- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Xenon Pharmaceuticals (XENE): Revenue Forecasts Soar 72.4% as Profitability Concerns Persist

Reviewed by Simply Wall St

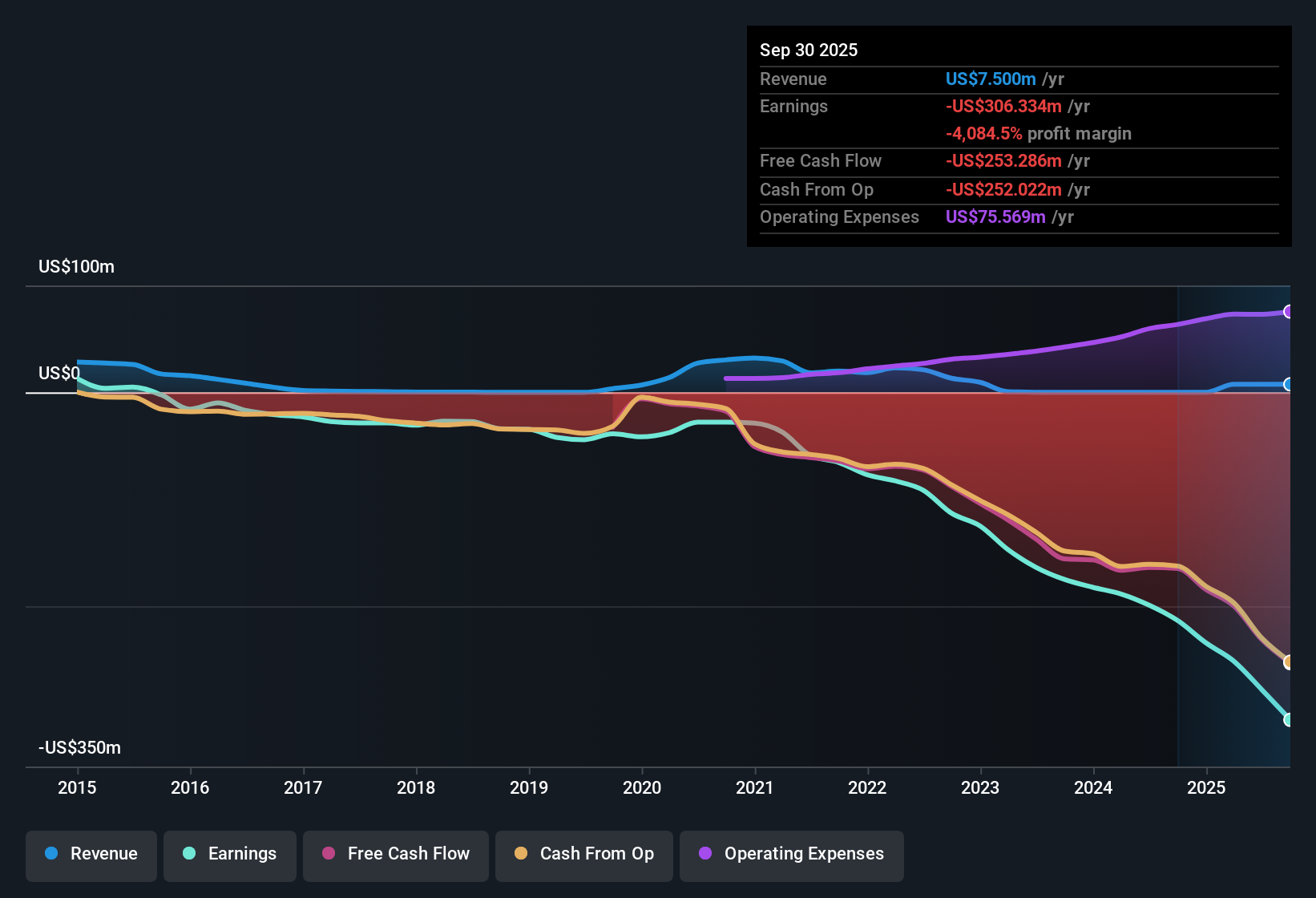

Xenon Pharmaceuticals (XENE) reported continued unprofitability in its latest quarter and is projected to remain in the red for at least three more years. Over the past five years, losses have grown at an average yearly rate of 37%. However, revenue growth is forecast to accelerate at 72.4% per year, outpacing both the broader US market and the biotech sector. Despite substantial top-line momentum, margins and net profit have yet to improve, keeping earnings quality under pressure.

See our full analysis for Xenon Pharmaceuticals.The next section examines how these headline results compare to the prevailing narratives about Xenon. This analysis explores where expectations are confirmed and where perceptions might be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trading Below DCF Fair Value But Above Peers

- Xenon's current share price of $39.09 trades well below the DCF fair value of $78.97, yet remains elevated relative to peers based on the Price-To-Book Ratio.

- The prevailing market view highlights this duality. While a deep discount to modeled fair value can fuel optimism about future upside, the company’s premium to peer valuations may dampen aggressive buying.

- This tension points toward Xenon as a classic high-growth biotech. Investors may be willing to pay above the sector for pipeline potential, provided the story holds up.

- However, ongoing losses and stretched valuation metrics urge caution for those hoping for a quick reversal to profitability.

Losses Mount Despite Soaring Revenue Forecasts

- Losses have compounded at a striking rate of 37% per year over the past five years, even as management guides for a market-beating 72.4% annual revenue growth going forward.

- This aligns with the prevailing market view that high growth rates are a key reward. The bullish case relies on strong top-line momentum to eventually unlock operating leverage.

- Investors betting on the upside are banking on this fast-expanding revenue base to eventually narrow losses and support a re-rating.

- The danger is that persistent losses could undermine these hopes if margin improvement does not materialize within the next few years.

No Insider Selling but Profitability Still a Key Concern

- No significant insider selling was reported in the past quarter, yet the company remains unable to turn a profit—a risk factor called out in filings.

- The prevailing market view recognizes this classic biotech risk profile. Strong pipeline and market excitement, but continued financial losses and uncertain execution may lead cautious investors to hold back.

- This risk is accentuated because sector attention has recently shifted to companies with clear profitability pathways, putting greater scrutiny on Xenon's ability to deliver on its high-growth promise.

- Still, the absence of insider selling can be viewed as a vote of confidence from leadership, even as financial execution remains in question.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Xenon Pharmaceuticals's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Xenon’s persistent losses and lack of clear profitability, despite high revenue growth forecasts, highlight the risks of chasing momentum without financial stability.

If you want to focus on consistency and minimize the volatility seen here, use stable growth stocks screener (2078 results) to find companies with reliable growth and proven earnings strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives