- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Could Wave Life Sciences' (WVE) Novel Obesity Data Reveal a Strategic Shift in Its Pipeline Focus?

Reviewed by Sasha Jovanovic

- Wave Life Sciences recently announced encouraging preclinical and ongoing clinical results for its WVE-007 GalNAc-siRNA investigational therapeutic targeting obesity, including potent and durable reductions in Activin E observed across both animal and human studies, as well as highlighted these advances at major scientific conferences.

- These findings suggest WVE-007 may offer an alternative approach to current obesity treatments by promoting fat loss while preserving lean muscle mass, which could set it apart in a competitive therapeutic landscape.

- We'll now explore how this reported evidence of differentiated fat and muscle effects with WVE-007 could influence Wave's broader investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Wave Life Sciences Investment Narrative Recap

At its core, Wave Life Sciences is a bet on the potential for RNA-based therapies to generate transformative data and drive large new revenue streams, especially as its lead programs advance toward late-stage readouts. The latest promising clinical evidence for WVE-007 could add momentum to the obesity franchise and supports the most important short-term catalyst: pivotal data for WVE-007; however, the company’s widening net losses and dependence on future funding remain significant risks, and these new results do not materially change that risk profile.

Among recent company updates, the October 29 announcement of clinically meaningful, dose-dependent Activin E reductions from the ongoing INLIGHT study is most aligned with the new WVE-007 findings. These clinical readouts remain central to Wave’s investment thesis and will likely shape both the pace of potential partnerships and its ability to fund continued R&D.

By contrast, it is also critical for investors to watch escalating operating expenses and the possibility of further dilution, especially as...

Read the full narrative on Wave Life Sciences (it's free!)

Wave Life Sciences' narrative projects $177.5 million in revenue and $41.2 million in earnings by 2028. This requires 23.6% yearly revenue growth and a $171.1 million increase in earnings from the current level of -$129.9 million.

Uncover how Wave Life Sciences' forecasts yield a $20.27 fair value, a 179% upside to its current price.

Exploring Other Perspectives

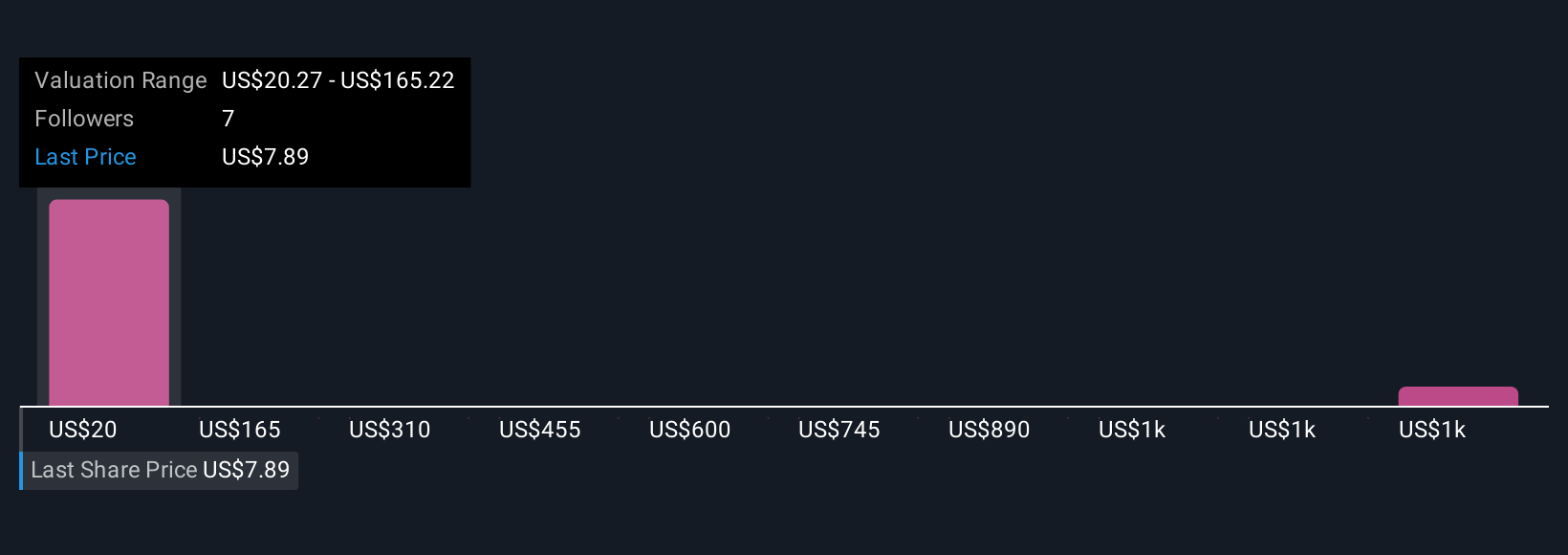

Simply Wall St Community contributors provided two fair value targets for Wave Life Sciences, spanning from US$20 to US$1,469 per share. With clinical catalysts in obesity and a widening loss profile, your own outlook on risk and reward may differ, explore diverse viewpoints to inform your perspective.

Explore 2 other fair value estimates on Wave Life Sciences - why the stock might be worth just $20.27!

Build Your Own Wave Life Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wave Life Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wave Life Sciences' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives