- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma Holdings, Inc. (NASDAQ:XERS) Stock Rockets 30% But Many Are Still Ignoring The Company

Xeris Biopharma Holdings, Inc. (NASDAQ:XERS) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

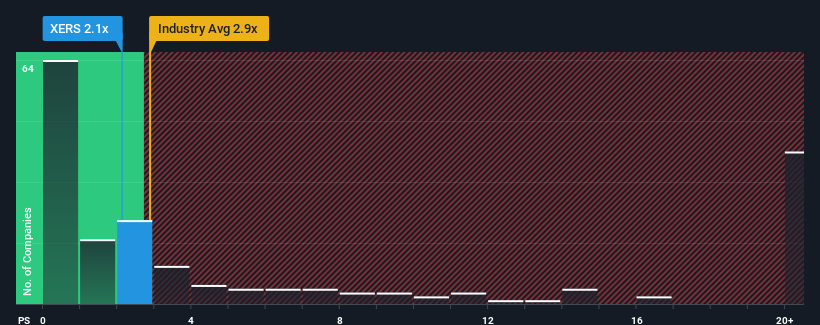

Although its price has surged higher, Xeris Biopharma Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.1x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xeris Biopharma Holdings

What Does Xeris Biopharma Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Xeris Biopharma Holdings as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Xeris Biopharma Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Xeris Biopharma Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the six analysts watching the company. With the industry predicted to deliver 18% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Xeris Biopharma Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Xeris Biopharma Holdings' P/S

Despite Xeris Biopharma Holdings' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Xeris Biopharma Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you settle on your opinion, we've discovered 2 warning signs for Xeris Biopharma Holdings (1 is a bit unpleasant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Good value with reasonable growth potential.

Market Insights

Community Narratives