- United States

- /

- Pharma

- /

- NasdaqGM:TRVI

Trevi Therapeutics (TRVI): Valuation Spotlight Following RIVER Trial Data Presentation Announcement

Reviewed by Kshitija Bhandaru

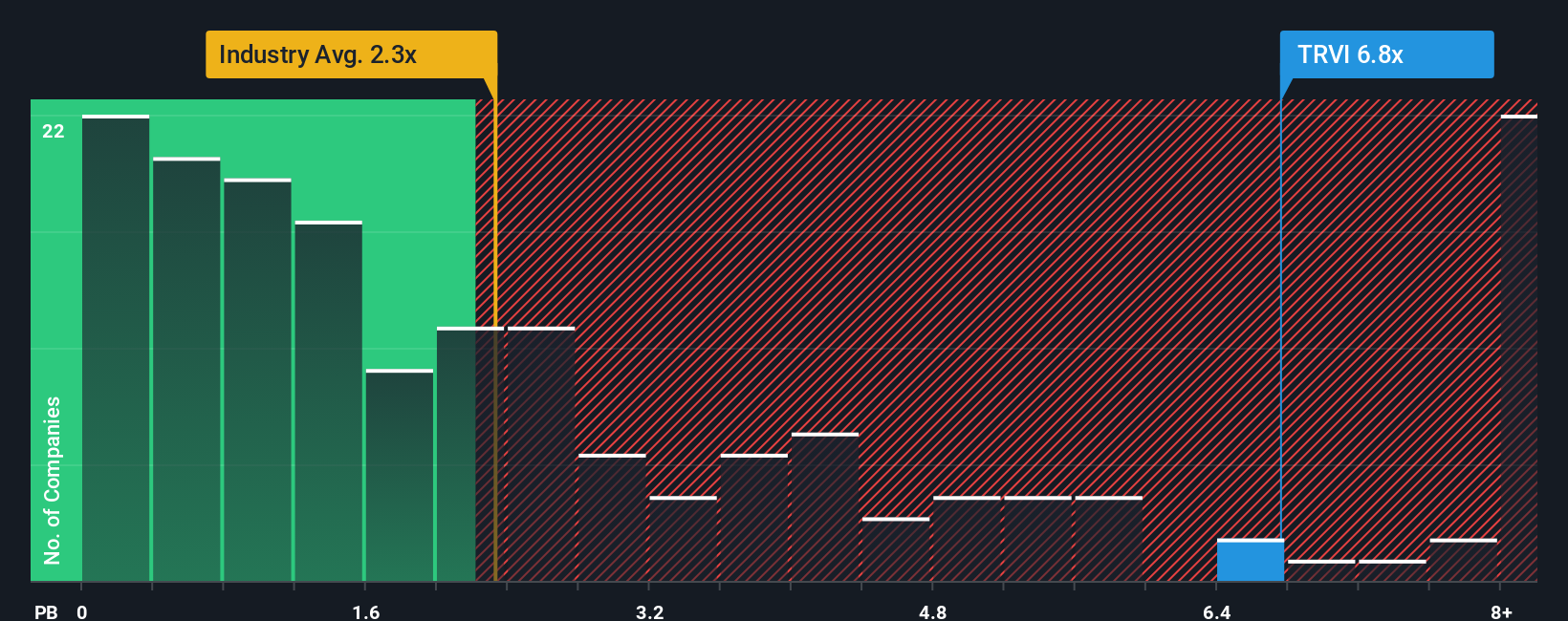

Price-to-Book of 5.1x: Is it justified?

Trevi Therapeutics is currently trading at a price-to-book (P/B) ratio of 5.1x, making it notably more expensive than the US Pharmaceuticals industry average of 2.1x. This suggests that, relative to the book value of its assets, the market is assigning a significant premium to Trevi's shares compared to many of its industry peers.

The price-to-book ratio helps investors assess how the market values a company's net assets. In the biotech and pharmaceutical sector, a high P/B ratio can sometimes reflect expectations of future breakthroughs, successful product commercialization, or strong intangible assets such as intellectual property and pipeline potential.

However, this premium appears to indicate that investors are willing to pay a much higher price for each dollar of Trevi's net assets. This could mean the market is pricing in substantial future pipeline success. Without current profitability or revenue, there is a risk that the valuation may be running ahead of the company’s near-term fundamentals.

Result: Fair Value of $8.38 (OVERVALUED)

See our latest analysis for Trevi Therapeutics.However, without current revenue and with annual net losses, any setback in clinical progress could quickly reverse recent momentum.

Find out about the key risks to this Trevi Therapeutics narrative.Another View: Comparing Multiples

Looking from a different angle, Trevi also appears expensive relative to industry norms when using this method. This again suggests the market is highly optimistic. Could the current price be a step ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trevi Therapeutics Narrative

If you want to draw your own conclusions or dig deeper into Trevi’s story, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Trevi Therapeutics research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to just one stock? Broaden your outlook and take advantage of fresh opportunities that others might miss by searching in smarter places. The right investment moves can set you apart from the crowd. Here are three ways to get started:

- Spot companies shaping health care's future by checking out those harnessing AI. See what's possible through our healthcare AI stocks.

- Pounce on stocks the market may have overlooked and find exceptional value opportunities using our powerful undervalued stocks based on cash flows.

- Tap into game-changing technology trends in quantum computing and join investors seeking tomorrow's tech leaders through our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trevi Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRVI

Trevi Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of investigational therapy for the treatment of chronic cough in patients with idiopathic pulmonary fibrosis (IPF) and non-IPF interstitial lung disease, and refractory chronic cough.

Flawless balance sheet with low risk.

Market Insights

Community Narratives