- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Is Veracyte’s Recent 9.8% Rally a Sign of More Value in 2025?

Reviewed by Bailey Pemberton

If you’ve been keeping an eye on Veracyte lately, you’re not alone. Plenty of investors are re-evaluating their game plan after the company’s recent moves in the market. Whether you’re wondering if it’s time to buy, hold, or steer clear entirely, you’ll want to dig a little deeper than the headlines when thinking about your next step. Over the last month, Veracyte’s stock has jumped 9.8%, bouncing back after a challenging start to the year. Zooming out, the one-year return sits at an impressive 11.2%, and over three years, the stock has soared 90.2%. Not everything is up and to the right, though. Year-to-date, shares are down 9.2%, which reflects some shifts in risk perception even as the broader diagnostics space faces regulatory and technology headwinds.

Recent partnerships and product expansion have generated some optimism, helping to explain the positive momentum in the last month. Investors are taking notice of the way Veracyte is positioning itself within the genomic diagnostics space, especially following the company’s moves into new testing categories. Still, even with this momentum, it’s worth asking whether the stock is really undervalued or if recent gains have already captured most of the potential upside.

Looking strictly at valuation, Veracyte scores a 2 out of 6 on our value metrics. This is not the most compelling on paper, but that’s just one part of the story. Next, we’ll break down how these valuation approaches stack up. And if you’re still searching for a deeper, more holistic way to interpret the numbers, you’ll want to stick around until the end.

Veracyte scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Veracyte Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors assess what the business is truly worth, based on its ability to generate cash in the future.

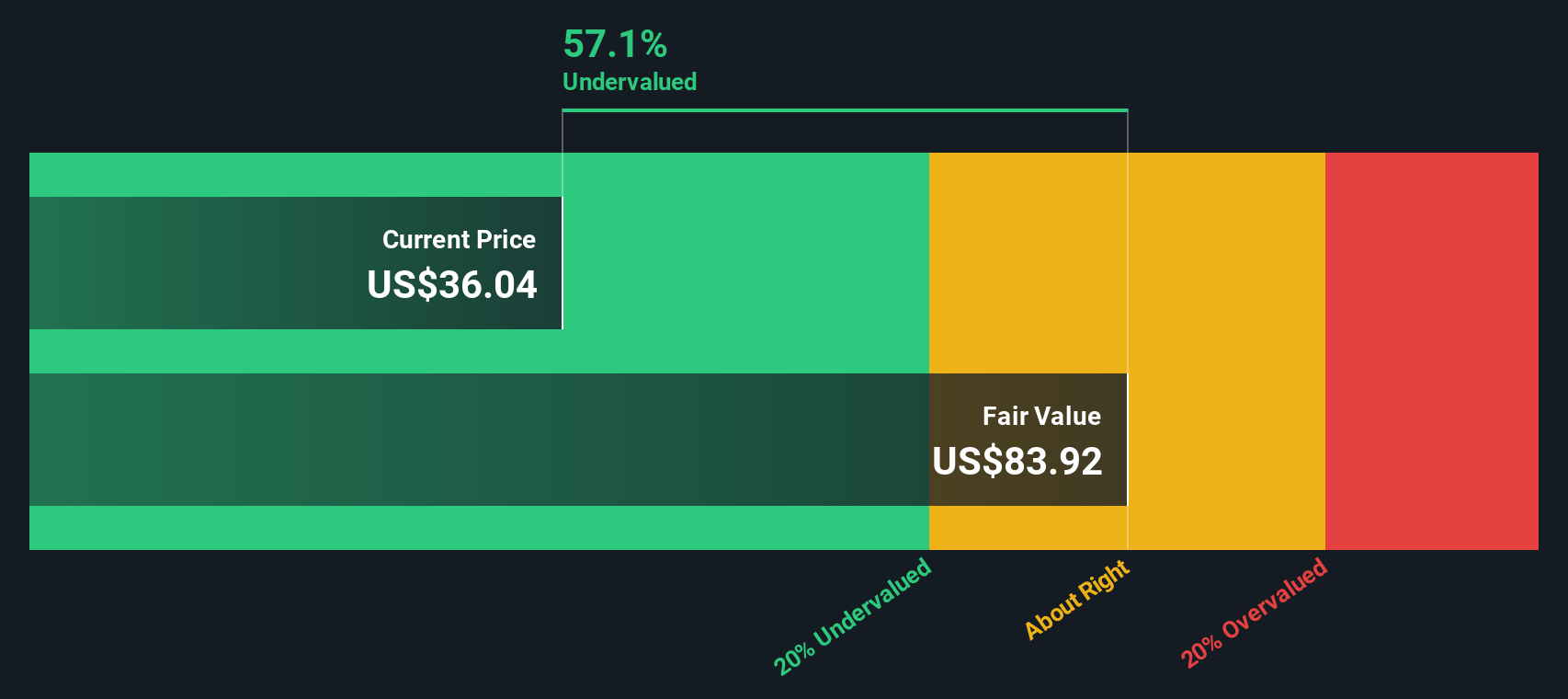

Veracyte's current Free Cash Flow (FCF) stands at $82.4 million. According to analyst estimates and further projections, FCF is expected to grow steadily, reaching $155.1 million by 2029. While analysts provide forecasts for the next few years, projections beyond 2029 are extrapolated using growth rates. The model utilized here is the 2 Stage Free Cash Flow to Equity method, which considers both near-term analyst inputs and longer-term company trends.

Applying this model, the intrinsic value of Veracyte's shares is estimated at $55.56. This figure represents a 33.9% discount to the current share price, which implies the stock is significantly undervalued based on the DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Veracyte is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Veracyte Price vs Earnings

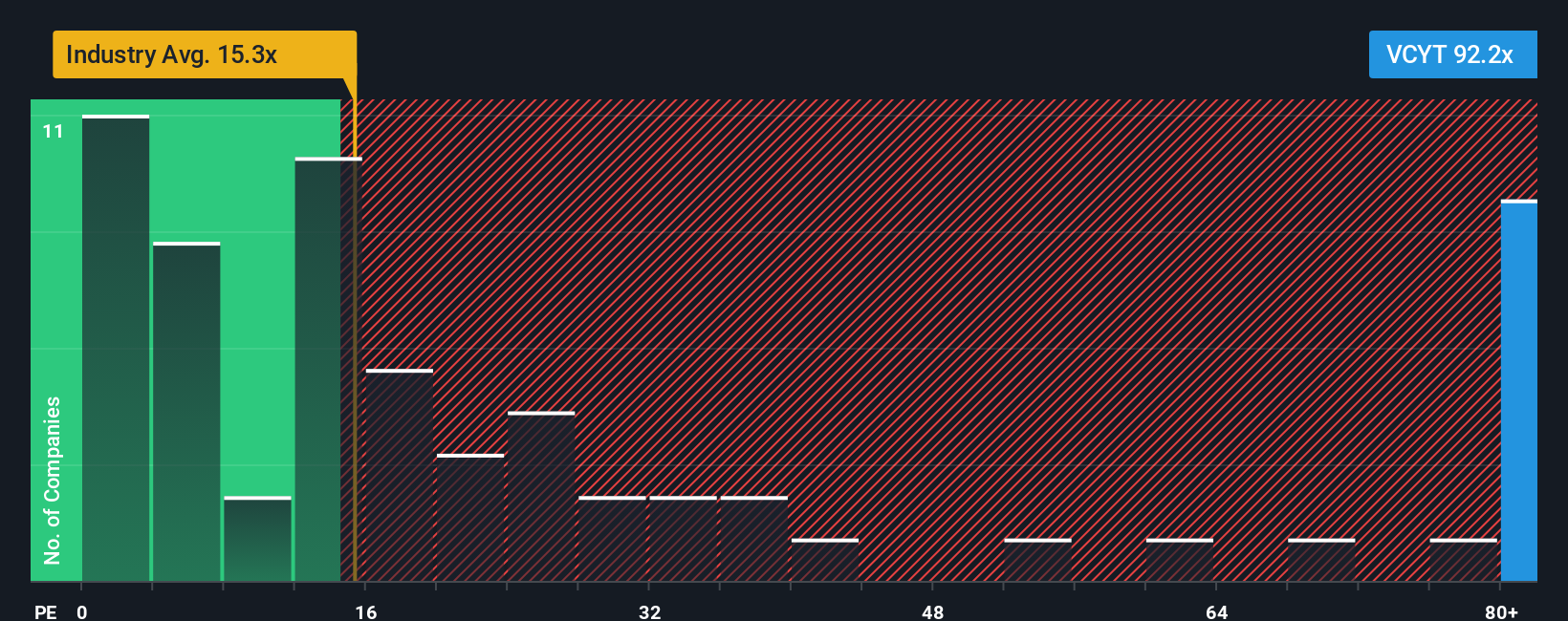

The price-to-earnings (PE) ratio is a widely used metric for evaluating profitable companies because it connects a company’s market value with its actual earnings. For businesses like Veracyte that are generating positive earnings, the PE ratio offers a straightforward way to gauge what investors are willing to pay today for a dollar of earnings and to compare this price tag to other companies or industry averages.

What counts as a “fair” PE ratio does not exist in a vacuum. Higher growth prospects, stronger margins, and lower risk warrant higher PE multiples, while elevated risk or slower expected growth can push that number down. So, knowing what’s “normal” means considering how Veracyte stacks up on these fronts.

Currently, Veracyte trades at a PE ratio of 109.7x. That figure is far above both the biotech industry average (17.3x) and its peer group average (11.8x). While these comparisons suggest Veracyte is expensive at first glance, they miss the nuances behind the company’s outlook and risk profile. That is where the Simply Wall St “Fair Ratio” comes in. Unlike industry averages, the Fair Ratio (24.7x for Veracyte) incorporates specifics like the company’s earnings growth, margins, scale, market cap, and risk factors to set a more tailored benchmark. By weighting these key drivers, the Fair Ratio goes beyond superficial comparisons, making it a more precise yardstick for investors.

In Veracyte’s case, its PE ratio of 109.7x exceeds the Fair Ratio of 24.7x by a substantial margin. This suggests the stock is trading well above what would be justified when accounting for all of the company’s fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Veracyte Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. This is a smarter, more dynamic approach that ties together the “story” behind Veracyte with the hard numbers and forecasts that influence its fair value.

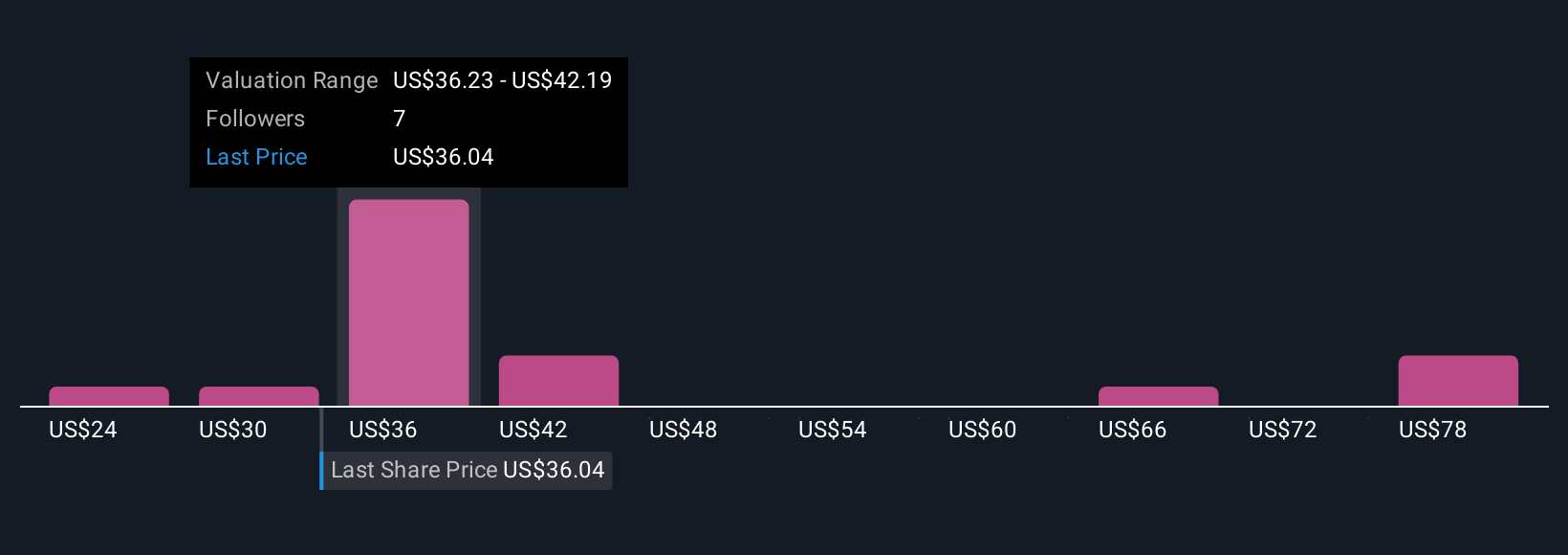

A Narrative is your personal perspective on a company, blending your views on its future revenue, earnings, and margins into a financial forecast that produces a fair value estimate. This tool connects what is happening in Veracyte’s business, such as pipeline launches, partnerships, or regulatory challenges, to real numbers so you can see how your outlook translates into actionable investment insights.

Narratives are available on Simply Wall St’s platform, used by millions of investors on the Community page, making it easy for anyone to create or explore different viewpoints. With Narratives, you can compare fair value to the current price, helping you decide when it may be time to buy, hold, or sell. In addition, Narratives update automatically when fresh news or earnings reports come in, ensuring your perspective stays current.

For example, one investor might believe Veracyte’s innovations and clinical expansion justify a high target price of $45.00 per share, while another sees risks from reimbursement pressures and values the stock at just $28.00. Your Narrative makes your analysis and actions truly your own.

Do you think there's more to the story for Veracyte? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives