- United States

- /

- Biotech

- /

- NasdaqGS:TWST

Investors Aren't Buying Twist Bioscience Corporation's (NASDAQ:TWST) Revenues

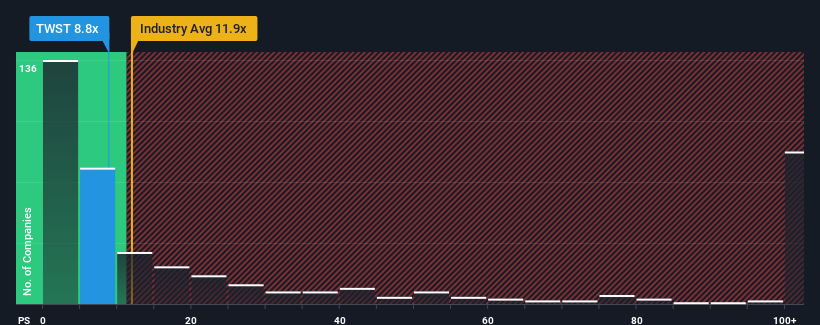

With a price-to-sales (or "P/S") ratio of 8.8x Twist Bioscience Corporation (NASDAQ:TWST) may be sending bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 11.9x and even P/S higher than 67x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Twist Bioscience

How Has Twist Bioscience Performed Recently?

Recent times haven't been great for Twist Bioscience as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Twist Bioscience will help you uncover what's on the horizon.How Is Twist Bioscience's Revenue Growth Trending?

In order to justify its P/S ratio, Twist Bioscience would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 133% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 21% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 139% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Twist Bioscience's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Twist Bioscience's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Twist Bioscience that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives