- United States

- /

- Biotech

- /

- NasdaqGS:TWST

Twist Bioscience Corporation (NASDAQ:TWST) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Twist Bioscience Corporation (NASDAQ:TWST) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 109% in the last year.

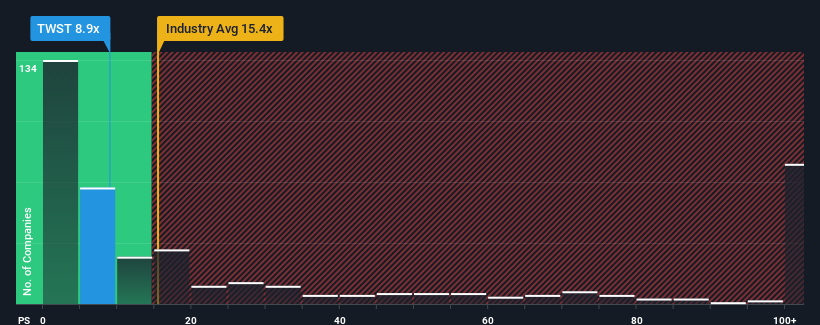

In spite of the firm bounce in price, Twist Bioscience's price-to-sales (or "P/S") ratio of 8.9x might still make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 15.4x and even P/S above 71x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Twist Bioscience

How Has Twist Bioscience Performed Recently?

Recent times haven't been great for Twist Bioscience as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Twist Bioscience will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Twist Bioscience's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 160% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 18% as estimated by the nine analysts watching the company. With the industry predicted to deliver 1,122% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Twist Bioscience's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Twist Bioscience's P/S

Despite Twist Bioscience's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Twist Bioscience's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Twist Bioscience that you need to be mindful of.

If these risks are making you reconsider your opinion on Twist Bioscience, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives