- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Can New FILSPARI Data Shift Travere Therapeutics' (TVTX) Competitive Position in Rare Kidney Disease?

Reviewed by Sasha Jovanovic

- Earlier this month, Travere Therapeutics announced it will present 11 abstracts, including new real-world and clinical data on FILSPARI, at the American Society of Nephrology Kidney Week 2025 in Houston, highlighting efficacy in lowering proteinuria and preserving kidney function across patient groups.

- This announcement underscores Travere’s continued progress in rare kidney disease research, as well as the growing recognition of FILSPARI's clinical impact ahead of potential regulatory milestones.

- We'll explore how new FILSPARI data bolsters Travere’s investment case and what it signals for the company’s growth trajectory.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Travere Therapeutics Investment Narrative Recap

To be a shareholder in Travere Therapeutics, an investor must believe in the company’s ability to deliver transformative therapies for rare kidney diseases, most importantly, that FILSPARI’s clinical performance and regulatory progress will support expansion into new indications. The latest real-world data and planned data presentations have the potential to support the upcoming FDA decision for FSGS, which remains the most important short-term catalyst; however, these updates do not alter the regulatory risk that still poses the biggest near-term threat.

Among recent developments, the September FDA update confirming no advisory committee meeting for the FILSPARI FSGS application stands out. By keeping the PDUFA date set for January 13, 2026, this regulatory milestone keeps investor focus tightly on whether FILSPARI can achieve expanded approval, a pivotal test for Travere’s immediate growth prospects.

By contrast, investors should be aware that heavy financial reliance on FILSPARI means any regulatory or commercial delay could…

Read the full narrative on Travere Therapeutics (it's free!)

Travere Therapeutics' outlook projects $832.7 million in revenue and $221.2 million in earnings by 2028. This reflects a 35.6% annual revenue growth rate and a $390.2 million increase in earnings from the current $-169.0 million.

Uncover how Travere Therapeutics' forecasts yield a $35.71 fair value, a 20% upside to its current price.

Exploring Other Perspectives

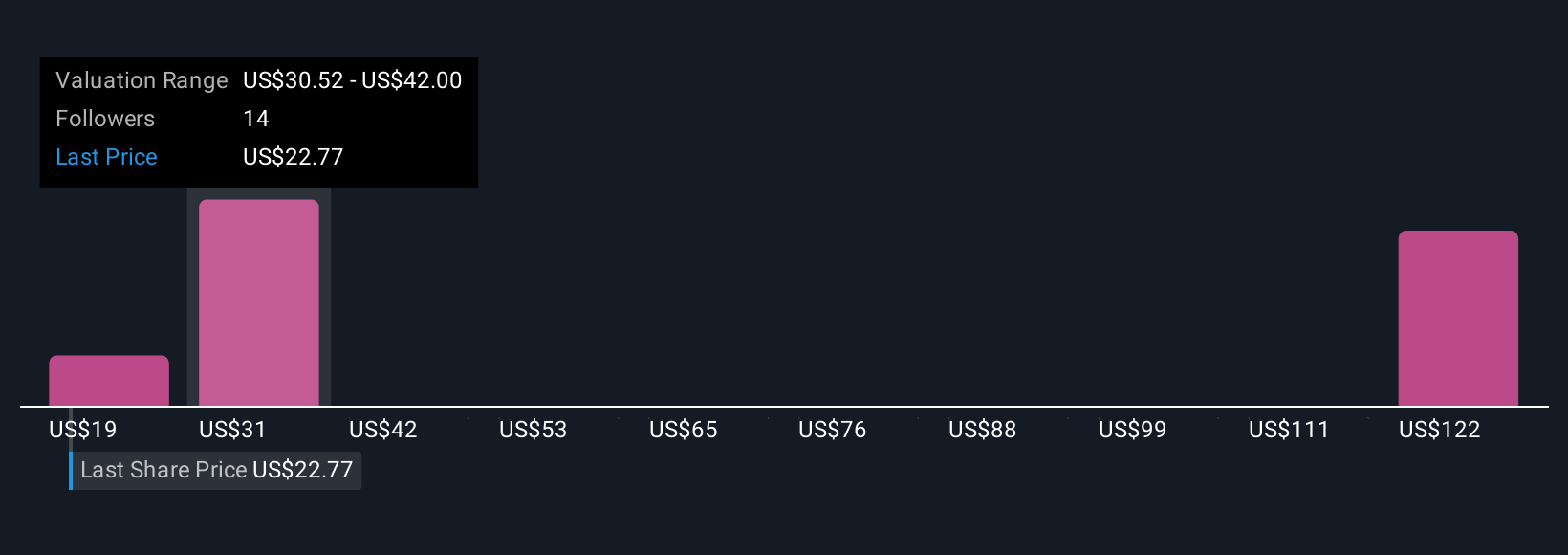

Eight members of the Simply Wall St Community value Travere Therapeutics between US$19.04 and US$134.44 per share, reflecting wide-ranging forecasts. With regulatory approval for FILSPARI in FSGS approaching, your view on its chances could make all the difference to your investment thesis.

Explore 8 other fair value estimates on Travere Therapeutics - why the stock might be worth over 4x more than the current price!

Build Your Own Travere Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travere Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travere Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travere Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives