- United States

- /

- Biotech

- /

- NasdaqCM:VRDN

What Viridian Therapeutics (VRDN)'s FDA BLA Submission for Veligrotug Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, Viridian Therapeutics announced the successful submission of a Biologics License Application (BLA) to the U.S. FDA for veligrotug, its investigational monoclonal antibody for thyroid eye disease, backed by data from two pivotal phase 3 trials.

- This milestone marks a significant regulatory step with the potential to offer a new therapy option for patients affected by thyroid eye disease, supported by evidence of efficacy and safety.

- We’ll explore how the BLA submission, along with a requested Priority Review, could shape Viridian’s long-term investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Viridian Therapeutics' Investment Narrative?

To see Viridian Therapeutics as a compelling story, you’d need to believe that its breakthrough with veligrotug isn’t just a clinical success, but a turning point for the company and the next phase of revenue growth. The recent BLA submission to the FDA is a major catalyst, with a Priority Review request that may shorten time to market if the agency agrees, building anticipation for a potential mid-2026 launch. This could bring commercial revenues forward, a key consideration when weighing the company’s rapid revenue growth against its ongoing losses and high price-to-sales ratio. However, this near-term milestone by no means ends the uncertainty; approval is not assured, and competition in TED therapies can intensify. These evolving factors are likely to change how investors view the balance between growth prospects and risks as the BLA moves through review.

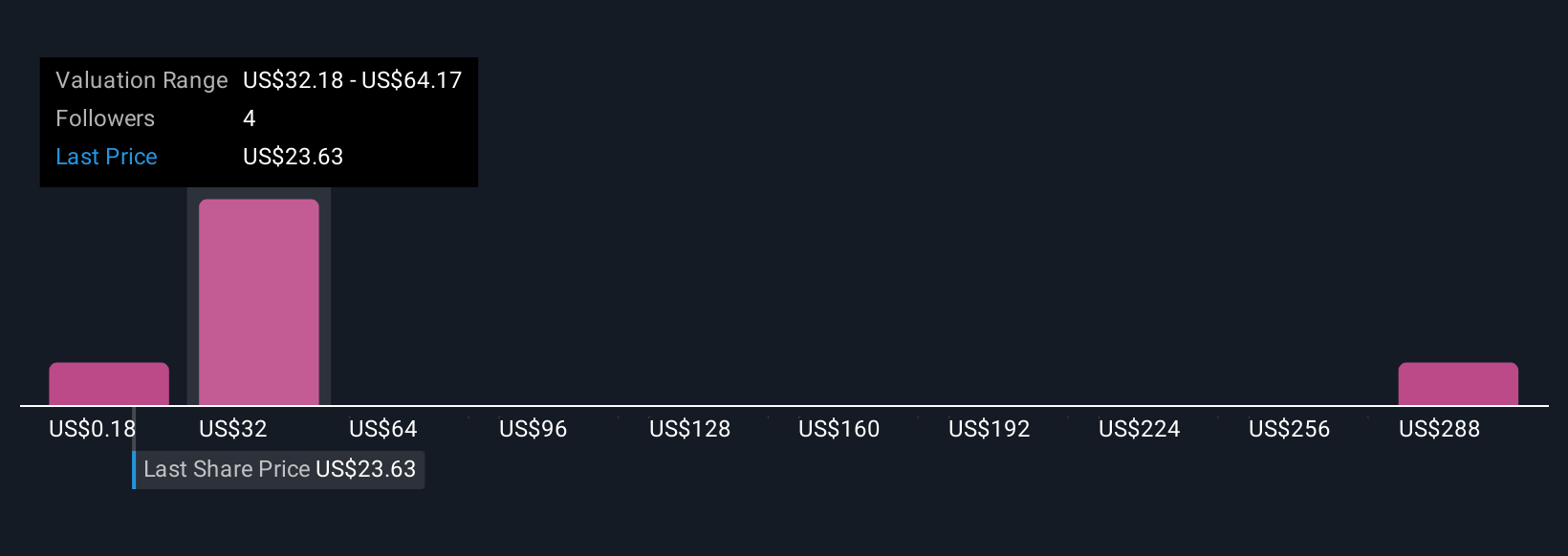

But risks around commercialization and competition remain important for investors to consider. Viridian Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Viridian Therapeutics - why the stock might be worth over 9x more than the current price!

Build Your Own Viridian Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viridian Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viridian Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viridian Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRDN

Viridian Therapeutics

Engages in discovering, developing, and commercializing treatments for serious and rare diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives