- United States

- /

- Pharma

- /

- NasdaqCM:UPC

Investors Don't See Light At End Of Universe Pharmaceuticals INC's (NASDAQ:UPC) Tunnel And Push Stock Down 31%

Universe Pharmaceuticals INC (NASDAQ:UPC) shares have had a horrible month, losing 31% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 95% loss during that time.

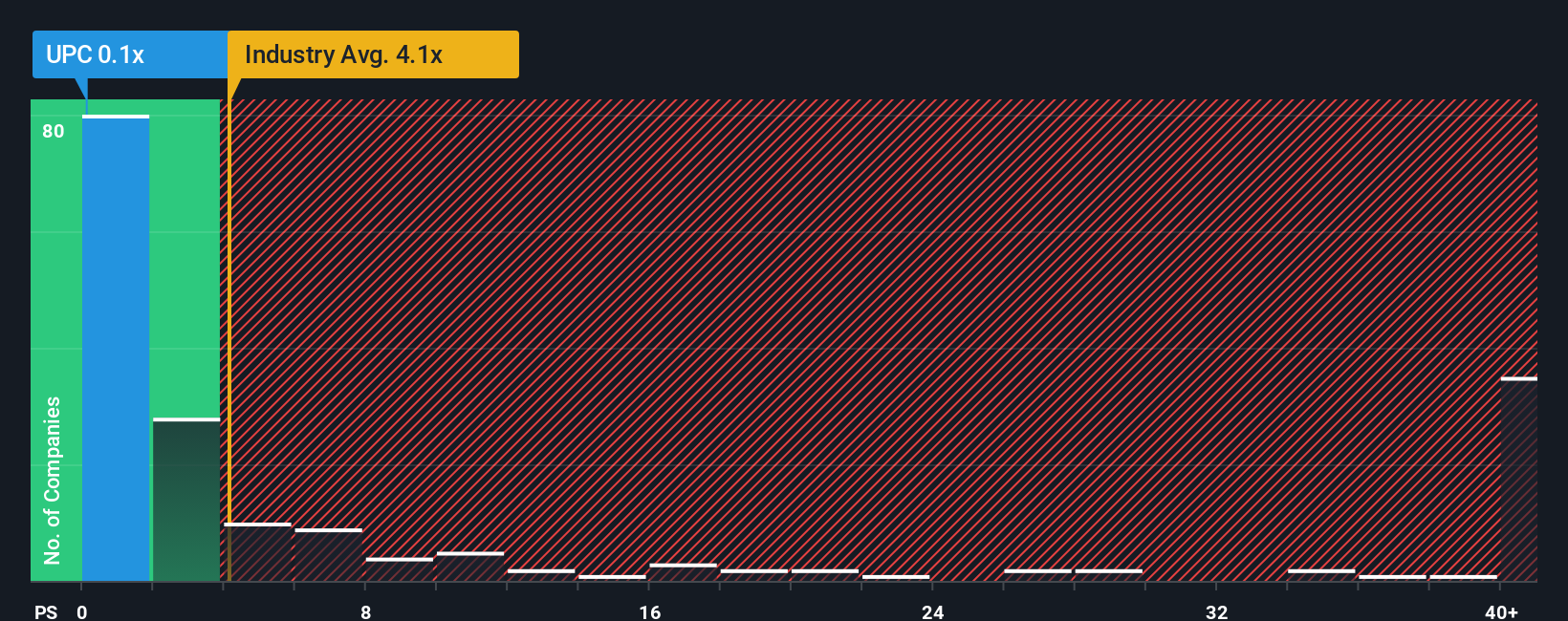

Following the heavy fall in price, Universe Pharmaceuticals may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 4.1x and even P/S higher than 20x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Universe Pharmaceuticals

How Universe Pharmaceuticals Has Been Performing

As an illustration, revenue has deteriorated at Universe Pharmaceuticals over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Universe Pharmaceuticals will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Universe Pharmaceuticals' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Universe Pharmaceuticals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Universe Pharmaceuticals' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. The last three years don't look nice either as the company has shrunk revenue by 60% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 23% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Universe Pharmaceuticals' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Universe Pharmaceuticals' P/S?

Universe Pharmaceuticals' P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Universe Pharmaceuticals revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Universe Pharmaceuticals, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UPC

Universe Pharmaceuticals

Through its subsidiaries, engages in the manufacturing, marketing, distribution, and sells of traditional Chinese medicine derivative products in China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success