- United States

- /

- Biotech

- /

- NasdaqGS:BDTX

Vanda Pharmaceuticals Leads The Pack Of 3 US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market navigates the complexities of a presidential election and anticipated Federal Reserve rate decisions, investors are closely watching the movements of major indices like the Dow Jones and Nasdaq. In such a climate, penny stocks—though an older term—remain relevant for those seeking investment opportunities in smaller or newer companies. These stocks often offer potential value when supported by strong financials, presenting a unique opportunity for growth at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.56M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.05 | $47.83M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.05B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.67 | $526.12M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $158.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.12 | $3.26M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.44 | $128.24M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.08 | $97.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.105 | $95.79M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Vanda Pharmaceuticals (NasdaqGM:VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company that develops and commercializes therapies for high unmet medical needs globally, with a market cap of $271.63 million.

Operations: The company's revenue is derived from its biotechnology startups segment, totaling $182.02 million.

Market Cap: $271.63M

Vanda Pharmaceuticals, with a market cap of US$271.63 million and revenue of US$182.02 million, recently rejected a US$490 million acquisition offer from Cycle Pharmaceuticals, considering it undervalued. The company is debt-free and trades significantly below its estimated fair value, suggesting potential for appreciation. Despite being unprofitable with negative return on equity, Vanda's short-term assets comfortably cover both short- and long-term liabilities. The management team is experienced, providing stability amidst challenges like the FDA's rejection of their tradipitant application for gastroparesis treatment—a setback they continue to contest while maintaining an expanded access program for patients.

- Get an in-depth perspective on Vanda Pharmaceuticals' performance by reading our balance sheet health report here.

- Evaluate Vanda Pharmaceuticals' prospects by accessing our earnings growth report.

Black Diamond Therapeutics (NasdaqGS:BDTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Diamond Therapeutics, Inc. is a clinical-stage oncology medicine company that develops MasterKey therapies for genetically defined tumors, with a market cap of $163.30 million.

Operations: Black Diamond Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $163.3M

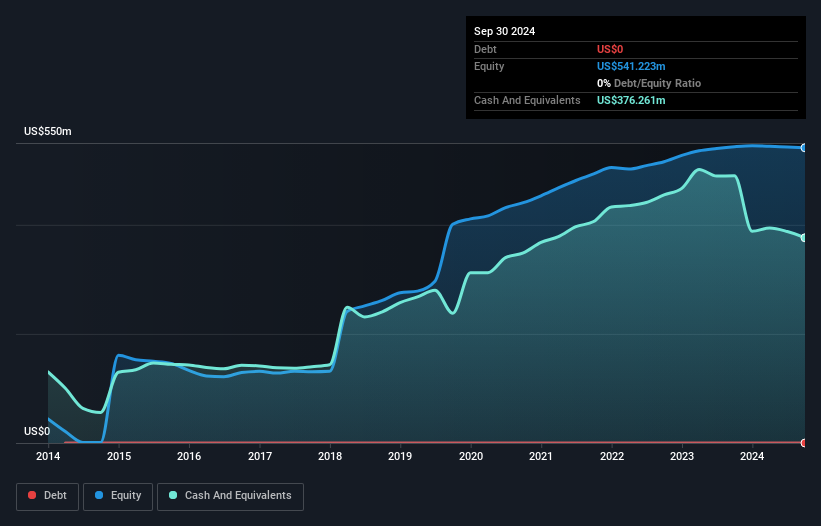

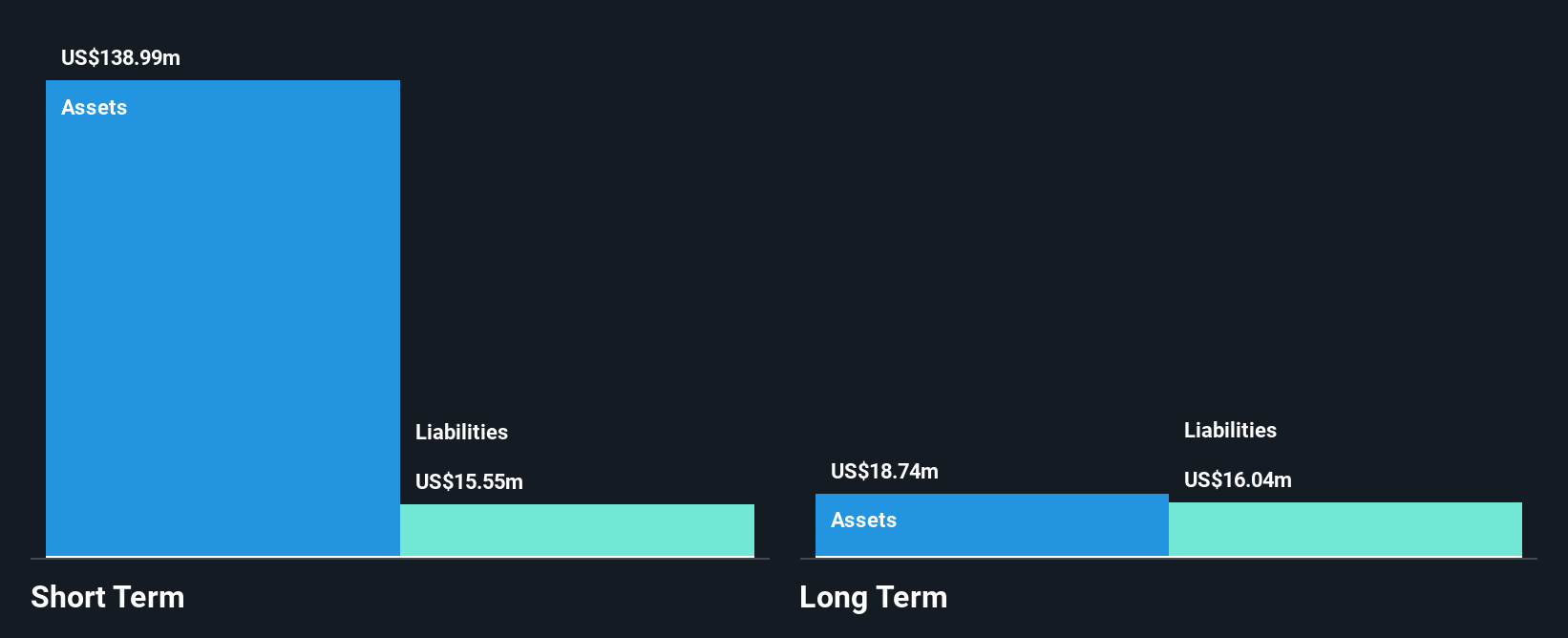

Black Diamond Therapeutics, with a market cap of US$163.30 million, is a pre-revenue company focused on oncology therapies. Despite being debt-free and having sufficient cash runway for over a year, it has experienced shareholder dilution with shares outstanding increasing by 9.6%. Recent Phase 2 trials of BDTX-1535 showed promising results in treating EGFR-mutant non-small cell lung cancer, achieving an objective response rate of 42% among certain patients. However, the company remains unprofitable with losses widening over five years and earnings expected to decline by an average of 5.7% annually over the next three years amidst ongoing corporate restructuring efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Black Diamond Therapeutics.

- Understand Black Diamond Therapeutics' earnings outlook by examining our growth report.

Kaltura (NasdaqGS:KLTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kaltura, Inc. offers a range of software-as-a-service (SaaS) and platform-as-a-service (PaaS) products globally, with a market cap of approximately $196.67 million.

Operations: The company generates revenue from two main segments: Media & Telecom, which accounts for $50.76 million, and Enterprise, Education and Technology, contributing $126.07 million.

Market Cap: $196.67M

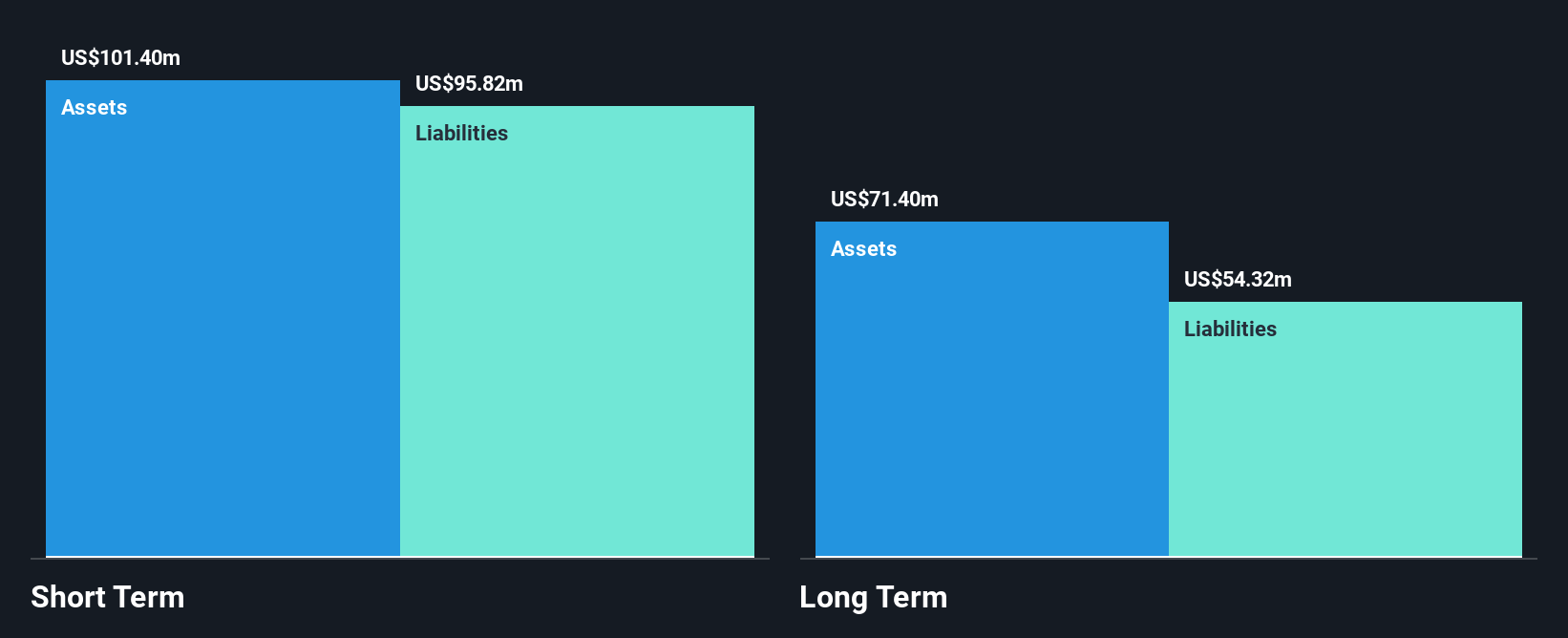

Kaltura, Inc., with a market cap of US$196.67 million, is navigating challenges typical of penny stocks. It remains unprofitable but has managed to reduce its losses by 5.7% annually over the past five years. The company reported US$88.81 million in revenue for the first half of 2024, slightly up from the previous year, yet it forecasts flat to minimal growth for the full year. While Kaltura's short-term assets exceed liabilities and it maintains a strong cash position relative to debt, shareholder dilution and recent exclusion from the S&P Global BMI Index may concern investors seeking stability in this volatile segment.

- Dive into the specifics of Kaltura here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Kaltura's future.

Taking Advantage

- Dive into all 755 of the US Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BDTX

Black Diamond Therapeutics

A clinical-stage oncology medicine company, focuses on the discovery and development of MasterKey therapies for patients with genetically defined tumors.

Flawless balance sheet moderate.