- United States

- /

- Semiconductors

- /

- NYSE:SQNS

3 US Penny Stocks With Market Caps Under $200M To Consider

Reviewed by Simply Wall St

As the Dow, S&P 500, and Nasdaq reach record highs fueled by a surge in technology stocks, investor optimism is palpable. In such a buoyant market climate, penny stocks—often overlooked yet still significant—present intriguing opportunities for those seeking growth potential in smaller or newer companies. Though the term may seem outdated, these stocks can offer substantial returns when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.36 | $1.96B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.85 | $6.03M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.14M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.97 | $90.69M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.5309 | $51.48M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.39B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9244 | $84.37M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tiziana Life Sciences (NasdaqCM:TLSA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tiziana Life Sciences Ltd is a biotechnology company that focuses on discovering and developing molecules to treat human diseases in oncology and immunology in the United States, with a market cap of $99.27 million.

Operations: Currently, there are no reported revenue segments for this biotechnology company.

Market Cap: $99.27M

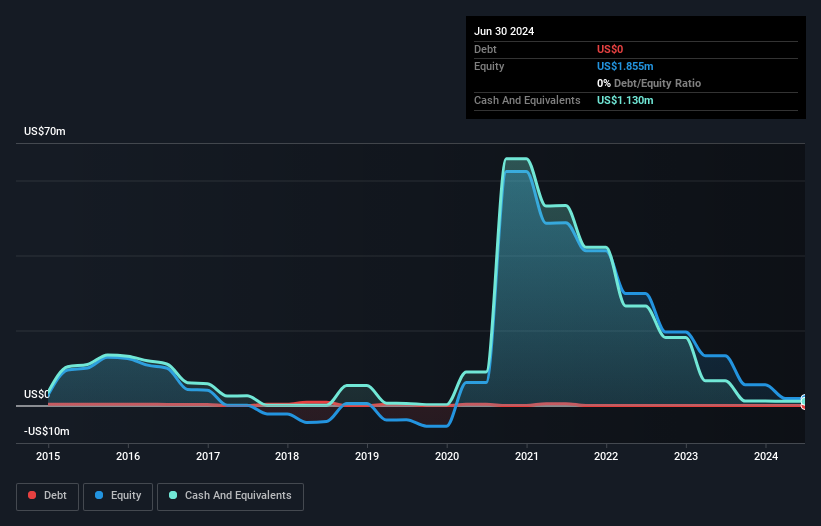

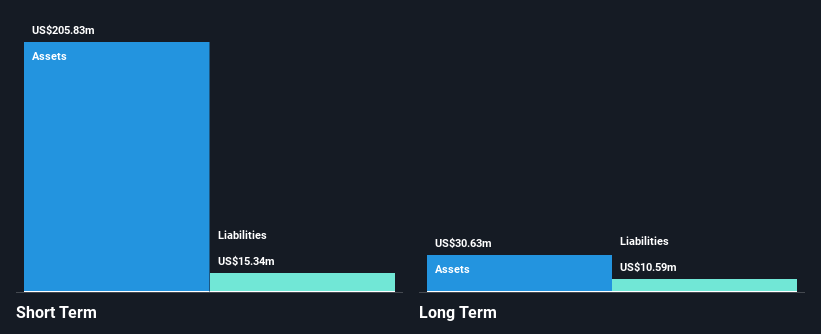

Tiziana Life Sciences, a pre-revenue biotechnology company with a market cap of US$99.27 million, is actively advancing its intranasal foralumab through Phase 2 trials for non-active secondary progressive multiple sclerosis (SPMS). Despite having no significant revenue streams, the company has been expanding its clinical trials to prestigious institutions like Yale and Johns Hopkins. Recent positive preclinical results suggest potential in combining foralumab with semaglutide to address obesity-related inflammation. However, Tiziana's financial health shows short-term assets of US$7.8M not covering liabilities of US$9.1M and recent shareholder dilution due to equity offerings.

- Click to explore a detailed breakdown of our findings in Tiziana Life Sciences' financial health report.

- Explore historical data to track Tiziana Life Sciences' performance over time in our past results report.

Quantum-Si (NasdaqGM:QSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quantum-Si is a life sciences company focused on developing a single-molecule detection platform for Next Generation Protein Sequencing, with a market cap of approximately $159.84 million.

Operations: The company generates its revenue from the Biotechnology (Startups) segment, amounting to $2.27 million.

Market Cap: $159.84M

Quantum-Si, with a market cap of US$159.84 million, is navigating challenges typical for penny stocks. Recent product launches like the Platinum Library Prep Kit and protein Barcoding Kit highlight its innovative strides in proteomics, aiming to simplify workflows and enhance research capabilities. Despite these advancements, Quantum-Si remains unprofitable with revenues at US$2.27 million and faces potential Nasdaq delisting due to non-compliance with bid price requirements. The company has no debt and sufficient cash runway for nearly two years but operates under a relatively inexperienced management team while striving for significant revenue growth projected at 70.7% annually.

- Click here to discover the nuances of Quantum-Si with our detailed analytical financial health report.

- Explore Quantum-Si's analyst forecasts in our growth report.

Sequans Communications (NYSE:SQNS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sequans Communications S.A. is a fabless company that designs, develops, and supplies cellular semiconductor solutions for the massive and broadband internet of things markets globally, with a market cap of $85.73 million.

Operations: The company's revenue is primarily generated from the design and marketing of semiconductor components for cellular wireless systems, amounting to $30.56 million.

Market Cap: $85.73M

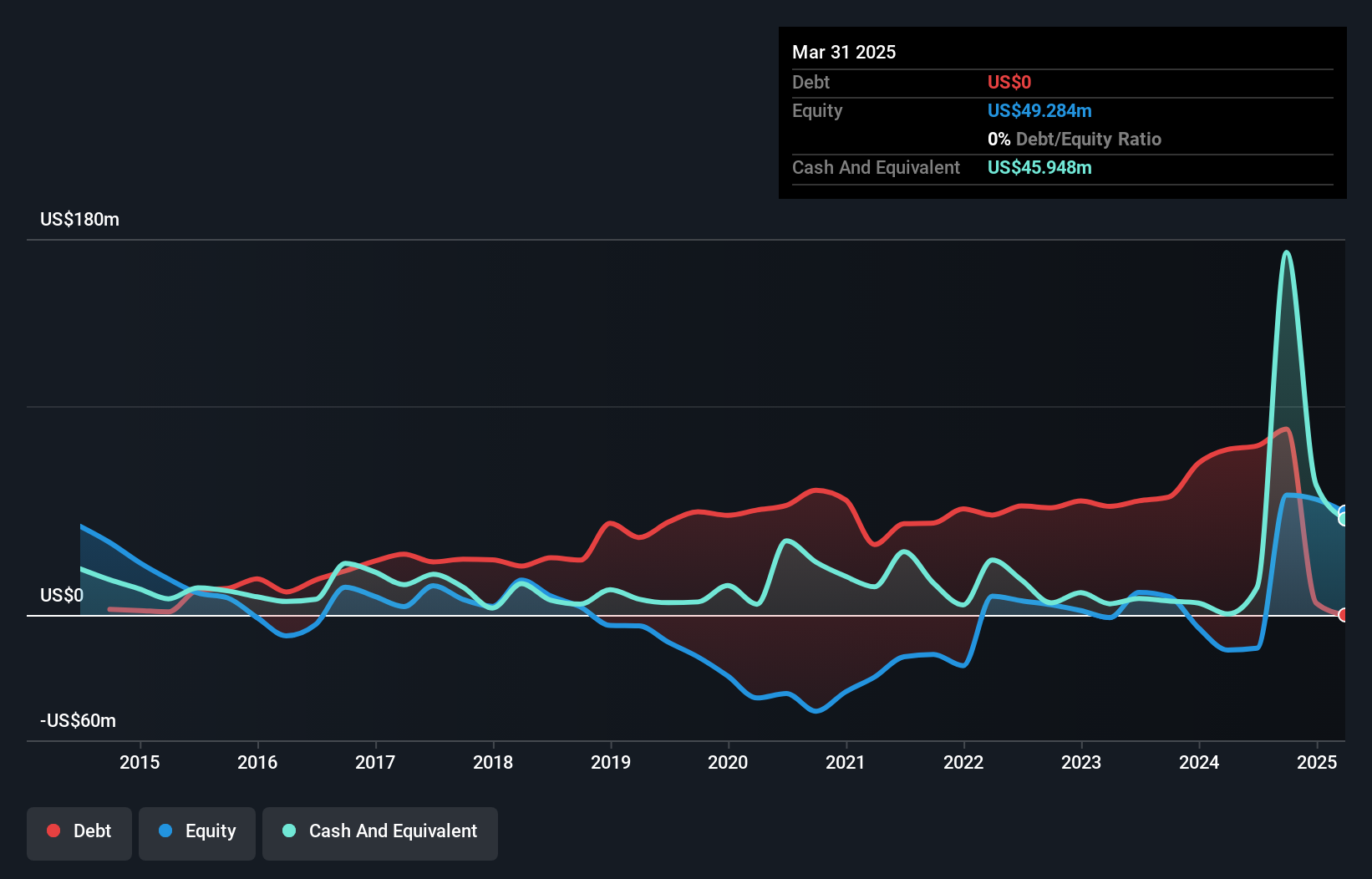

Sequans Communications, with a market cap of US$85.73 million, has shown significant financial improvement by becoming profitable and reporting a net income of US$72.28 million for Q3 2024, compared to a loss the previous year. The company is trading below its estimated fair value and maintains positive shareholder equity after reducing debt over time. Despite this progress, Sequans faces challenges such as high share price volatility and recent asset impairments totaling US$56.59 million. The company anticipates sequential revenue growth in Q4 2024, supported by product revenue increases and strategic partnerships like the Qualcomm deal.

- Click here and access our complete financial health analysis report to understand the dynamics of Sequans Communications.

- Evaluate Sequans Communications' prospects by accessing our earnings growth report.

Summing It All Up

- Explore the 706 names from our US Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQNS

Sequans Communications

Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets in Taiwan, Korea, China, rest of Asia, Germany, the United States, and internationally.

Undervalued moderate.