- United States

- /

- Biotech

- /

- NasdaqGS:BDTX

Veru And Two Other Penny Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.7%, and over the past year, it is up 12%, with earnings forecasted to grow by 15% annually. For investors seeking opportunities beyond well-known stocks, penny stocks can offer intriguing prospects, especially when they possess strong balance sheets and solid fundamentals. Although the term "penny stock" might seem outdated, these smaller or newer companies continue to present valuable growth potential at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $502.71M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.88 | $156.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $94.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.68 | $380.59M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.355 | $55.27M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8399 | $6.06M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.88 | $88.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.38 | $9.92M | ✅ 1 ⚠️ 4 View Analysis > |

| TETRA Technologies (TTI) | $3.32 | $459.1M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 447 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Veru (VERU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Veru Inc. is a late clinical stage biopharmaceutical company that develops medicines for metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS), with a market cap of $97.90 million.

Operations: Veru Inc. has not reported any specific revenue segments.

Market Cap: $97.9M

Veru Inc., with a market cap of US$97.90 million, is currently pre-revenue and unprofitable, with losses increasing over the past five years. Despite its financial challenges, Veru has no debt and its short-term assets exceed both short-term and long-term liabilities. The company's share price has been highly volatile recently but remains below analyst price targets suggesting potential upside. Recent positive results from its Phase 2b clinical trials for enobosarm have led to an FDA meeting request, indicating progress in their drug development pipeline which could impact future valuation positively if successful outcomes continue.

- Navigate through the intricacies of Veru with our comprehensive balance sheet health report here.

- Evaluate Veru's prospects by accessing our earnings growth report.

Black Diamond Therapeutics (BDTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Black Diamond Therapeutics, Inc. is a clinical-stage oncology company specializing in the discovery and development of MasterKey therapies for genetically defined tumors, with a market cap of $141.59 million.

Operations: Black Diamond Therapeutics, Inc. does not report distinct revenue segments.

Market Cap: $141.59M

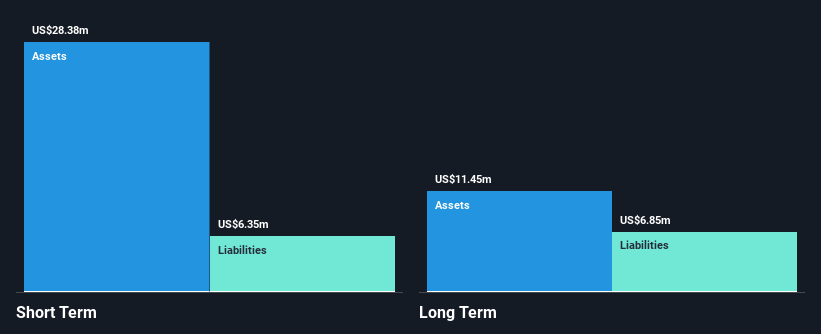

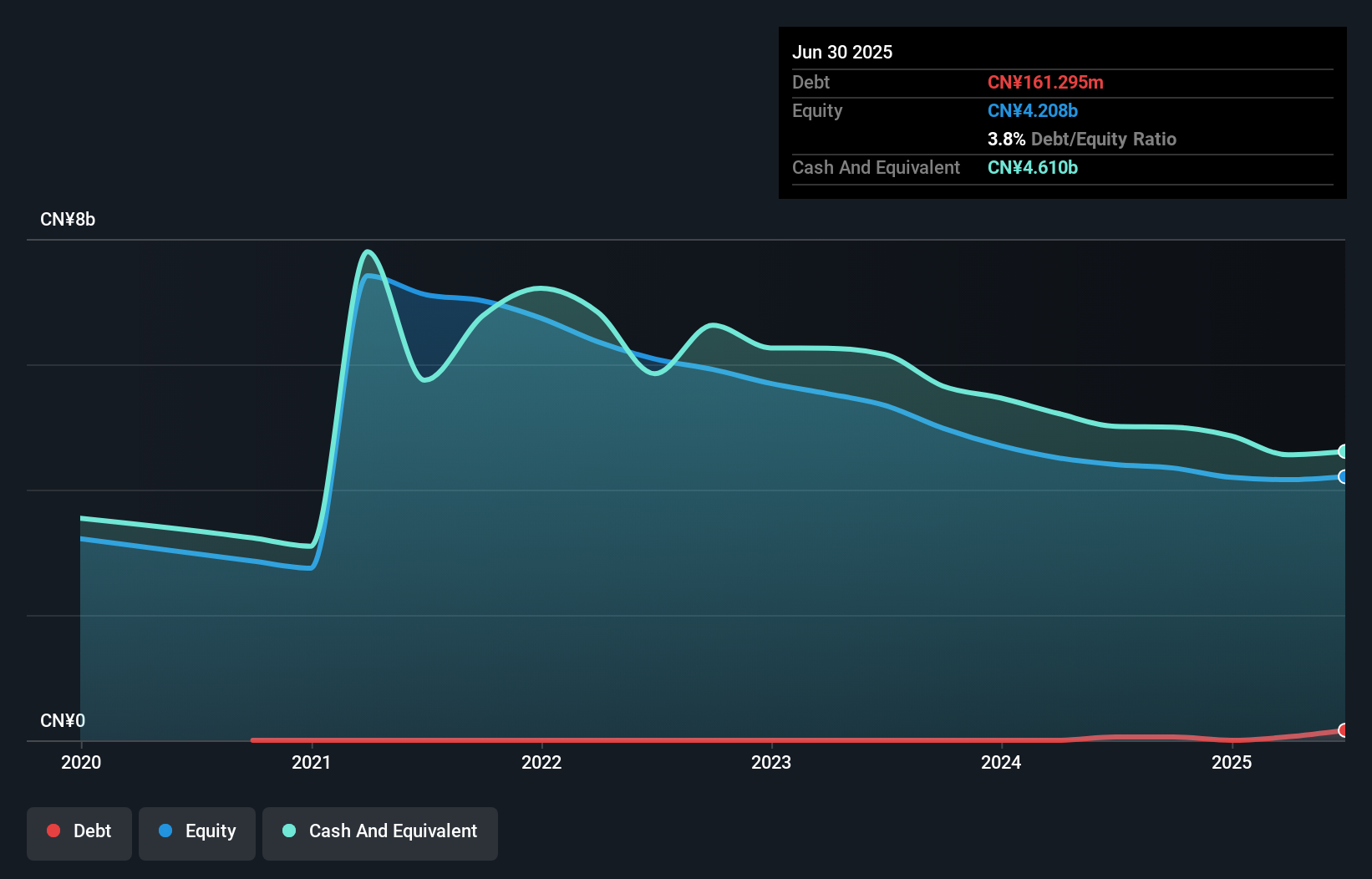

Black Diamond Therapeutics, Inc., with a market cap of US$141.59 million, has recently transitioned to profitability, reporting net income of US$56.54 million for Q1 2025. The company is debt-free and its short-term assets significantly exceed both short-term and long-term liabilities, reflecting strong financial health. Despite the low return on equity at 3.6%, Black Diamond's earnings are considered high quality. Analysts anticipate a substantial stock price increase by over threefold in the future, although earnings are forecasted to decline over the next three years. The management team and board have solid experience with average tenures of 3.4 and 4.4 years respectively.

- Take a closer look at Black Diamond Therapeutics' potential here in our financial health report.

- Gain insights into Black Diamond Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Zhihu (ZH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhihu Inc. operates an online content community in the People’s Republic of China with a market cap of approximately $315.47 million.

Operations: The company generates revenue from advertising, totaling CN¥3.37 billion.

Market Cap: $315.47M

Zhihu Inc., with a market cap of approximately US$315.47 million, is unprofitable but has shown progress by reducing losses annually by 26.3% over the past five years. Despite a revenue decline to CN¥729.67 million in Q1 2025 from CN¥960.86 million the previous year, net losses decreased significantly, indicating potential operational improvements. The company’s short-term assets comfortably cover both its short and long-term liabilities, suggesting financial stability despite current profitability challenges. Analysts expect Zhihu's stock price to rise substantially, trading well below estimated fair value with no significant shareholder dilution recently observed.

- Jump into the full analysis health report here for a deeper understanding of Zhihu.

- Understand Zhihu's earnings outlook by examining our growth report.

Make It Happen

- Access the full spectrum of 447 US Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BDTX

Black Diamond Therapeutics

A clinical-stage oncology company, focuses on the discovery and development of MasterKey therapies for patients with genetically defined tumors.

Flawless balance sheet and fair value.

Market Insights

Community Narratives