- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray’s Global Medical Cannabis Expansion Might Change The Case For Investing In Tilray Brands (TLRY)

Reviewed by Sasha Jovanovic

- Tilray Medical, a division of Tilray Brands, recently announced expanded pricing support programs in Canada and broadened international operations, including new licenses, product launches, and partnerships in Panama, Germany, Italy, and Australia to advance medical cannabis accessibility.

- These developments suggest Tilray's increasing focus on both affordability for patients at home and building a diversified, global presence in medical cannabis and related consumer goods.

- We’ll explore how Tilray’s expanded global cannabis initiatives and inclusive Canadian patient programs could reshape the company’s long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Tilray Brands Investment Narrative Recap

To be a Tilray Brands shareholder, you need to believe in the company’s ability to build a truly global cannabis and consumer goods platform that can expand despite near-term uncertainty around US legalization and ongoing profitability challenges. While Tilray Medical’s expanded pricing support in Canada may enhance its domestic credibility and inclusivity, this development does not appear to materially impact the biggest short-term catalyst, progress on US regulatory reform, or reduce ongoing risks from international regulatory shifts or domestic price compression.

The recent move into Panama, granting Tilray a license to cultivate and distribute medical cannabis locally, stands out as particularly relevant. This initiative aligns closely with Tilray’s international growth catalysts and signals a strengthened commitment to diversified revenue sources beyond the maturing Canadian market and the still-developing US sector.

However, with ongoing headwinds in key global and Canadian markets, investors should also be aware that international regulatory changes, such as potential restrictions in Germany, could suddenly disrupt future growth momentum...

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands' narrative projects $940.4 million revenue and $193.4 million earnings by 2028. This requires 4.6% yearly revenue growth and a $2.4 billion earnings increase from current earnings of -$2.2 billion.

Uncover how Tilray Brands' forecasts yield a $1.78 fair value, a 38% upside to its current price.

Exploring Other Perspectives

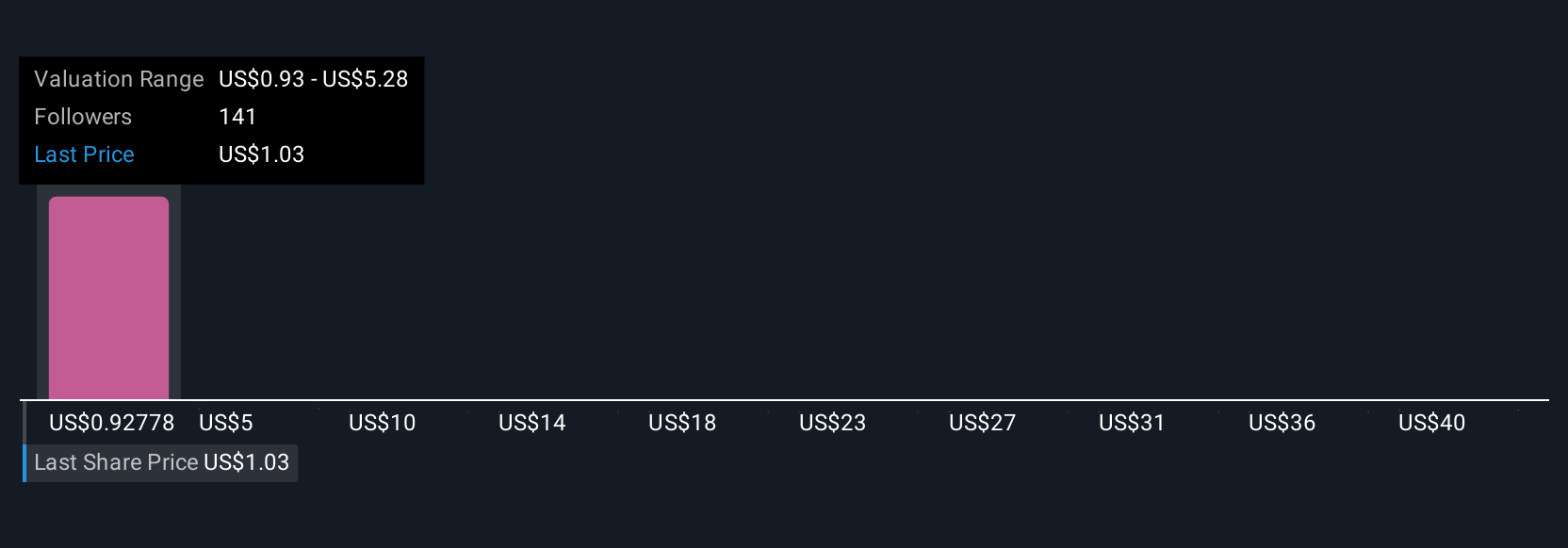

Twenty members of the Simply Wall St Community provided fair value estimates for Tilray, spanning US$1.12 to US$8.04 per share. Views on the company’s growth potential are just as wide ranging as the market’s approach to international regulatory risk, so you may want to explore several perspectives before making up your own mind.

Explore 20 other fair value estimates on Tilray Brands - why the stock might be worth 13% less than the current price!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives