- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Should You Rethink Vertex After Recent Gains and Gene Therapy Progress?

Reviewed by Bailey Pemberton

Thinking about what to do with your Vertex Pharmaceuticals shares? You are not alone. Lately, this stock has drawn plenty of attention for both its potential and its price swings. Over the past month, Vertex climbed a healthy 8.9%, and even though it dipped 1.4% in the last week, that hardly tells the whole story. Zoom out a bit and it is clear the past few years have rewarded patient investors—a whopping 99.0% gain over five years stands out, despite recent bumps like a 10.7% drop over the last year.

Recent headlines have certainly added a twist. Excitement around Vertex's progress in advanced gene therapies and anticipation over regulatory milestones have both played into changing perceptions of risk and reward. Long-term optimism is still strong, but newer market jitters, whether over shifting drug pipelines or competitive threats, have made the price chart a lively watch.

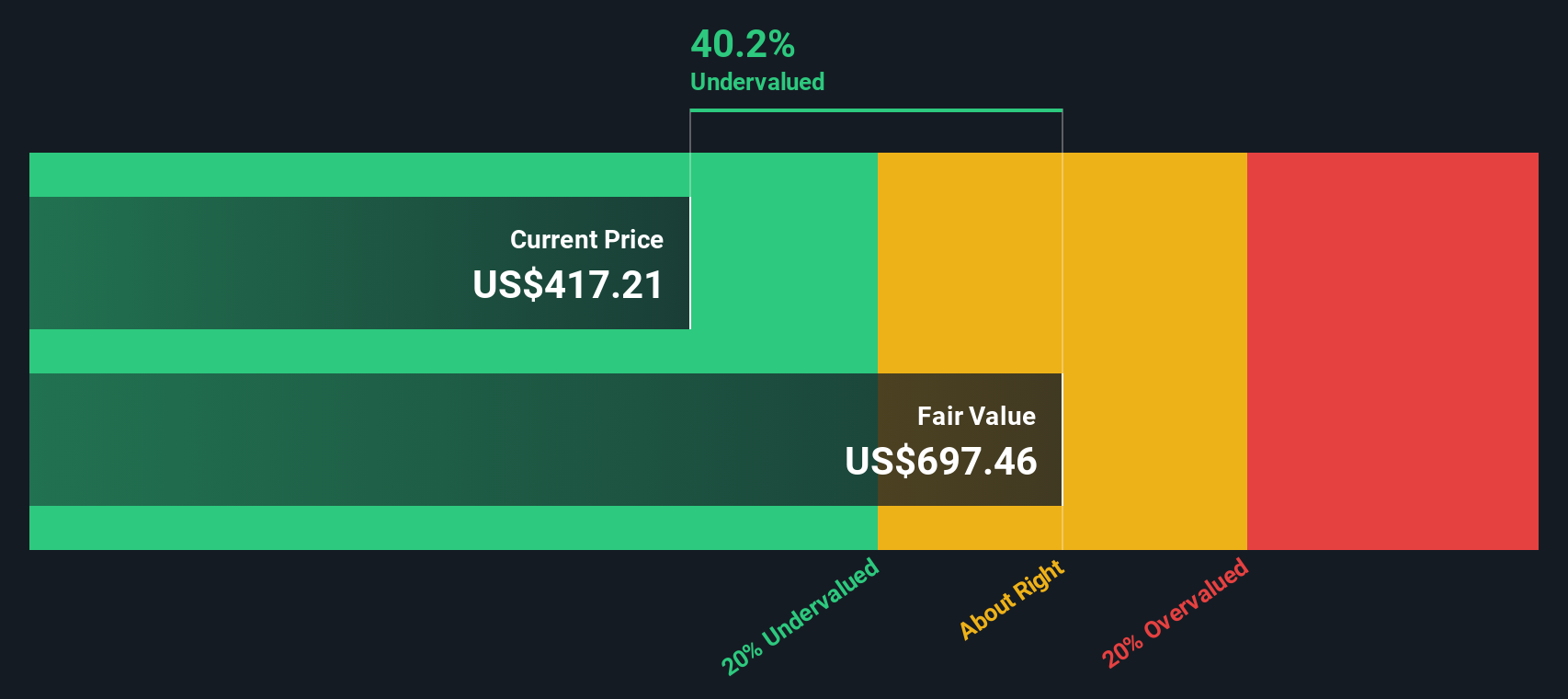

Given all of that, is Vertex actually undervalued at these levels? According to our valuation score, which counts six key checks and adds a point for each mark of undervaluation, Vertex scores a 3, so it is undervalued in half of the measures we care about. That is a good start, but the real story goes deeper.

Next, we will break down these valuation methods and weigh what they reveal. Stick around, because at the end of the article we will walk through the more insightful, real-world metric that often matters most to smart investors.

Why Vertex Pharmaceuticals is lagging behind its peers

Approach 1: Vertex Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to their value today. For Vertex Pharmaceuticals, this approach starts with the company’s most recent Free Cash Flow of $3.46 billion over the last twelve months and relies on analyst forecasts for the next five years. After that, Simply Wall St carries the projections forward based on estimated growth trends.

According to analyst consensus, Vertex’s Free Cash Flow is expected to reach $6.62 billion by 2029, showing steady growth from its current level. Looking at the ten-year projection, later years are estimated and then discounted, acknowledging both optimism in cash generation and the uncertainties further out in time.

When all these future cash flows are summed and adjusted for the time value of money, the resulting intrinsic value for Vertex shares comes in at $696.12. Compared to the current share price, this DCF analysis suggests the stock is trading at a 39.6% discount. This implies that shares are undervalued based on forecasted cash flow generation, at least according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vertex Pharmaceuticals is undervalued by 39.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

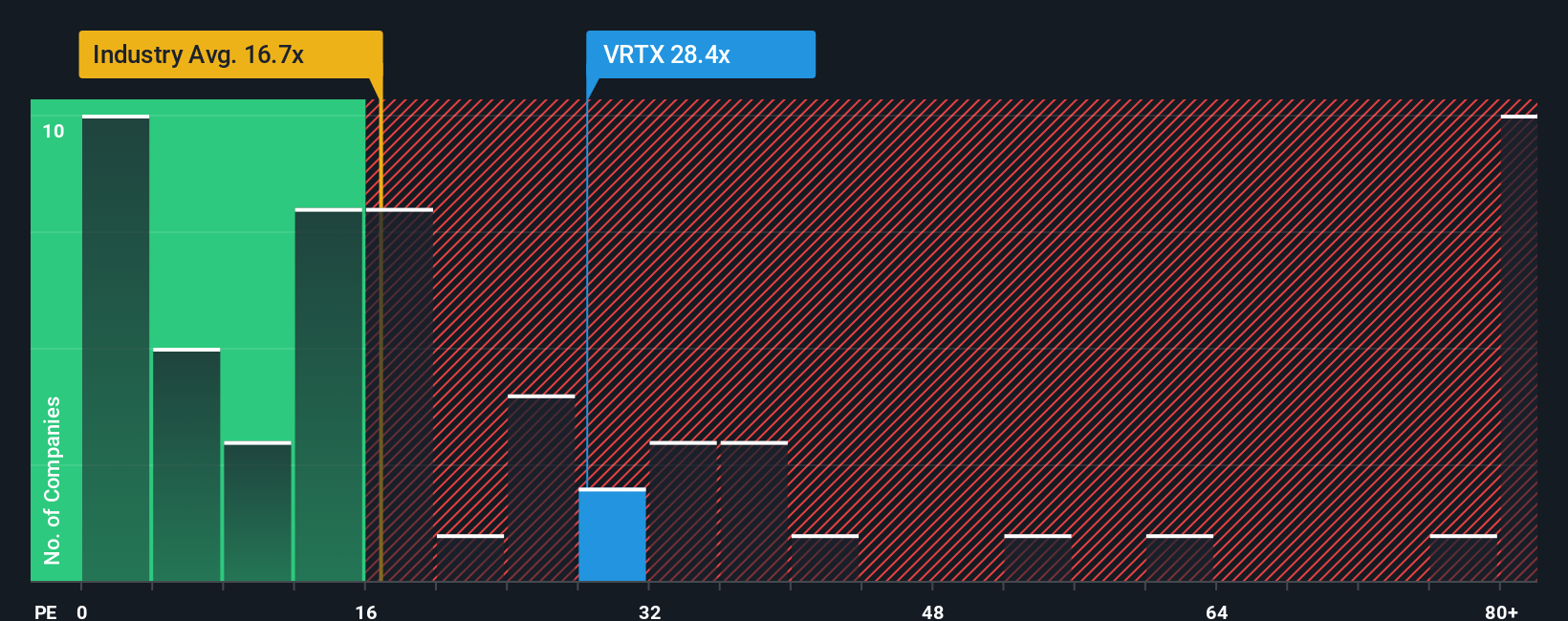

Approach 2: Vertex Pharmaceuticals Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a popular and effective valuation metric, especially for profitable companies like Vertex Pharmaceuticals. Since Vertex has consistent earnings, the P/E ratio allows investors to judge how much they are paying for each dollar of company profit. This provides a practical way to assess value for businesses generating positive net income.

Growth prospects and risk are important to keep in mind when using the P/E ratio. Companies with higher expected earnings growth or those perceived as lower risk often command a higher “normal” P/E multiple. In contrast, more mature or riskier businesses tend to trade at lower ratios, reflecting their slower outlook or added uncertainty.

Vertex Pharmaceuticals currently trades at a P/E of 29.62x. This is significantly higher than the biotech industry average of 17.82x and lower than the peer average of 42.29x. To help judge whether that premium makes sense, Simply Wall St uses a proprietary “Fair Ratio,” which is a benchmark multiple customized for Vertex. This ratio factors in its earnings growth, risk profile, profit margins, market cap, and industry context. Unlike simple industry or peer comparisons, the Fair Ratio of 27.03x is tailored to the company’s unique characteristics and may serve as a more reliable signal for value-conscious investors.

Comparing the current P/E of 29.62x to the Fair Ratio of 27.03x, the stock is trading slightly ahead of its tailored benchmark, indicating a modest premium by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vertex Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your investment story—a concise perspective that connects what you believe about a company’s future with hard numbers like projected revenue, profits, and margins, all flowing through to a calculated fair value.

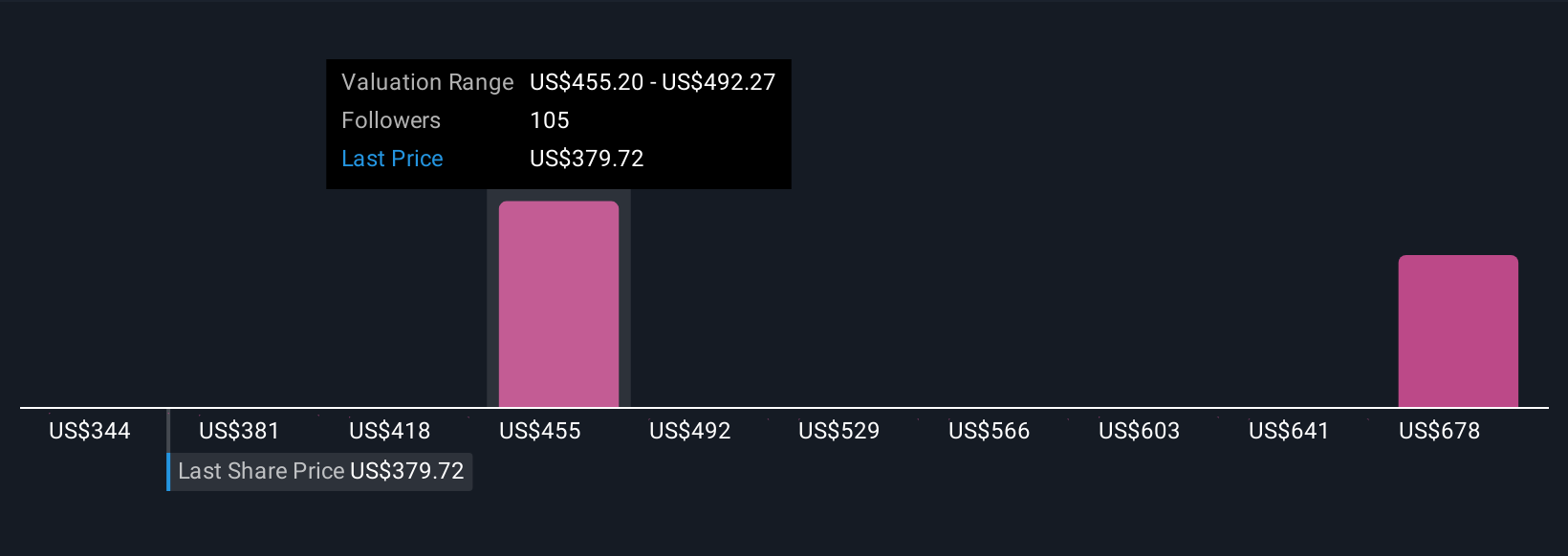

Instead of seeing valuation as just a static ratio or model, Narratives help frame your expectations for Vertex Pharmaceuticals by tying together recent developments, growth drivers, risks, and future milestones. This approach is accessible to all investors on Simply Wall St’s Community page, where millions of users easily create and share their own Narratives, pairing their outlook with dynamic forecasts and fair value estimates.

With Narratives, you can quickly sense-check whether you think Vertex is a buy, hold, or sell by comparing your fair value calculation with the live share price. Since Narratives are automatically updated as soon as new earnings or news are released, your investment thesis evolves in real time.

For Vertex, Narratives created by different investors can vary widely. One user with a bullish view may set a fair value of $615.66, betting on rapid adoption of new gene therapies. Another, taking a more cautious consensus, sets fair value at $479.83, reflecting steady but measured future growth.

Do you think there's more to the story for Vertex Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives