- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (WVE): Assessing Valuation After Recent Volatility and Analyst Price Target Gap

Reviewed by Simply Wall St

See our latest analysis for Wave Life Sciences.

After a tough stretch, Wave Life Sciences' share price is showing notable volatility. A 1-day drop of 4.1% capped off a 7-day slide of over 15%. While recent momentum has cooled, the stock’s three-year total shareholder return remains solidly positive. In contrast, the one-year total return tells a much more challenging story.

If today’s biotech swings have you rethinking your watchlist, why not broaden your outlook and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets despite recent revenue growth, investors may wonder if Wave Life Sciences is now undervalued or if the market is already factoring in all future progress.

Most Popular Narrative: 67.1% Undervalued

With analysts targeting a fair value that is nearly three times the last close, Wave Life Sciences’ future prospects are drawing major interest from the market. The narrative sets out a detailed case for stronger growth driven by clinical milestones and industry trends.

The upcoming clinical data readouts for key programs (AATD with WVE-006 and obesity with WVE-007) in late 2025 and early 2026 represent potential inflection points. These are supported by strong early efficacy and favorable safety and, if positive, could significantly expand revenue opportunities in large, underserved markets. This is a result of an aging population and the rising prevalence of chronic disease.

Want to know the financial levers behind this bold price target? The narrative’s headline projections hinge on rapid revenue scaling, a dramatic margin swing, and a valuation multiple more commonly reserved for breakout biotech stars. What do the analyst forecasts see that the market is missing? Peek inside for the narrative’s full growth equation and the assumptions that set this company’s fair value high above today’s price.

Result: Fair Value of $20.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses and setbacks in key clinical programs could undermine the optimistic outlook that investors are currently considering for Wave Life Sciences.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: High Sales Ratio Raises Caution

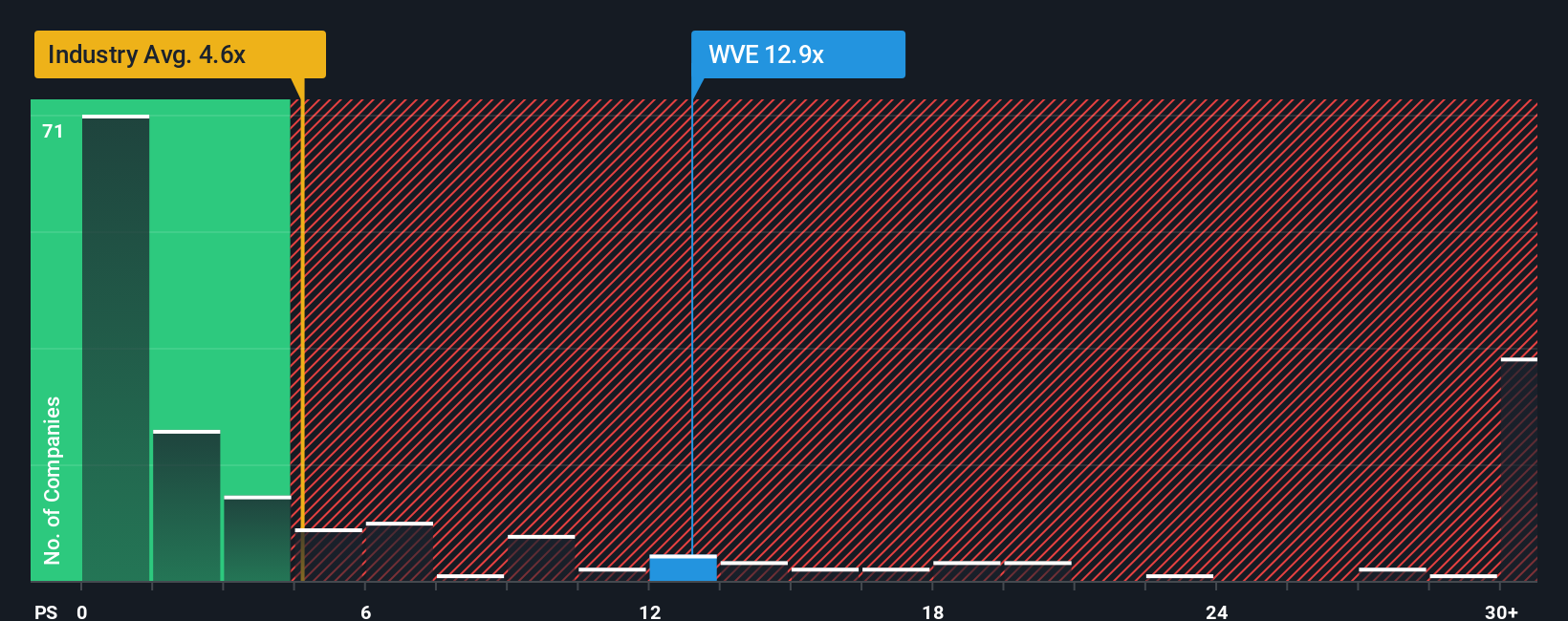

While the narrative paints Wave Life Sciences as undervalued, one key multiple tells a different story. Its price-to-sales ratio sits at 10.2x, which is more than double the industry average and nearly triple that of similar peers. The fair ratio, based on fundamentals, is just 1.6x. This sharp gap could mean significant downside risk if the market cools on future growth hopes. Could sentiment shift in the other direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you’d rather chart your own path or dig deeper into the numbers, crafting your personal take on Wave Life Sciences takes just a few minutes. Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to expand your portfolio with powerful investment opportunities you might be overlooking. Take action and see what else could work for your strategy.

- Capture the potential of new market entrants by targeting these 3592 penny stocks with strong financials with robust fundamentals and turnaround stories worth your attention.

- Maximize your income strategy by reviewing these 15 dividend stocks with yields > 3% that deliver dependable yields exceeding 3 percent.

- Get ahead of tomorrow’s breakthroughs by focusing on these 27 AI penny stocks as they push the boundaries of artificial intelligence innovation in every sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives