- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Will Taysha Gene Therapies' (TSHA) Full Control of Rett Program Redefine Its Rare Disease Ambitions?

Reviewed by Sasha Jovanovic

- In October 2025, Taysha Gene Therapies announced it regained full global rights to its TSHA-102 Rett syndrome gene therapy program following the expiration of its option agreement with Astellas, enabling independent advancement of this key asset into pivotal clinical trials.

- This transition grants Taysha unencumbered control over a program that has received FDA Breakthrough Therapy designation and shown promising safety and efficacy, positioning the company with greater strategic flexibility in the rare disease gene therapy market.

- We’ll now explore how regaining full rights to TSHA-102 could influence Taysha’s investment narrative, particularly regarding its regulatory and clinical trajectory.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Taysha Gene Therapies Investment Narrative Recap

To be a Taysha Gene Therapies shareholder, you need to believe in the potential of gene therapy to transform treatment for Rett syndrome and that TSHA-102 can achieve regulatory success and commercialization. The recent regaining of full global rights to TSHA-102 gives Taysha control, supporting advancement of the pivotal REVEAL trial, which remains the crucial near-term catalyst. However, the main short-term risk remains regulatory: setbacks or delays with the FDA could directly impact timelines and financial runway. This news improves strategic flexibility, but does not materially reduce regulatory risk right now. The recent supplemental data announced at the Child Neurology Society Annual Meeting offers relevant support to the TSHA-102 clinical program, showing additional functional gains outside of the primary trial endpoints. This adds to the breadth of clinical evidence as the company approaches its pivotal trial milestones and regulatory discussions, which are key near-term value drivers for the business. However, investors should be aware that while these clinical advances are substantial, regulatory approval can still be affected by...

Read the full narrative on Taysha Gene Therapies (it's free!)

Taysha Gene Therapies' narrative projects $88.9 million in revenue and $14.1 million in earnings by 2028. This requires 120.1% yearly revenue growth and an $103.4 million increase in earnings from the current -$89.3 million.

Uncover how Taysha Gene Therapies' forecasts yield a $9.50 fair value, a 101% upside to its current price.

Exploring Other Perspectives

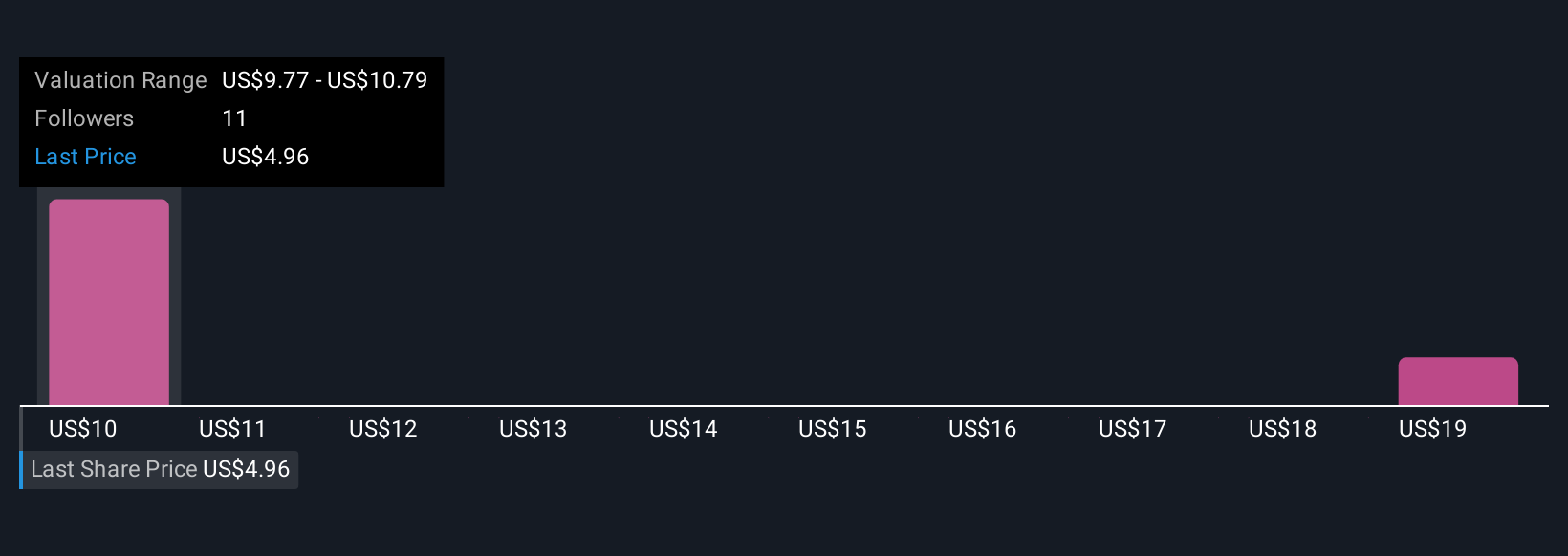

Community fair value estimates for Taysha Gene Therapies range from US$9.50 to US$27.89, based on 3 independent Simply Wall St Community viewpoints. Even with these diverse opinions, the pivotal trial’s outcome remains the single most important factor shaping Taysha’s ability to reach its long-term targets.

Explore 3 other fair value estimates on Taysha Gene Therapies - why the stock might be worth just $9.50!

Build Your Own Taysha Gene Therapies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taysha Gene Therapies research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Taysha Gene Therapies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taysha Gene Therapies' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives