- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

A Look at Vertex Pharmaceuticals's Valuation Following Breakthrough Kidney Drug Data and Raised 2025 Guidance

Reviewed by Simply Wall St

Vertex Pharmaceuticals (VRTX) is in focus after unveiling new clinical trial data for povetacicept in kidney diseases at a major conference. The company also secured FDA Breakthrough Therapy and Fast Track statuses, and raised its 2025 revenue guidance following strong third quarter results.

See our latest analysis for Vertex Pharmaceuticals.

Momentum around Vertex has picked up lately, with recent clinical milestones and upbeat financials sparking investor optimism. The share price has climbed over 12% in the past 90 days, helping offset a wider 6% decrease in total shareholder return over twelve months. Longer term, returns remain strong, with a 103% total shareholder return over five years.

If Vertex’s progress has you watching the healthcare space more closely, consider uncovering new ideas with the See the full list for free.

With the stock trading around 11% below analyst targets and showing almost 40% intrinsic discount, investors may wonder whether the market is still overlooking Vertex’s growth potential or if expectations for future breakthroughs are already reflected in the price.

Most Popular Narrative: 8.9% Undervalued

Vertex's most widely followed narrative places its fair value at $479.83, which is roughly 8.9% above the last close of $437.15. This sets expectations for how analysts are weighing the company's growth levers against near-term risks.

Robust global launches, improving reimbursement, and disciplined reinvestment strengthen future earnings and broaden opportunities amid rising healthcare spending and AI-driven drug development trends.

Want to know which financial leap sets this price target? The secret lies in aggressive revenue scaling and a bold assumption about profit expansion. Dive in to see what bold growth projections drive this narrative's valuation. What might you uncover?

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on cystic fibrosis drugs and regulatory setbacks could quickly challenge this consensus view and limit Vertex’s projected upside.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another View: Are Market Multiples Sending a Different Signal?

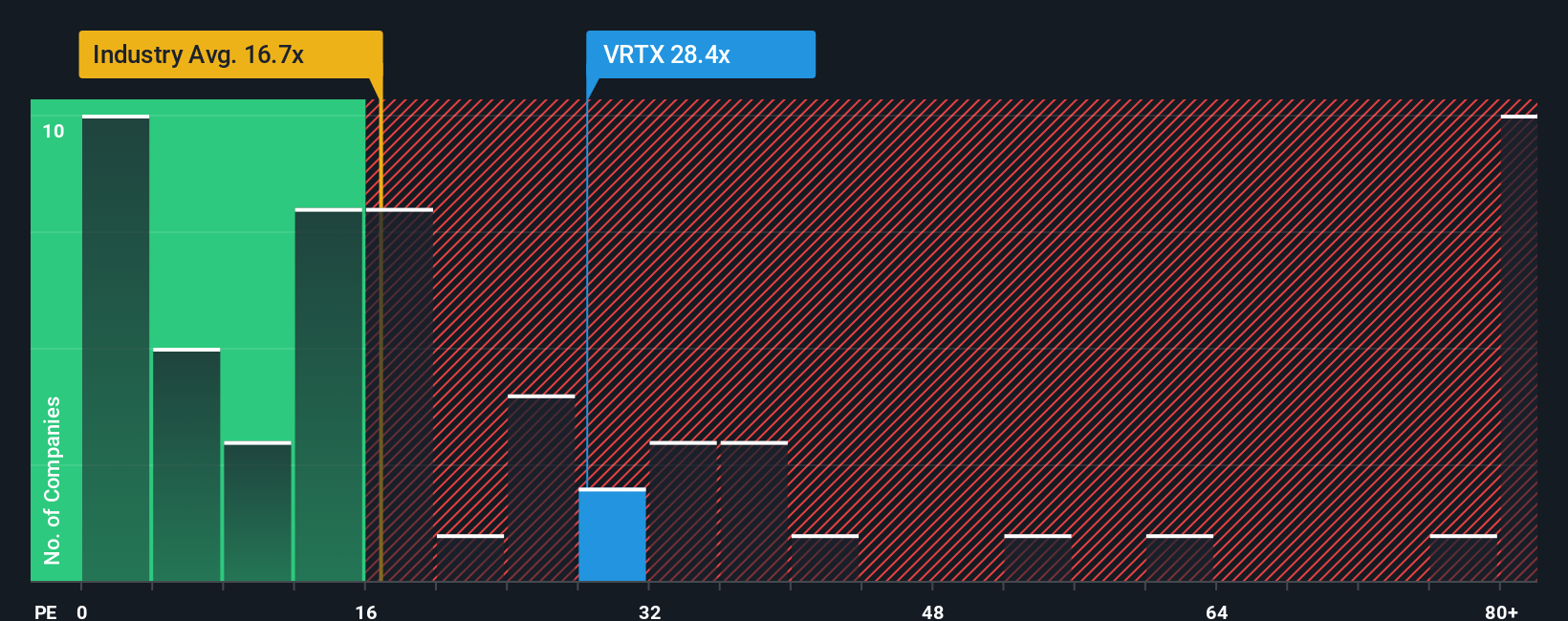

While analyst consensus values Vertex as undervalued, looking at its price-to-earnings ratio reveals a more complex picture. Vertex trades at 30.2x earnings, making it pricier than the US Biotechs industry average of 17.4x and just above its fair ratio of 29.1x. Compared to peers at 58.9x, there is some appeal. However, these figures highlight real uncertainty about what the market will pay for Vertex’s future growth. Does this premium mean investors are overconfident, or is it justified given the pipeline?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you see things differently or want to dig deeper into the numbers yourself, it's easy to craft your own Vertex narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Investment Ideas?

Don't let great opportunities slip through your fingers when the market is full of potential. Power up your search and capture the next big winner using these handpicked ideas:

- Capture market gains faster by targeting undervalued companies. Start with these 886 undervalued stocks based on cash flows that are trading well below their fair value right now.

- Pounce on future tech leaders by evaluating these 25 AI penny stocks that are harnessing artificial intelligence for unstoppable growth.

- Secure steady income from these 16 dividend stocks with yields > 3% designed for investors seeking attractive yields above 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives