- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Is Vertex Stock Poised for Growth After Recent Pipeline Advancements?

Reviewed by Bailey Pemberton

- Ever wondered if Vertex Pharmaceuticals is a hidden gem or if its current share price leaves little room for upside? Let's dive in together and see what the numbers say.

- The stock has seen some mild positive movements lately, up 2.6% over the past week and up 2.9% for the month. However, it is still down 7.0% over the last year even with strong long-term returns.

- Recent news has highlighted ongoing advancements in Vertex's drug pipeline along with several regulatory milestones, fueling a mix of optimism and caution among investors. This ongoing innovation helps explain both the recent uptick in the stock and shifts in risk sentiment seen in the market.

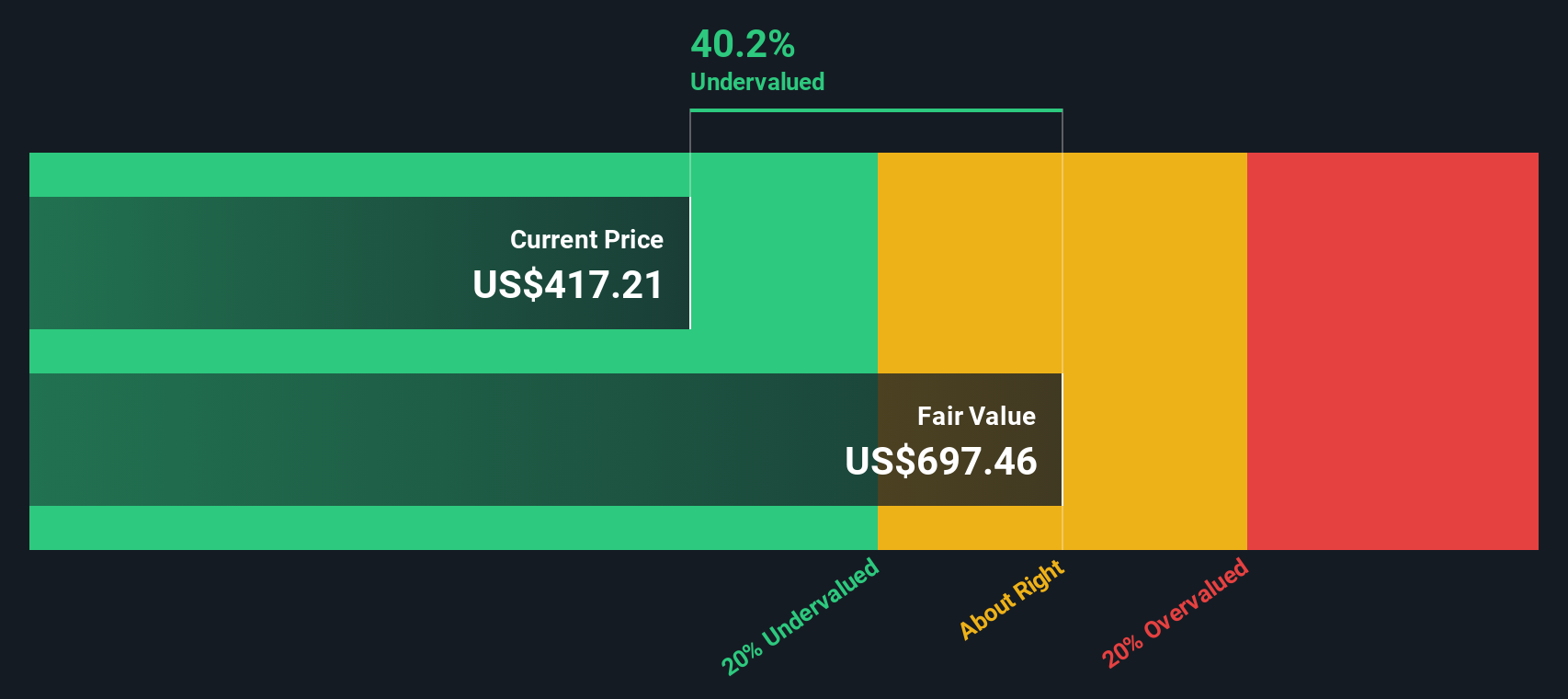

- On our valuation scale, Vertex scores 3 out of 6 for being undervalued. Next, we will break down how different valuation models see Vertex, and at the end, reveal an even smarter way to think about value that goes beyond the usual numbers.

Find out why Vertex Pharmaceuticals's -7.0% return over the last year is lagging behind its peers.

Approach 1: Vertex Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's value. This approach helps investors understand what the business is worth based on its ability to generate cash over time, rather than just relying on current profits or sales.

Vertex Pharmaceuticals currently generates Free Cash Flow of $3.31 billion. Analysts provide projections for the next five years, and these show healthy expected growth in cash flows. By 2029, projections have Free Cash Flow reaching $6.73 billion, with further growth anticipated and extrapolated by Simply Wall St through 2035. This rising trend highlights the company’s ongoing potential to deliver strong financial performance in $.

Based on the DCF analysis, Vertex's estimated intrinsic value is $709.90 per share. This suggests the stock is trading at a 39.1% discount to its fair value, implying it is significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vertex Pharmaceuticals is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Vertex Pharmaceuticals Price vs Earnings

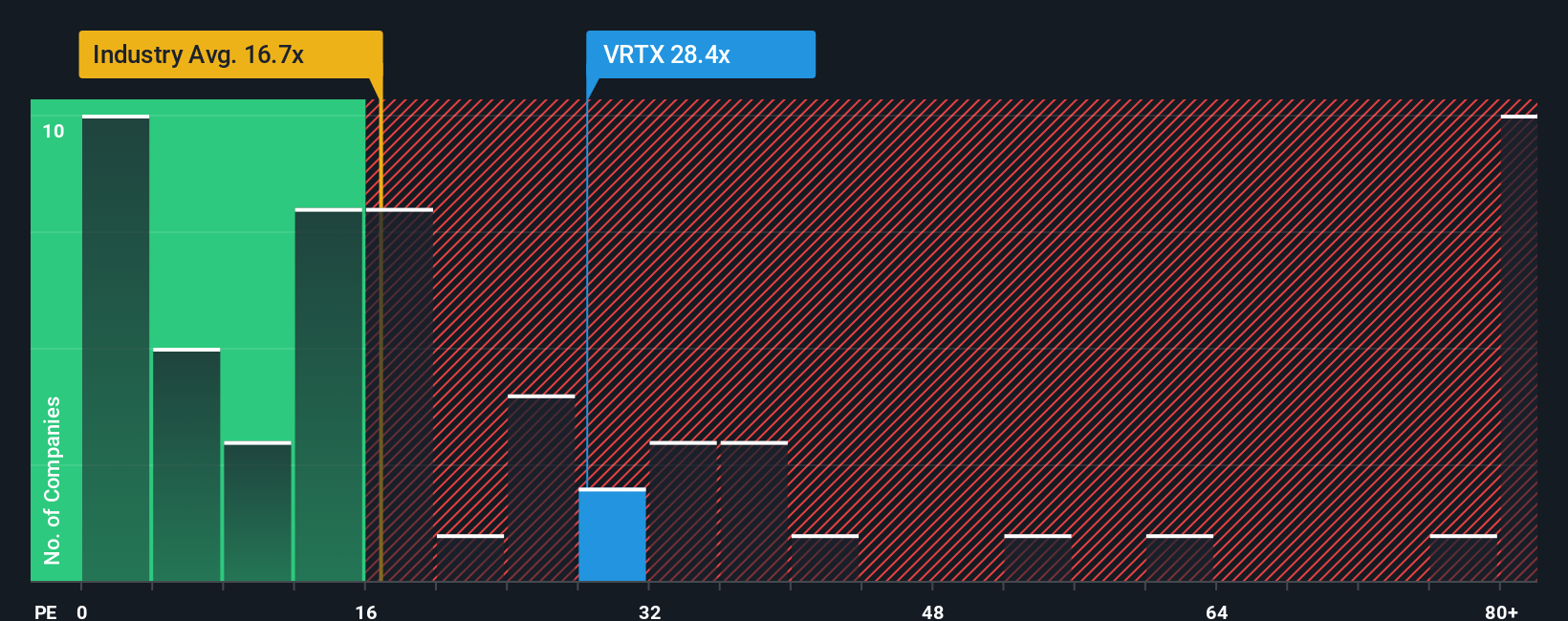

The Price-to-Earnings (PE) ratio is widely considered a reliable valuation metric for profitable companies because it directly relates the stock price to the company’s actual earnings. This makes it a useful tool for comparing value across similar businesses. When a company is consistently earning profits, the PE ratio helps investors assess how much they are paying for each dollar of earnings generated.

It is important to note, however, that what qualifies as a "normal" or "fair" PE ratio can vary considerably based on two key factors: expectations for future growth and perceived risk. Companies with higher expected growth rates or lower risk profiles often command higher PE ratios, reflecting investor optimism and confidence in sustained profitability. In contrast, higher risk or lower growth expectations tend to push the PE ratio lower, signaling caution.

Currently, Vertex Pharmaceuticals trades at a PE ratio of 29.8x. Compared to the broader Biotechs industry average of 19.1x and the peer group average of 58.7x, Vertex stands between these benchmarks. This suggests the market assigns a premium on its earnings, but not an excessive one. Simply Wall St’s proprietary “Fair Ratio” model, which incorporates considerations such as Vertex’s earnings growth, industry trends, profit margins, market capitalization and specific risks, calculates an appropriate PE for the company at 29.0x. Unlike simple peer or industry comparisons, this Fair Ratio provides a more tailored benchmark by accounting for factors that directly impact Vertex’s valuation outlook.

With Vertex’s current PE (29.8x) aligning closely to the Fair Ratio (29.0x), the stock appears fairly valued based on this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

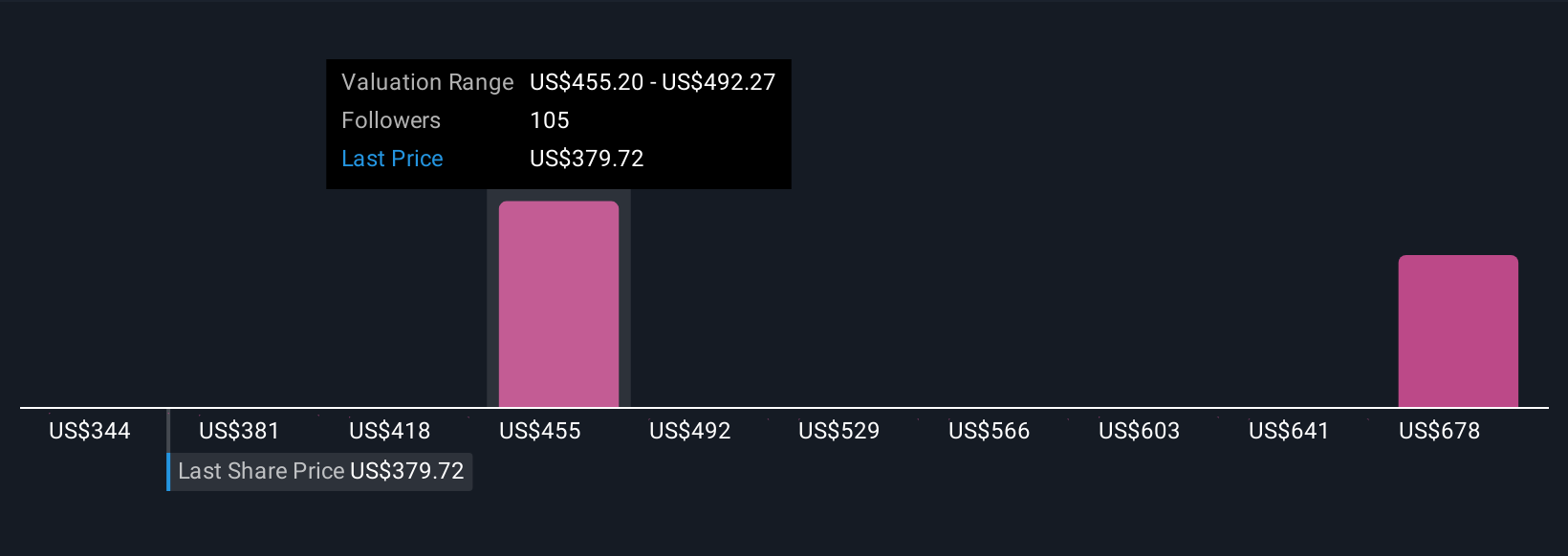

Upgrade Your Decision Making: Choose your Vertex Pharmaceuticals Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own unique, story-driven view of a company. It connects what you believe about Vertex Pharmaceuticals' products, competition, and future to specific financial forecasts, such as projected revenue, margins, and a fair value estimate.

Narratives make investing more personal and insightful by translating your perspective and research into actual numbers. This allows you to see how your outlook measures up against market expectations. On Simply Wall St's Community page, millions of investors use Narratives as an easy, interactive tool to map out their scenarios for the companies they follow.

What sets Narratives apart is how they turn the “why” behind your investment view into a clear, actionable plan. This helps you compare your calculated Fair Value to the current share price and decide if you think it's time to buy, hold, or sell.

Narratives update automatically whenever new events occur, such as earnings releases or big news, so your story and valuations stay relevant. For example, some investors currently estimate a fair value for Vertex as high as $616, seeing robust growth in gene therapies and global expansion. Others are more cautious with a $330 target, concerned about competition and pipeline risks.

Do you think there's more to the story for Vertex Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success