corporation has shown remarkable revenue growth, with a 32.6% increase per year, significantly outpacing the US market's 8.5%. The company's earnings are projected to grow by an impressive 75.18% annually, indicating strong future potential despite current unprofitability. Recent financials highlight a net income of $15.99 million for Q2 2024 compared to a previous net loss of $5.4 million, demonstrating significant improvement in profitability metrics. The company's strategic focus on R&D is evident from its substantial investment in innovation, which is crucial for sustaining long-term growth and competitiveness in the tech sector. With its addition to multiple Russell Growth Indexes and recent name change reflecting its royalty-based business model, XOMA positions itself strongly within the high-growth tech landscape despite historical volatility in share price and past shareholder dilution issues.

- Take a closer look at XOMA Royalty's potential here in our health report.

Assess XOMA Royalty's past performance with our detailed historical performance reports.

Dynavax Technologies (NasdaqGS:DVAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dynavax Technologies Corporation is a commercial-stage biopharmaceutical company that develops and commercializes vaccines in the United States, with a market cap of approximately $1.45 billion.

Operations: Dynavax Technologies focuses on the discovery, development, and commercialization of novel vaccines in the United States, generating $249.69 million in revenue. The company operates as a commercial-stage biopharmaceutical entity with a market cap of approximately $1.45 billion.

Dynavax Technologies has shown a strong revenue increase, with Q2 2024 revenue at $73.8 million, up from $60.25 million last year. The net income also improved significantly to $11.39 million from $3.43 million in the same period, reflecting better profitability metrics and operational efficiency. The company's R&D expenditure is notable for its substantial investment in innovation; it spent approximately 17% of its revenue on R&D to drive future growth and maintain competitiveness within the biotech sector. The company reiterated its full-year financial guidance for HEPLISAV-B net product revenue between $265-$280 million, indicating robust market demand and strategic partnerships abroad, such as in Germany contributing around $3 million in sales. Dynavax's earnings are projected to grow by an impressive 38.5% annually, positioning it well within the high-growth tech landscape despite recent volatility in profit margins which saw a shift from 24.1% last year to 6.9%.

- Dive into the specifics of Dynavax Technologies here with our thorough health report.

Understand Dynavax Technologies' track record by examining our Past report.

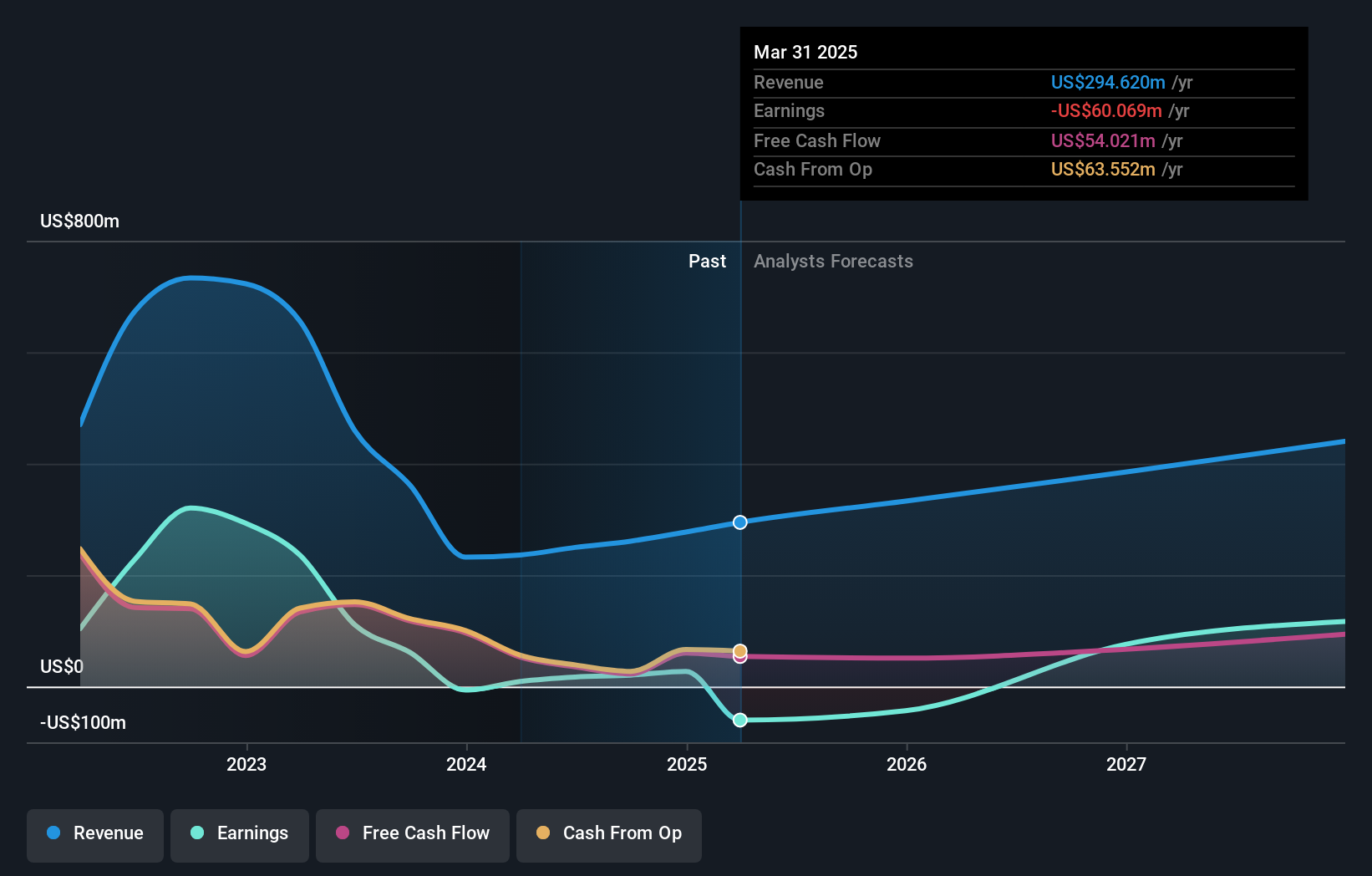

Enfusion (NYSE:ENFN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enfusion, Inc. offers software-as-a-service solutions tailored for the investment management industry across multiple regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $1.03 billion.

Operations: Enfusion, Inc. generates revenue primarily from its online financial information provider services, totaling approximately $188.35 million. The company operates across various regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Enfusion reported a 16.4% revenue increase to $49.46 million in Q2 2024, with net income rising to $1.83 million from $0.63 million the previous year. Their R&D expenses have been substantial, reflecting a commitment to innovation and user-centric design; this is evident in their new Portfolio Workbench features aimed at enhancing portfolio management for both traditional and alternative investment managers. Earnings are projected to grow by an impressive 66.8% annually, driven by strategic enhancements and robust market demand for their solutions.

- Get an in-depth perspective on Enfusion's performance by reading our health report here.

Review our historical performance report to gain insights into Enfusion's's past performance.

Summing It All Up

- Unlock our comprehensive list of 249 US High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enfusion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENFN

Enfusion

Provides software-as-a-service solutions for investment management industry in the United States, Europe, the Middle East, Africa, and the Asia Pacific.