- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

What Do Recent US Cannabis Reform Hopes Mean for Tilray’s Share Price Valuation?

Reviewed by Bailey Pemberton

Deciding what to do with Tilray Brands right now is no easy feat. The stock has been on a wild ride lately, with a 35.3% gain over the last week and up 28.8% over the past month. Year to date, it is still up 10.3% despite trailing off over the past year with a -5.3% return. Step back three years, and the share price tells a different story with a hard-to-ignore decline of 58.7%. Whether you are a believer in cannabis industry momentum or warily watching from the sidelines, it is impossible to ignore these shifting trends. Volatility is ever-present, but so is the potential for big moves.

What is behind these recent swings? Most notably, optimism around shifting U.S. cannabis reform has reignited attention in the sector, sending cannabis-related stocks like Tilray surging. With speculation growing around future regulatory changes and more states embracing legal sales, investors are seeing new reasons to revisit companies that once seemed out of favor.

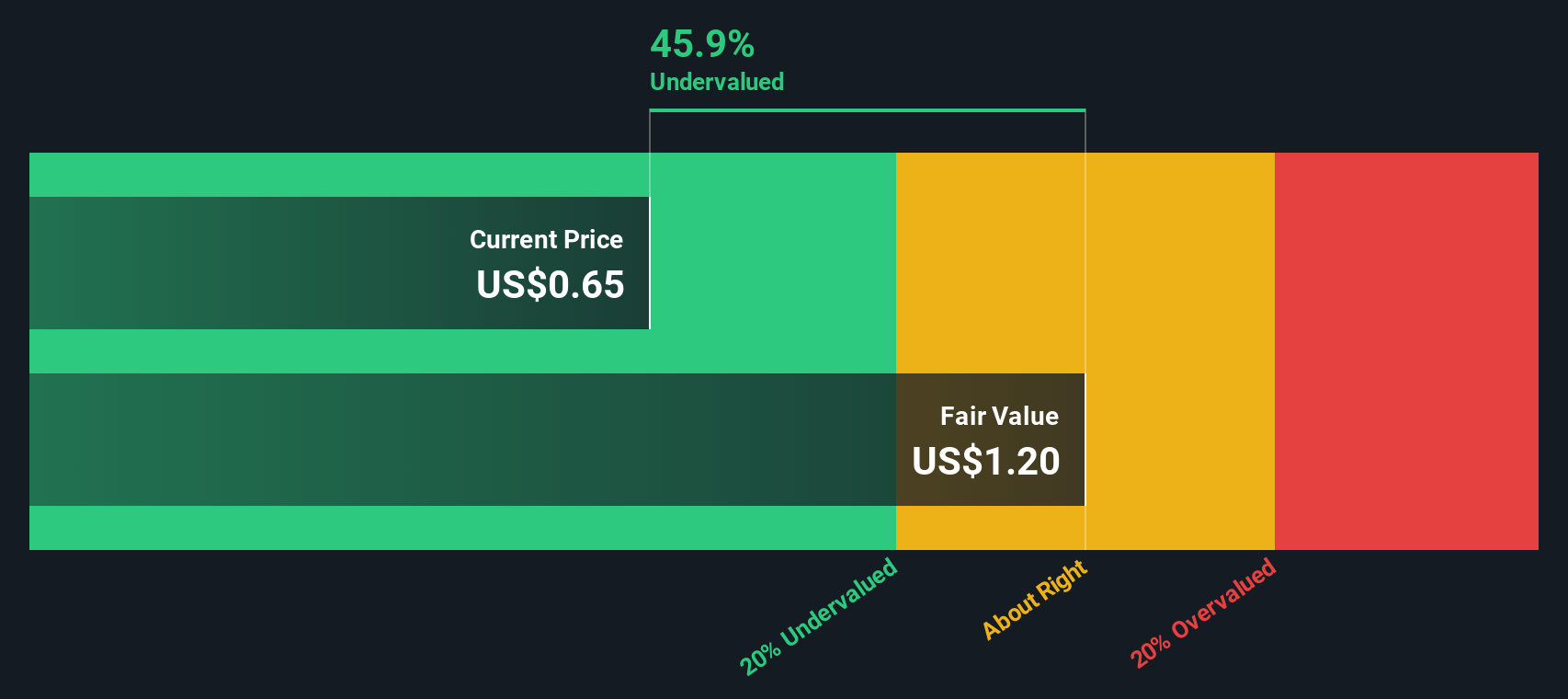

With all this action, is Tilray Brands undervalued or is the share price just chasing headlines? By our valuation score, the company gets a 2 out of 6, meaning it is undervalued in two checks but still comes up short in several others. So, what does that actually mean for you and your portfolio? Let’s break down the most common ways analysts value a company, and why there might just be an even smarter way to assess Tilray’s true worth by the end of this article.

Tilray Brands scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tilray Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. This approach helps investors gauge whether a company's stock price reflects its true earning potential in the years ahead.

For Tilray Brands, the most recent Free Cash Flow (FCF) stands at -$125.05 Million. Analyst forecasts suggest an improvement, with FCF projected to reach approximately $45 Million by 2030. Estimates up to five years are built from a consensus of analyst predictions; future years rely on extrapolations. The DCF model used here is a two-stage Free Cash Flow to Equity method, designed to capture both near-term tightening and longer-term growth assumptions.

According to this model, Tilray’s estimated intrinsic value is $1.18 per share. Compared to its current trading price, this implies the stock is about 36.6% overvalued by the DCF method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tilray Brands may be overvalued by 36.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tilray Brands Price vs Sales

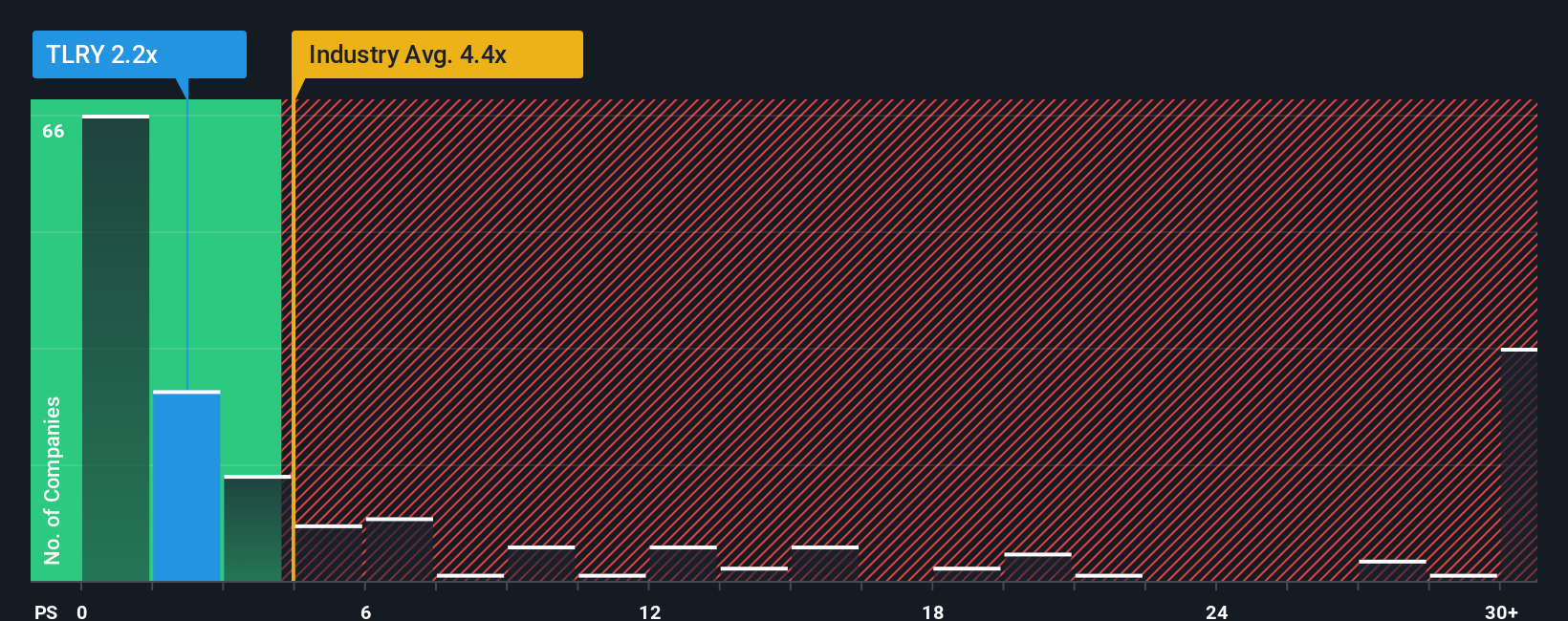

For companies like Tilray Brands that are not yet consistently profitable, the price-to-sales (P/S) ratio is often a more practical valuation tool than earnings-based ratios. The P/S multiple evaluates a company’s market value relative to its sales, making it especially useful when profits are erratic or negative, as is common in fast-changing industries such as cannabis.

Growth expectations and company-specific risks play a big role in what is considered a “normal” or fair P/S ratio. High-growth companies or those with innovative products may justify a premium. Firms with greater uncertainty typically trade at a discount.

Currently, Tilray Brands trades at a P/S ratio of 2.19x. Compared to the pharmaceuticals industry average of 4.43x and its peer group’s average of 1.50x, Tilray sits somewhere in the middle. Simply Wall St’s proprietary “Fair Ratio” for Tilray is 2.38x. This Fair Ratio is calculated based on a combination of factors unique to Tilray, such as its growth profile, operating risks, profit margins, industry dynamics, and market capitalization. This provides a more holistic valuation benchmark than simply comparing industry standards or peer averages.

Given that Tilray’s actual P/S of 2.19x is very close to the Fair Ratio of 2.38x, the stock appears to be fairly valued at current prices.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tilray Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives: a smarter, more dynamic approach that connects a company’s real-world story with the numbers behind its financial forecasts and fair value.

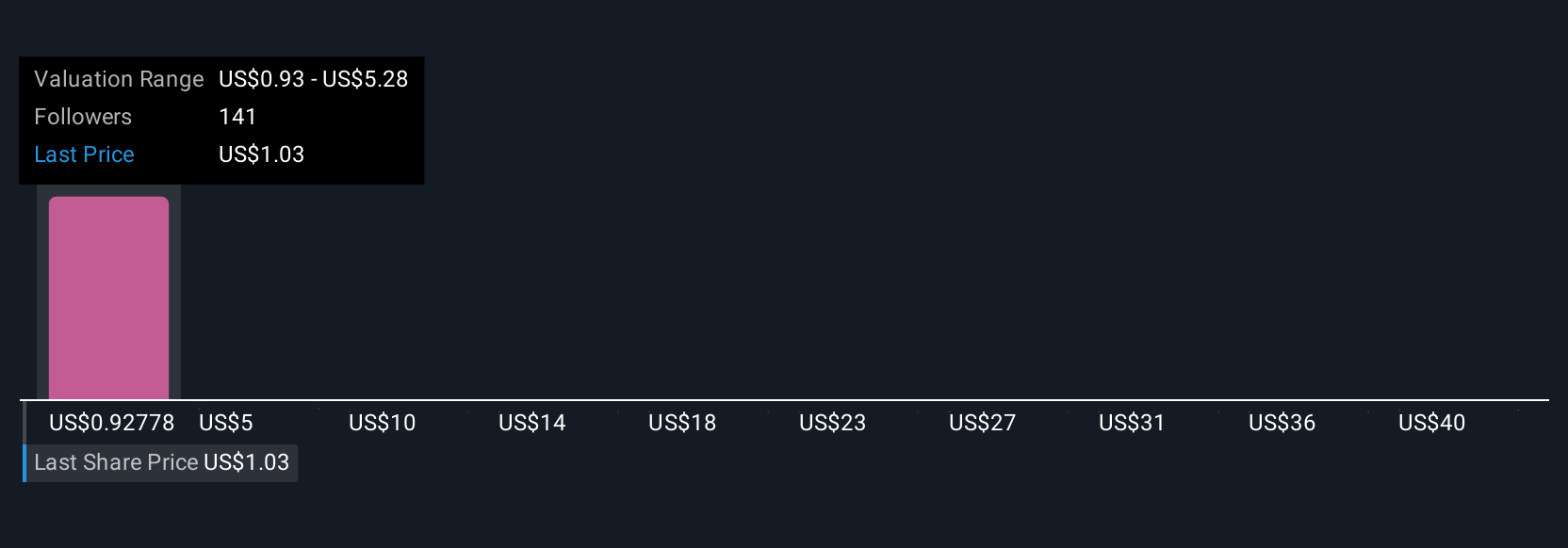

A Narrative lets you express your own perspective about Tilray Brands by combining the wider context of what’s happening in the cannabis industry, your assumptions for future growth and margins, and what you think the company is truly worth. Narratives bring the numbers to life by explaining why you’ve arrived at your estimates and fair value, making investment decisions more transparent and meaningful.

On Simply Wall St’s Community page, millions of investors are already using Narratives to compare their unique views, monitor changes, and see how fair value stacks up against the actual share price. Easy to create and update, Narratives automatically adjust when news, earnings or key data change, so your thesis is never out of date.

For example, one investor’s Narrative for Tilray Brands might highlight European expansion and a shift to premium products, which could lead to a bullish $1.50 fair value. On the other hand, a more cautious outlook citing regulatory and profitability risks could set fair value as low as $0.60. Narratives empower you to invest with confidence by turning your story into actionable numbers.

Do you think there's more to the story for Tilray Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success