- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Why Taysha Gene Therapies (TSHA) Is Up 46.5% After FDA Breakthrough for Rett Syndrome Therapy

Reviewed by Sasha Jovanovic

- Taysha Gene Therapies announced that the U.S. Food and Drug Administration granted Breakthrough Therapy designation to its lead gene therapy candidate, TSHA-102, for the treatment of Rett syndrome, and finalized agreement on the pivotal REVEAL trial protocol and statistical analysis plan following positive Phase 1/2 data.

- This regulatory milestone, based on a 100% response rate in trial patients for a key developmental endpoint, positions TSHA-102 as a potential disease-modifying therapy and could significantly speed up its pathway to potential approval.

- We’ll examine how Breakthrough Therapy designation and FDA protocol alignment for TSHA-102 could reshape Taysha’s investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Taysha Gene Therapies Investment Narrative Recap

To be a Taysha Gene Therapies shareholder, you need to believe the company can secure regulatory approval and bring its gene therapy for Rett syndrome, TSHA-102, successfully to market. The FDA’s Breakthrough Therapy designation and protocol alignment are material events that address the most important short-term catalyst, expedited pathway to approval, but do not eliminate the risks of clinical or financial setbacks, especially given the company's ongoing net losses and dependence on regulatory timelines.

Among recent announcements, Taysha’s FDA Breakthrough Therapy designation stands out as the most directly relevant. This designation, a result of strong clinical data and FDA alignment, may help the company accelerate its pivotal trial start in late 2025, which supports the near-term approval catalyst and increases visibility for investors tracking regulatory progress.

In contrast, investors should be aware that even with accelerated FDA review, the company’s history of net losses and its dependence on trial outcomes remain...

Read the full narrative on Taysha Gene Therapies (it's free!)

Taysha Gene Therapies’ projections show $88.9 million in revenue and $14.1 million in earnings by 2028. This outlook assumes a 120.1% annual revenue growth rate and a $103.4 million increase in earnings from the current earnings of $-89.3 million.

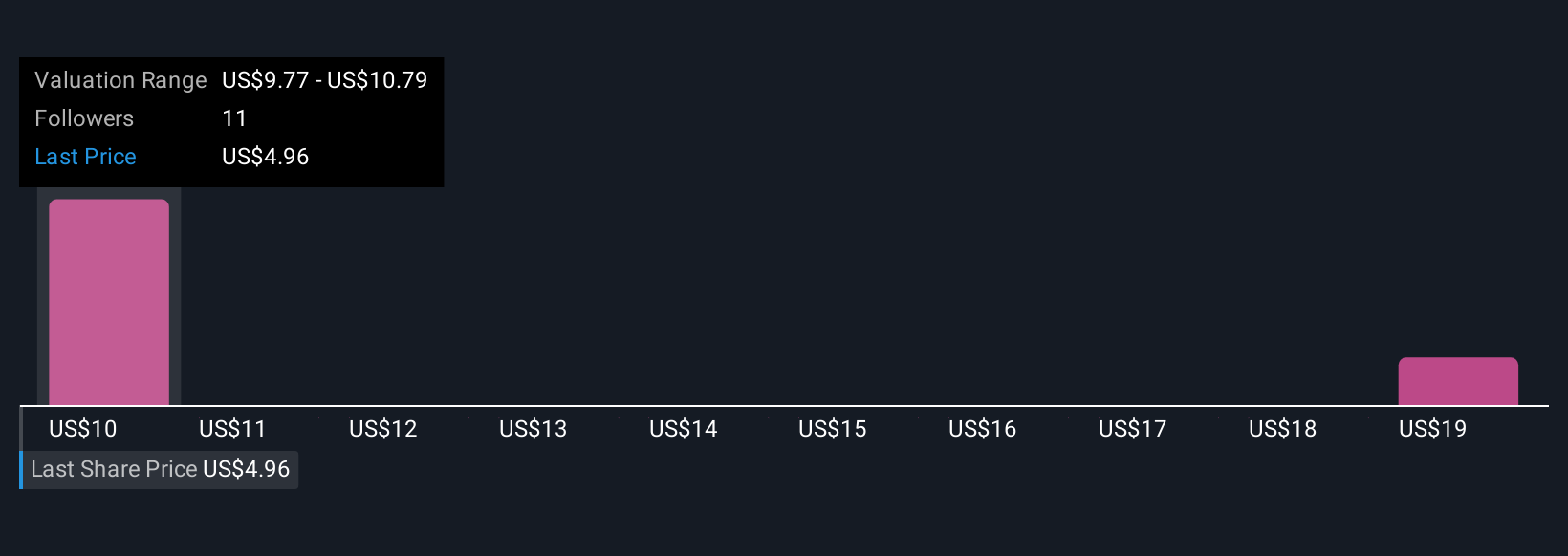

Uncover how Taysha Gene Therapies' forecasts yield a $9.42 fair value, a 98% upside to its current price.

Exploring Other Perspectives

Individual fair value estimates from the Simply Wall St Community for Taysha Gene Therapies range from US$9.42 to US$28.30, based on two distinct forecasts. As recent regulatory milestones aim to speed product approval, these differing views highlight how investor sentiment can shift quickly, be sure to weigh multiple opinions before forming your own outlook.

Explore 2 other fair value estimates on Taysha Gene Therapies - why the stock might be worth over 5x more than the current price!

Build Your Own Taysha Gene Therapies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taysha Gene Therapies research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Taysha Gene Therapies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taysha Gene Therapies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives