- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Taysha Gene Therapies (TSHA): Evaluating Valuation After Leadership Changes, Q3 Results, and $200M Shelf Registration

Reviewed by Simply Wall St

Taysha Gene Therapies (TSHA) released a string of updates, including the arrival of a new Chief Commercial Officer, its latest third quarter financials, and a $200 million shelf registration filing that suggests capital-raising moves could be on the horizon.

See our latest analysis for Taysha Gene Therapies.

After a series of high-profile updates this quarter, Taysha Gene Therapies’ stock has reflected shifting investor sentiment. Despite a recent dip, the 90-day share price return sits at 40.5%, while the year-to-date return has soared to 123%. Over the past year, its total shareholder return reached 100.5%, signaling significant momentum in the wake of new leadership and strategic moves, even as long-term investors are still recovering from losses over the past five years.

If these big moves in biotech have sparked your curiosity, it’s the perfect moment to check out other innovative healthcare players. See the full list for free.

But with volatility and recent leadership changes shaping the company’s narrative, is Taysha Gene Therapies genuinely undervalued at current levels? Or has the market already priced in the next phase of anticipated growth?

Most Popular Narrative: 57.7% Undervalued

Taysha Gene Therapies’ most widely followed narrative presents a markedly higher fair value compared to the recent closing price. This highlights a clear disconnect between market sentiment and forward-looking projections built into the fair value estimate.

"Bullish analysts highlight that Taysha now has sufficient capital following its recent financing. This capital supports operational runway through pivotal trial data and mitigates near-term funding risk."

What is driving this upside? It is not just expectations for clinical progress. This narrative bases its valuation on aggressive growth forecasts and industry-beating profit margins. Get the full details on which surprising financial targets, market share assumptions, and sector dynamics push this fair value so far above today’s price.

Result: Fair Value of $9.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in regulatory approvals or setbacks in pivotal trial data could quickly dampen the optimism surrounding Taysha’s future prospects.

Find out about the key risks to this Taysha Gene Therapies narrative.

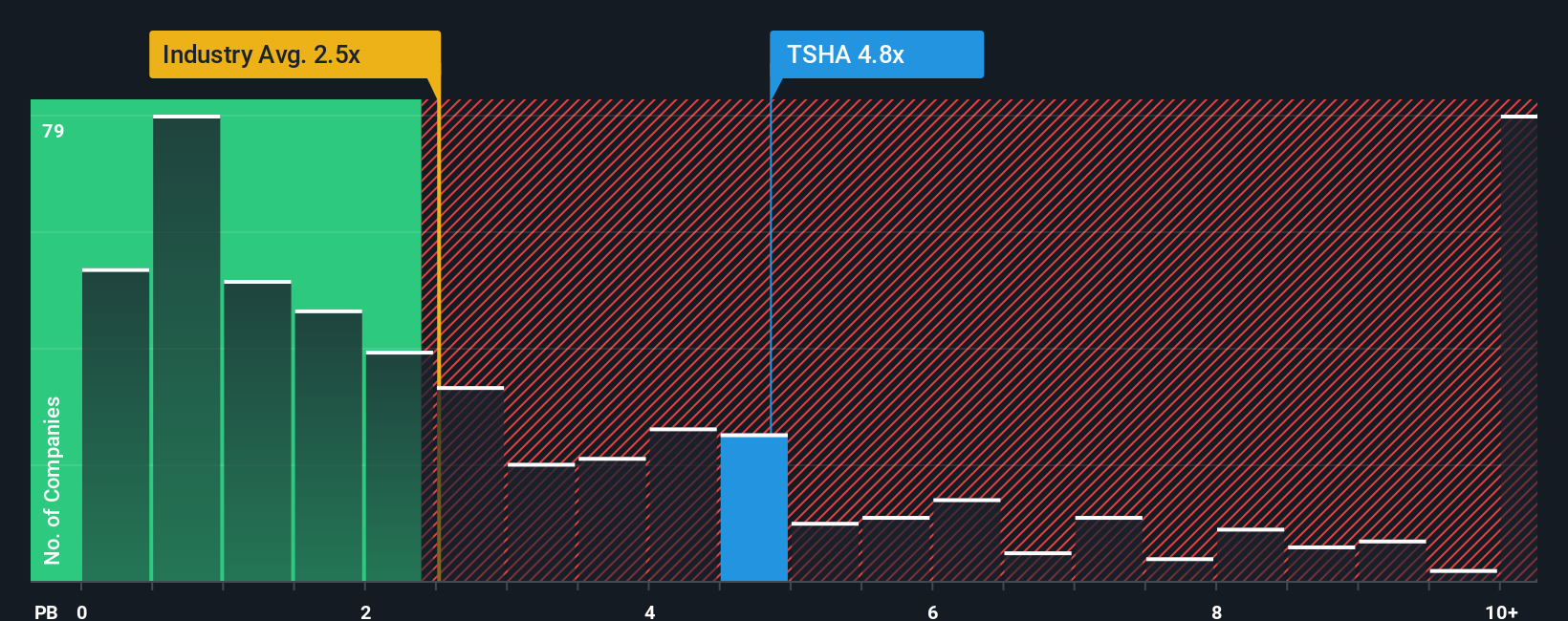

Another View: The Price-to-Book Perspective

Looking through a different lens, Taysha Gene Therapies appears expensive based on its price-to-book ratio of 5.2x. This figure is well above both the US biotech industry average of 2.5x and its peer average of 4.2x. This sizable gap may introduce valuation risks that cannot be ignored, especially given current investor enthusiasm. How much higher can investor optimism carry the stock before reality kicks in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taysha Gene Therapies Narrative

If you want to dig deeper, run your own numbers, or believe there’s more to the story, you can craft your own view in just minutes. Do it your way

A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There are countless ways to put your capital to work, and the smartest opportunities often go unnoticed. Don’t let the next breakout idea slip past you and capitalize now with these proven shortcuts:

- Unlock hidden potential by targeting value plays. Secure your advantage with these 879 undervalued stocks based on cash flows loaded with stocks that could be trading below their worth.

- Supercharge your portfolio with rapid-growth trends. Start building your edge in advanced technologies with these 25 AI penny stocks and ride the AI wave ahead of the crowd.

- Tap into the future of money and security. Position yourself early by tracking promising innovators via these 82 cryptocurrency and blockchain stocks that are shaping digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives