- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

Is United Therapeutics Attractively Priced After Regulatory Milestones and Market Recalibration in 2025?

Reviewed by Bailey Pemberton

- Wondering whether United Therapeutics is a hidden bargain or already priced for perfection? You are not alone. Let's unpack where the real value may lie.

- The stock has delivered a 21.8% return year-to-date and an impressive 221.9% rise over the last five years. However, the past month saw a slight 3.2% dip, signaling both robust growth and recent recalibration.

- United Therapeutics recently caught the market’s attention with regulatory milestones and pipeline updates fueling optimism. Investors are responding to expansion news and collaboration announcements in the biotech space.

- On our valuation scorecard, United Therapeutics earns a 5 out of 6, indicating strong undervaluation across multiple checks. Next, we will break down what actually goes into these valuations and touch on a smarter way to gauge true value by the end of the article.

Approach 1: United Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s dollars. This approach gives investors a picture of what United Therapeutics could be worth based on how much actual cash it is expected to generate, rather than just reported earnings.

United Therapeutics is currently producing more than $1.2 billion in free cash flow annually. Analysts forecast that free cash flow could climb substantially in the coming years, with projections reaching over $2 billion by 2029 and more than $3.1 billion by 2035. While detailed analyst estimates go out only five years, longer-term numbers are extrapolated based on historical growth rates and trends in the biotech sector.

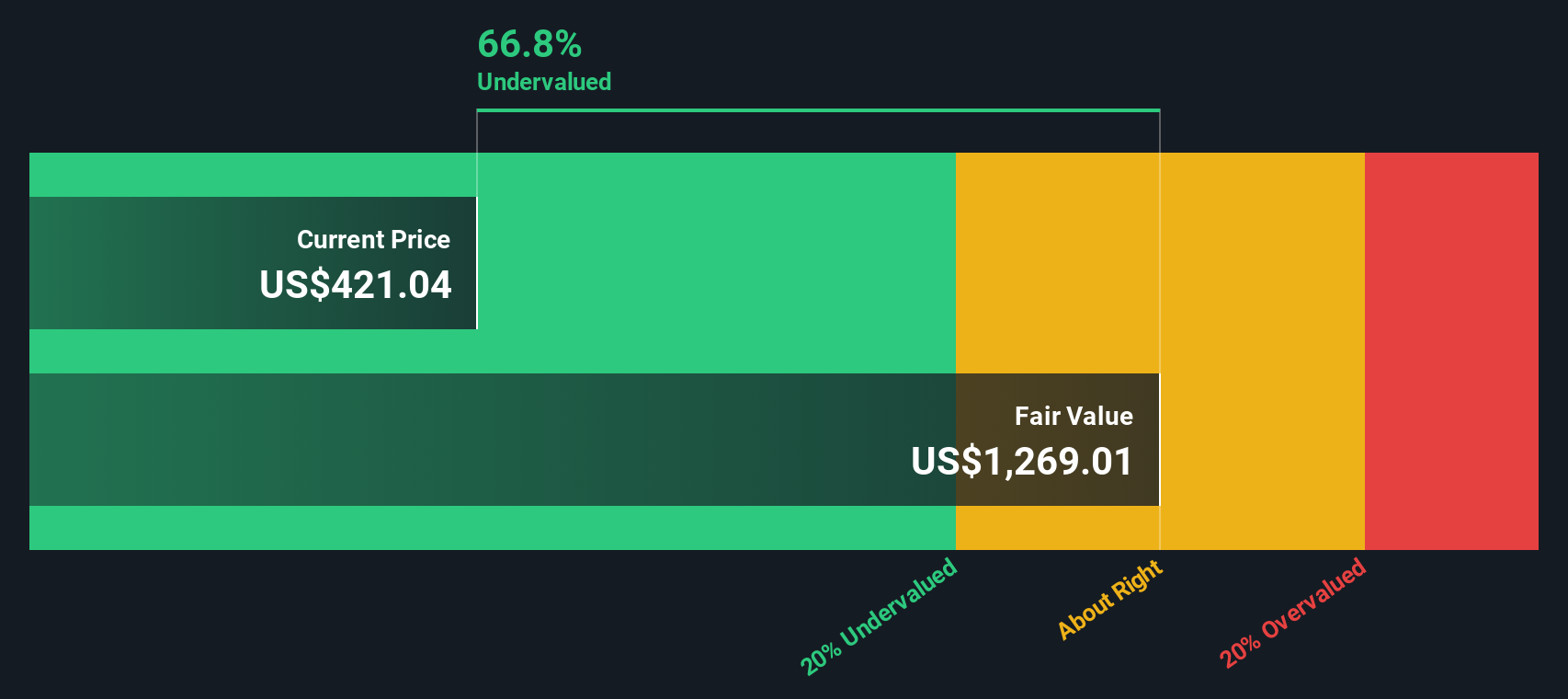

Based on these cash flow projections, the intrinsic value calculated by the DCF method arrives at $1,352.55 per share. This represents a notable 67.6% discount compared to the current share price, suggesting that United Therapeutics may be significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Therapeutics is undervalued by 67.6%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: United Therapeutics Price vs Earnings

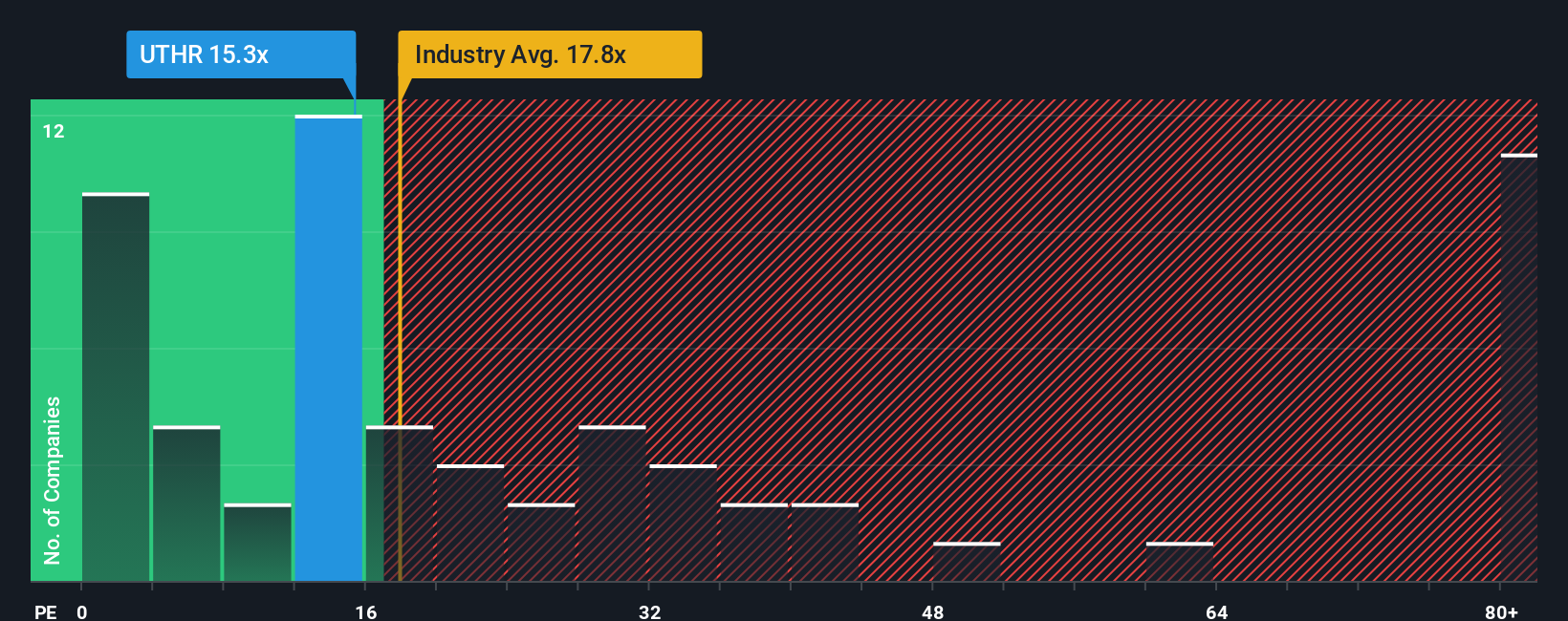

The price-to-earnings (PE) ratio is a popular tool for valuing profitable companies like United Therapeutics because it shows how much investors are willing to pay for each dollar of earnings. Since United Therapeutics is generating consistent profits, the PE ratio offers a straightforward way to benchmark the company’s valuation against peers and the broader biotech industry.

Generally, a higher PE ratio can indicate that investors expect stronger future growth or view the company as lower risk compared to its peers. On the other hand, a lower PE ratio may suggest the market sees fewer growth opportunities or greater risk. Striking the right balance is key because a “normal” or “fair” PE will depend on expectations around future earnings, growth prospects, and the predictability of those factors in this sector.

United Therapeutics is trading at a PE ratio of 14.9x, which is below the biotech industry average of 17.0x and also lower than the peer group’s average of 20.8x. However, just comparing raw numbers does not tell the whole story. This is where Simply Wall St’s “Fair Ratio” comes in, a proprietary PE figure set at 25.1x, which measures what the company’s PE ratio should be based on factors such as earnings growth, profit margins, market cap, and unique risks, rather than only considering what industry peers are doing. This provides a more balanced and tailored benchmark.

With United Therapeutics’ current PE of 14.9x well below its Fair Ratio of 25.1x, the analysis points to the shares being undervalued at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Therapeutics Narrative

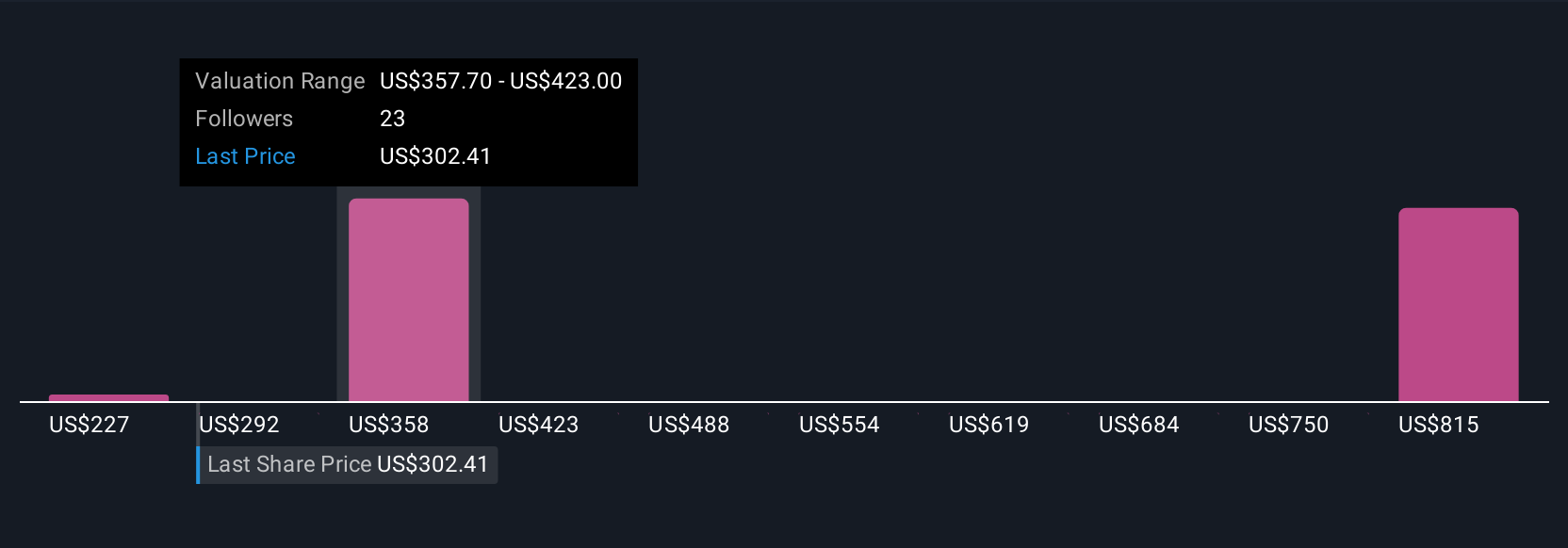

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story for United Therapeutics, combining your unique perspective with the company’s financial forecasts such as fair value, future revenues, earnings, and profit margins.

Think of a Narrative as the bridge between what you believe about United Therapeutics, including its strengths, industry risks, and upcoming catalysts, and hard numbers like projected earnings and your fair value estimate. Narratives transform abstract data into a clear, actionable outlook for the stock’s potential.

Available on Simply Wall St’s Community page, Narratives make it simple for investors of any skill level to connect their own research with current financials, so a buy or sell decision is not just a guess but grounded in a coherent, live story. Narratives continually adapt: as soon as new news, earnings, or data emerge, your Narrative and its associated fair value refresh automatically, ensuring your view of the company always stays up to date.

For example, United Therapeutics bulls, seeing breakthrough clinical trials and robust cash flow, set the highest fair values upwards of $575, while bears, worried about patent risk or rising competition, see fair value closer to $320. This reflects how Narratives capture every side of the investment debate.

Do you think there's more to the story for United Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives