- United States

- /

- Biotech

- /

- NasdaqCM:VKTX

Is Viking Therapeutics’ (VKTX) Independent Path an Advantage in the Consolidating Metabolic Disease Market?

Reviewed by Sasha Jovanovic

- Viking Therapeutics recently drew increased attention from investors after analysts highlighted its advanced portfolio in the obesity and metabolic disease market and its status as one of the few independent biopharmaceutical companies in this space.

- This attention has been fueled by speculation regarding the company’s potential as an acquisition or partnership target in a market characterized by recent consolidation activity.

- We’ll explore how Viking Therapeutics’ independent position in the competitive metabolic disease space shapes its investment narrative for investors.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Viking Therapeutics' Investment Narrative?

For those considering Viking Therapeutics, the core story rests on the ability of its weight-loss therapies, especially VK2735 and VANQUISH, to convert strong clinical results into commercial success in the obesity and metabolic disease markets. The company’s independence and advanced portfolio remain compelling, particularly as recent sector consolidation fuels speculation of an acquisition or licensing deal, which some analysts cite as a potential catalyst. However, the latest earnings outlook and recent Zacks #4 (Sell) rating remind us that near-term profitability remains a significant challenge, and forecast declines in earnings add pressure to expectations for continued positive clinical milestones. Importantly, despite short-term price outperformance after the news, the impact on the primary catalysts, positive trial results and news on partnerships or buyouts, appears limited for now, as fundamentals and longer-term risks around ongoing losses and clinical development timelines remain in focus.

Yet, with deepening losses and uncertain timing for clinical breakthroughs, these are risks investors should be mindful of.

Exploring Other Perspectives

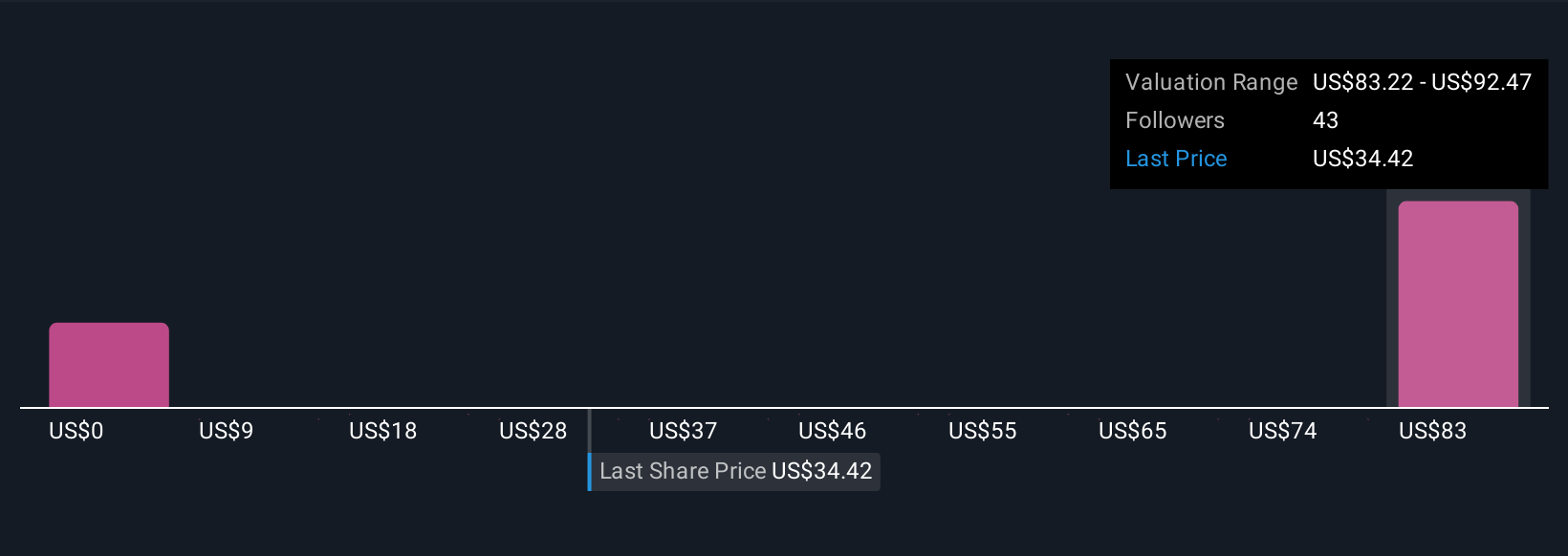

Explore 24 other fair value estimates on Viking Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own Viking Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Viking Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VKTX

Viking Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives