- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG) Valuation in Focus After Joining Pioneering Asia-Pacific Cancer Research Alliance

Reviewed by Simply Wall St

10x Genomics (TXG) has taken a central role in the creation of the Asia-Pacific Spatial Translational Research Alliance, a new consortium spanning Australia and Japan. The group will use TXG’s Xenium platform to study cancer cell interactions across 2,000 tumor samples.

See our latest analysis for 10x Genomics.

The ASTRA partnership is catching investors’ attention just as 10x Genomics posts a 33% share price return for the past month and a robust 28% total shareholder return over the last year. While the company’s long-term total shareholder returns remain deeply negative, recent momentum suggests sentiment is turning. This could be influenced by high-profile research initiatives and leadership changes.

If the surge in genomics collaborations has you looking for other biotech movers, now is the perfect opportunity to explore See the full list for free.

With shares rallying despite mixed long-term returns, investors are now left wondering if 10x Genomics is still trading below its true value or if the latest optimism has already been reflected in the stock price.

Most Popular Narrative: 15.7% Overvalued

With 10x Genomics closing at $18.34 compared to the most-followed narrative's fair value of $15.86, the market is currently pricing in more optimism than the analyst consensus suggests. This sets the stage for a closer look at what is driving that viewpoint.

The acquisition of Scale Biosciences broadens 10x Genomics' technical capabilities in single-cell analysis. This allows integration of foundational innovations like combinatorial indexing and quantum barcoding, which may accelerate innovation, reduce costs, and open up new high-value markets, positively impacting future revenue growth and margins.

Want to know the financial leap behind this valuation? The story includes ambitious forecasts for future profitability and a forward profit multiple tighter than the industry standard. Discover which assumptions change the game and reshape market expectations.

Result: Fair Value of $15.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and discounts to address customer spending constraints could slow adoption and put pressure on margins, which challenges the case for rapid improvement.

Find out about the key risks to this 10x Genomics narrative.

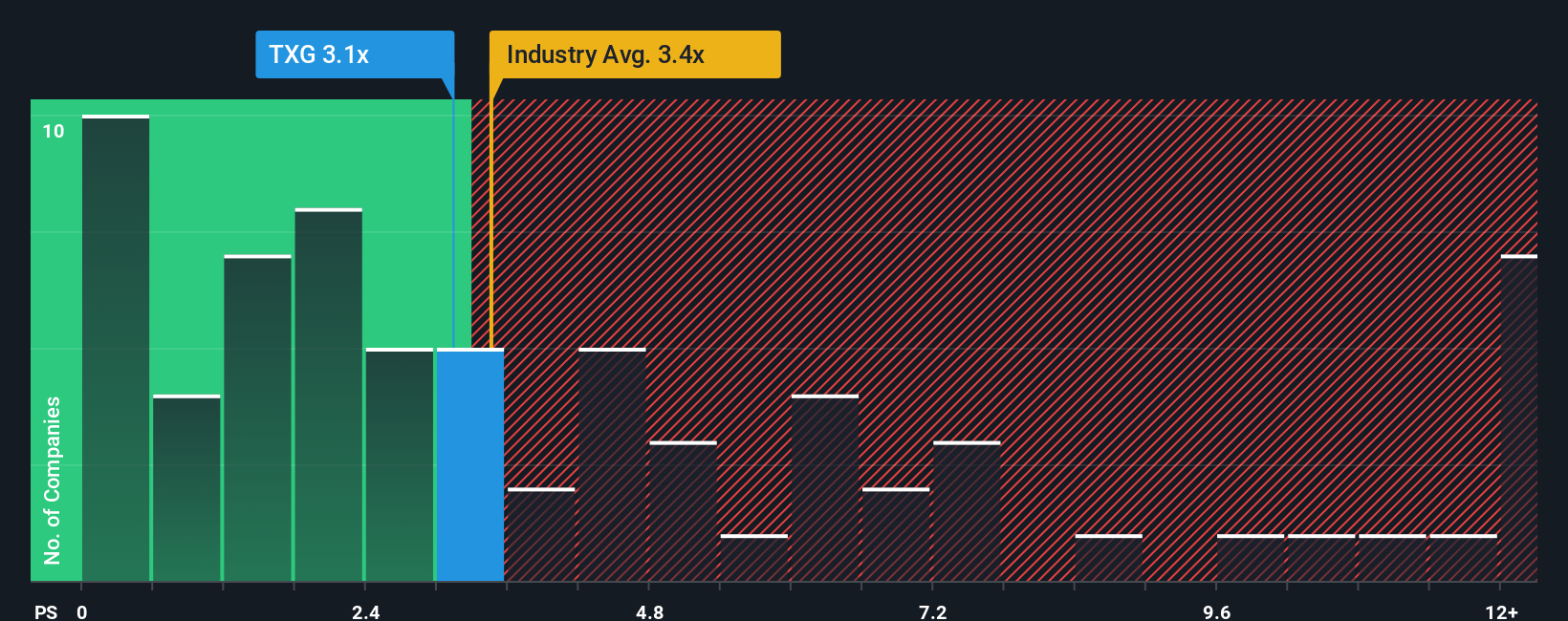

Another View: Multiple-Based Valuation Signals Opportunity

Looking from a multiples perspective, 10x Genomics trades at a price-to-sales ratio of 3.6x, which is below both its peer average of 5.6x and the US Life Sciences industry average of 3.7x. Compared to a fair ratio of 4x, this gap suggests the market is not fully pricing in the company’s potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 10x Genomics Narrative

If your perspective differs or you want to dig into the numbers yourself, building a personal view of 10x Genomics takes just a few minutes. Do it your way

A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next headline to signal opportunity. Use these curated lists to position yourself ahead of the crowd and seize tomorrow’s winners today.

- Catch undervalued stocks poised for a comeback by starting with these 926 undervalued stocks based on cash flows before the market catches on.

- Fuel your portfolio’s future with AI-driven companies by checking out these 26 AI penny stocks that are reshaping entire industries right now.

- Supercharge your income strategy and tap into reliable market returns using these 16 dividend stocks with yields > 3% with yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives