- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

How Vertex’s Kidney Drug Breakthrough and FDA Recognition Will Impact VRTX Investors

Reviewed by Sasha Jovanovic

- Vertex Pharmaceuticals recently reported positive interim data from the RUBY-3 trial at ASN Kidney Week 2025, showing that its investigational kidney disease therapy povetacicept led to substantial reductions in proteinuria and favorable safety results in adults with IgA nephropathy and primary membranous nephropathy.

- Alongside these clinical findings, Vertex received Breakthrough Therapy Designation from the FDA for povetacicept in IgA nephropathy, completed late-stage trial enrollment, and outlined plans for an accelerated regulatory path, reinforcing its progress in kidney disease therapeutics.

- We’ll examine how these advances with povetacicept in kidney disease could influence Vertex’s growth profile and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vertex Pharmaceuticals Investment Narrative Recap

To be comfortable as a Vertex shareholder, you need confidence that its pipeline diversification efforts can balance reliance on cystic fibrosis revenues and offset margin pressures as competition intensifies. The recent strong RUBY-3 data on povetacicept and expedited regulatory designation may strengthen the narrative for near-term pipeline catalysts, but do not fundamentally change the key risk: uncertain outcomes for large late-stage clinical and regulatory programs could still leave CF as the dominant earnings driver.

Among Vertex’s recent updates, the company’s raised 2025 revenue guidance to US$11.9 billion to US$12.0 billion is closely tied to continual CF franchise resilience and new launches. While povetacicept is making clinical progress, the pivotal revenue drivers remain in CF and early-stage pain and gene-editing therapies, reinforcing why diversification and execution beyond CF remain central to the investment thesis.

Yet, in contrast to pipeline momentum, investors should be aware that Vertex’s long-term outlook also depends on how it manages...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

Vertex Pharmaceuticals is expected to reach $14.9 billion in revenue and $5.6 billion in earnings by 2028. This outlook assumes annual revenue growth of 9.4% and a $2.0 billion increase in earnings from the current $3.6 billion.

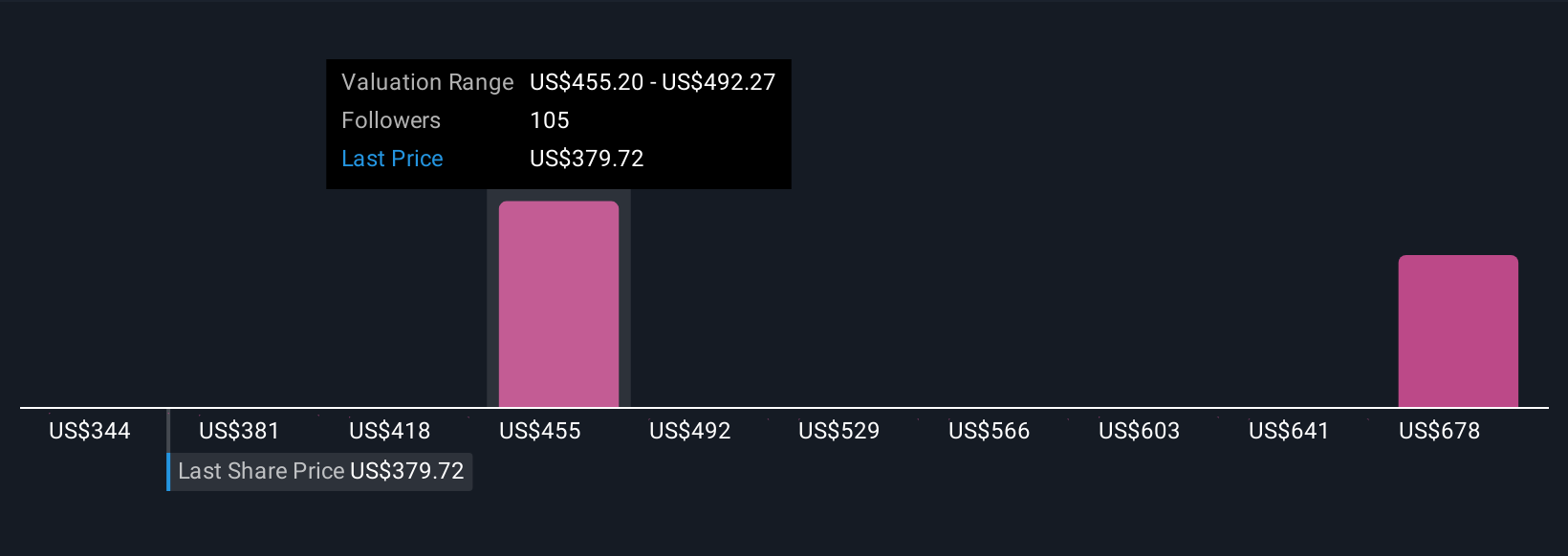

Uncover how Vertex Pharmaceuticals' forecasts yield a $479.83 fair value, a 10% upside to its current price.

Exploring Other Perspectives

While the baseline view focuses on mitigating overreliance on cystic fibrosis drugs, the highest analysts see Vertex’s breakthrough therapies and rapid CF innovation as setting the stage for US$16.9 billion in revenue by 2028. These optimistic forecasts highlight how your own expectations for new programs like povetacicept could reshape your take on risk and opportunity, explore how views differ and why they might soon change.

Explore 7 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth 21% less than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives