- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

Shareholders in 10x Genomics (NASDAQ:TXG) have lost 87%, as stock drops 12% this past week

As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of 10x Genomics, Inc. (NASDAQ:TXG); the share price is down a whopping 87% in the last three years. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 48% in the last year. The last week also saw the share price slip down another 12%. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for 10x Genomics

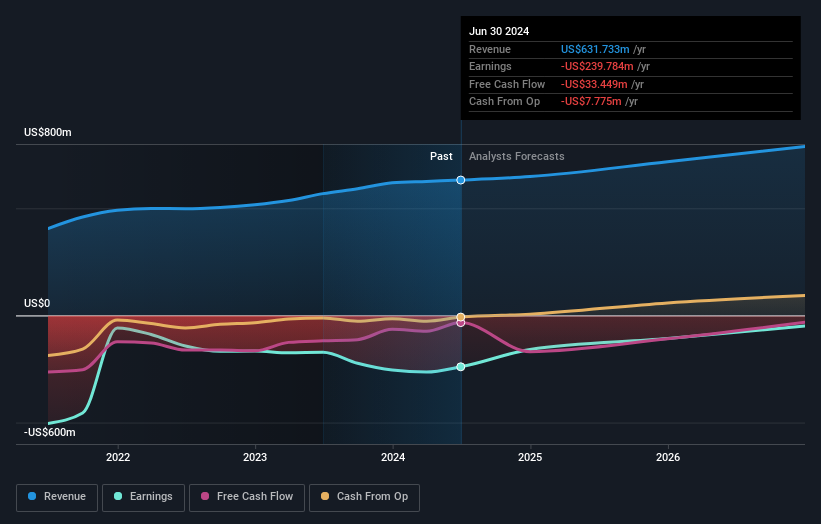

10x Genomics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, 10x Genomics saw its revenue grow by 13% per year, compound. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 23% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

10x Genomics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Investors in 10x Genomics had a tough year, with a total loss of 48%, against a market gain of about 35%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for 10x Genomics you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the America, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet slight.