- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Is Vertex Pharmaceuticals a Smart Investment After Recent FDA Approval for Sickle Cell Therapy?

Reviewed by Bailey Pemberton

Trying to decide what to do with Vertex Pharmaceuticals stock right now? You are far from alone. After all, over the past year, the company’s share price dipped by 10.1%. However, if you zoom out further, you will see a different story: a robust climb of 36.9% over three years and an even more impressive 46.9% over the last five years. Even in the short term, Vertex has eked out a positive run, gaining 2.0% in the last week and 1.8% across the most recent month, despite being slightly down for the year to date.

Investors considering this biotech powerhouse are not just tracking numbers. Recent sentiment in the market has grown more optimistic, reflecting both the company's pipeline developments and a wider shift toward pharma innovation. In addition, a fresh round of sector enthusiasm has rekindled discussion about whether now might be an opportunity to buy into undervalued industry leaders like Vertex. At present, Vertex scores a 3 out of 6 on fundamental valuation checks for being undervalued, which might signal potential for future outperformance or at least justify a deeper look.

So how do the standard ways of valuing a company measure up for Vertex Pharmaceuticals right now? Let’s walk through each method, point out their strengths and blind spots, and build to a perspective that may offer an even clearer answer.

Why Vertex Pharmaceuticals is lagging behind its peers

Approach 1: Vertex Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps determine whether a stock is currently priced below or above its fundamental worth, based on how much cash the business is expected to generate over time.

For Vertex Pharmaceuticals, current free cash flow stands at approximately $3.46 billion. Analysts forecast steady growth, projecting free cash flow to reach about $6.64 billion by 2029. Extending the view out to ten years, further estimates put Vertex’s free cash flow close to $9.24 billion in 2035, with projections past 2029 based on continued growth patterns illustrated by sector analysts and modeled scenarios.

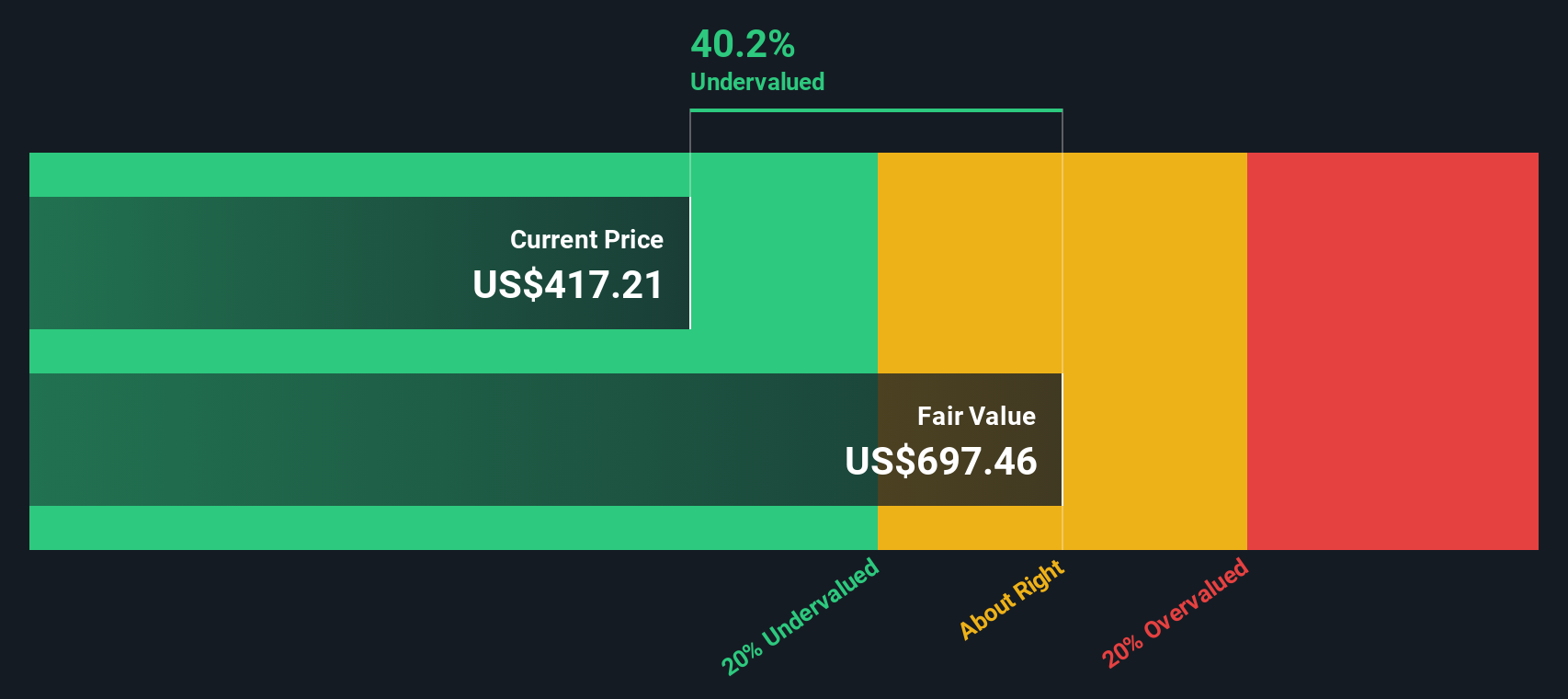

Based on these cash flows and applying the DCF model, the estimated fair value of Vertex shares comes in at $711.72. This calculation suggests the stock is trading at a 43.3% discount to its intrinsic value, signaling a significant undervaluation when compared to current market prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vertex Pharmaceuticals is undervalued by 43.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vertex Pharmaceuticals Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Vertex Pharmaceuticals because it quickly relates a company’s market value to its actual earnings power. For businesses with consistent profits, the PE ratio provides a straightforward picture of how much investors are willing to pay for each dollar of earnings.

Determining what counts as a “normal” or “fair” PE ratio depends on a mix of factors. Companies with high growth prospects or lower perceived risk typically trade at higher PE ratios, reflecting investors’ willingness to pay a premium for future earnings expansion. In contrast, slower growth or riskier businesses command lower ratios.

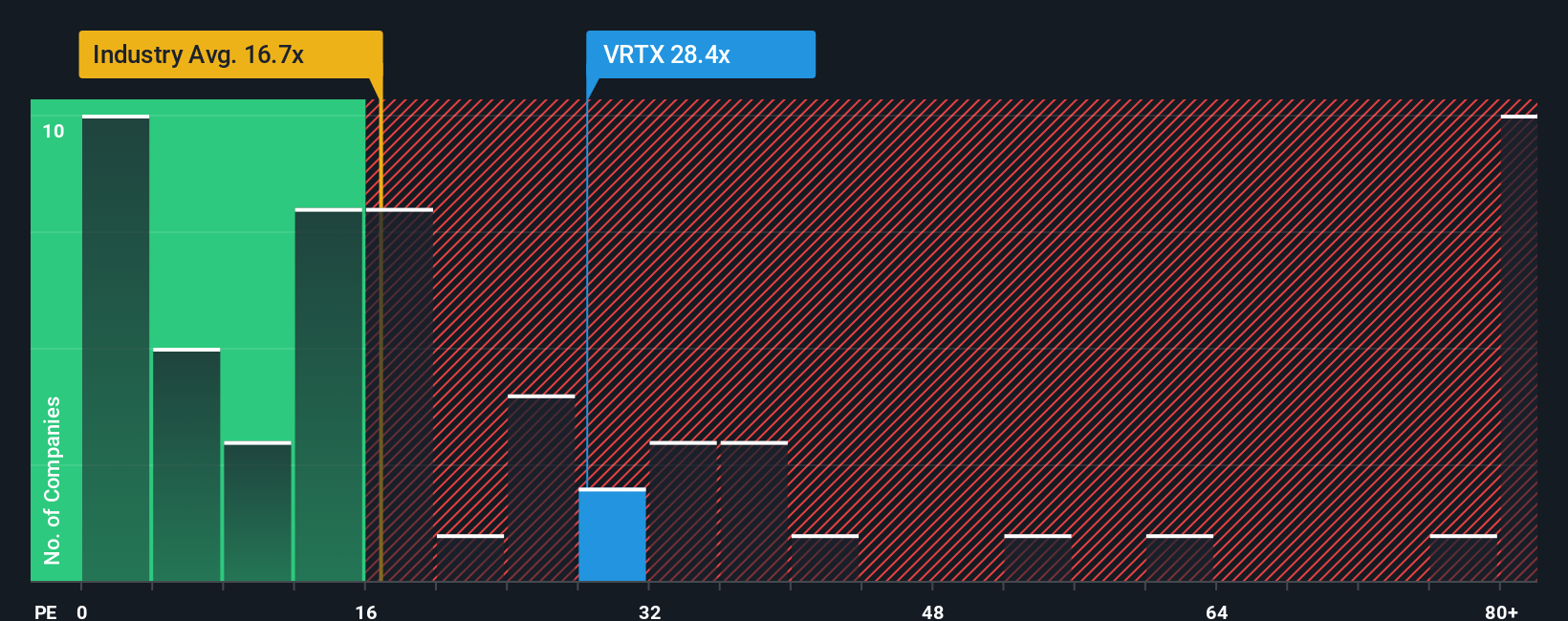

Currently, Vertex Pharmaceuticals trades at a PE ratio of 28.4x. Compared to the broader biotech industry average of 16.7x and its peer average of 42.8x, Vertex sits somewhere in the middle. It is higher than the industry's typical company, but well below the average of its closest competitors. To assess whether this valuation is justified, Simply Wall St’s proprietary Fair Ratio steps in. The Fair Ratio takes company-specific factors, such as earnings growth, margins, size, and risks, into account and estimates that Vertex’s “fair” PE should be about 26.9x. This approach is more robust than simply comparing industry or peer averages because it provides a tailored benchmark grounded in the company’s own fundamentals.

With the actual PE and the Fair Ratio so close, Vertex looks fairly valued by this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vertex Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are a tool that allow you to go beyond just the numbers by defining your own story of what you think will happen for a company. This involves combining your expectations for future results, such as revenue, earnings growth, and profit margins, into a financial forecast and then automatically calculating a Fair Value based on your assumptions.

With Narratives, you can easily see how your perspective compares to other investors and analysts, all within the Community page on Simply Wall St’s platform used by millions. Narratives connect the dots by linking a company’s business story and new developments to real-time financial forecasts and valuations. This approach allows you to assess whether the current price aligns with your own logic and beliefs.

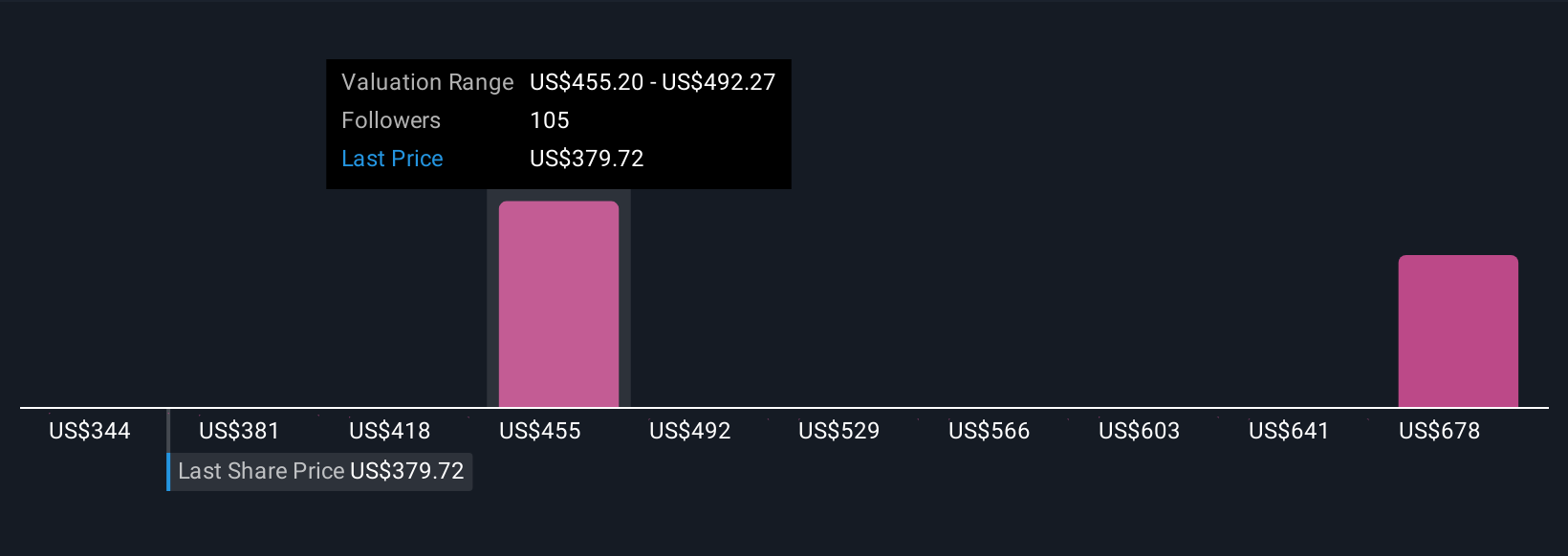

Narratives update dynamically whenever news or earnings releases are published, so your investment thesis stays relevant. For example, some investors might believe Vertex is worth over $615 based on expectations of aggressive innovation and market expansion. Others may see a fair value closer to $330 if concerns about competition and reliance on cystic fibrosis drugs are a greater focus. Narratives make it easy to compare your view with the range of market opinions, supporting more informed, story-driven investment decisions.

Do you think there's more to the story for Vertex Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives