- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte (VCYT): Evaluating Valuation After Recent Share Price Gain and Growth Headlines

Reviewed by Simply Wall St

Veracyte (VCYT) has delivered notable growth over the past month, catching attention as shares climbed nearly 10%. With revenue increasing and profits up on the year, investors are watching for what could shape the next leg higher.

See our latest analysis for Veracyte.

Veracyte’s momentum has been building, with a 32.8% share price return over the past 90 days standing out. This comes even as year-to-date returns are slightly negative, while the stock’s 1-year total shareholder return of 7% highlights steady progress for longer-term investors. Recent headlines about growth have only added fuel to the sentiment that confidence may be returning after a volatile stretch.

If this kind of renewed momentum interests you, it’s a good time to see what other innovative healthcare names are moving. See the full list for free.

With recent gains and forecasted upside, is Veracyte still trading below its true value? Alternatively, are markets already reflecting all the expected growth in today’s price, leaving little room for surprise upside?

Most Popular Narrative: 13.3% Undervalued

With Veracyte's fair value from the most widely followed narrative sitting at $45.30, the latest close of $39.28 suggests upside still remains. Market watchers are tuned in for what might unlock further value, as analysts see catalysts building.

Broad and accelerating adoption of advanced genomic and noninvasive cancer diagnostics, combined with growing cancer incidence and aging populations, are steadily expanding the potential patient pool, directly supporting sustained double-digit volume and revenue growth across Veracyte's core product lines (notably Decipher and Afirma).

How bold are the numbers powering this bullish view? What projections on future sales, margin strength, and market expansion could fuel this seemingly generous fair value? The narrative teases big moves. Find out which assumptions underpin this outlook and whether the profit ramp up can really rewrite the playbook.

Result: Fair Value of $45.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as Veracyte's reliance on a handful of core products and changing reimbursement landscapes could quickly undermine even strong momentum.

Find out about the key risks to this Veracyte narrative.

Another View: Stretch Versus Value?

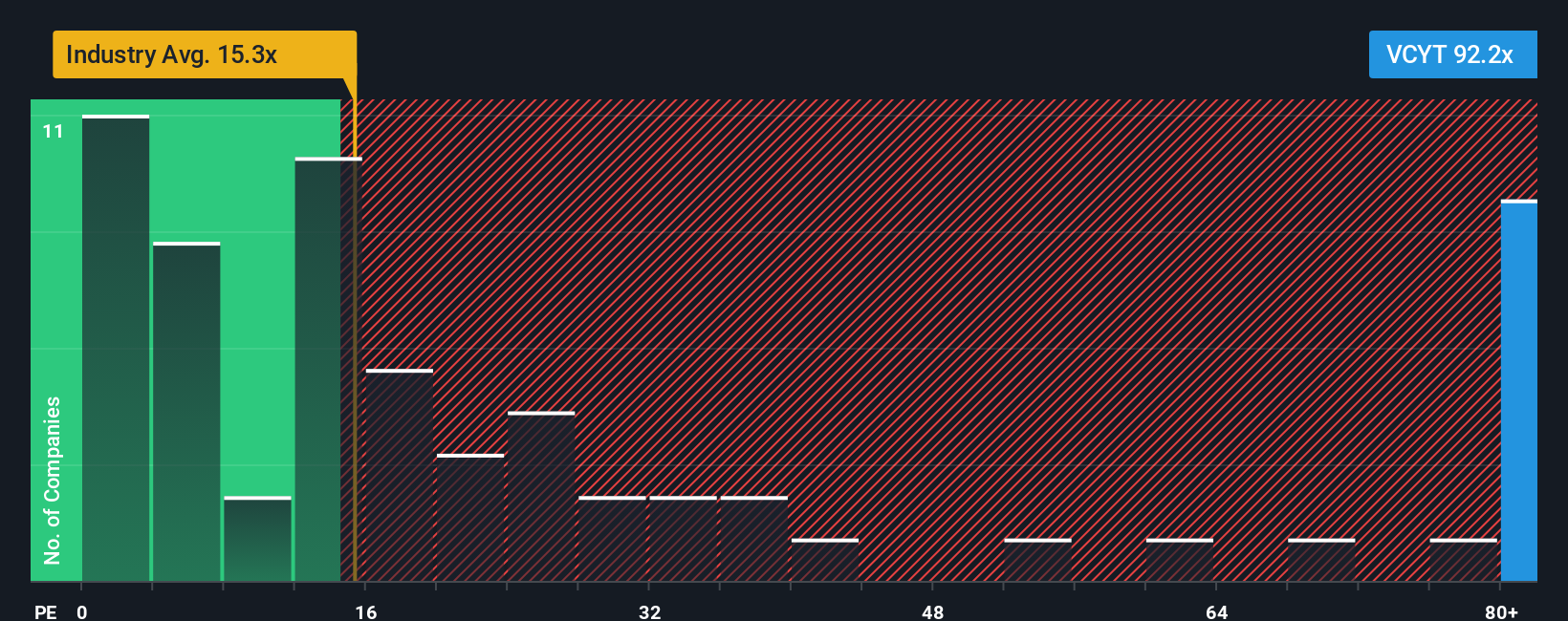

Looking through a different lens, Veracyte’s valuation is challenging. Its price-to-earnings ratio stands at 102.4 times, much higher than both the US Biotechs industry average of 17.4 times and its peer group at 67 times. The fair ratio, based on deeper analysis, is just 27.5 times. This steep gap could signal that the market is pricing in a lot of optimism already. Is there real risk of a cooldown if those bold expectations don’t play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veracyte Narrative

If you see things differently or enjoy digging into the numbers yourself, you can run your own analysis and craft a personal view in just a few minutes. Do it your way

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t just watch the market from the sidelines. Give yourself an edge by finding tomorrow’s leaders before everyone else with these tailored opportunities:

- Unlock passive income potential and steady returns by checking out these 18 dividend stocks with yields > 3% designed for yields over 3% and strong financials.

- Capitalize on breakthrough innovation in automation, language models, and robotics by reviewing these 27 AI penny stocks making headlines in the artificial intelligence revolution.

- Take advantage of stocks flying under Wall Street’s radar by reviewing these 894 undervalued stocks based on cash flows that could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives