- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Can Tilray (TLRY) Broaden Its US Reach Through New Cannabis Beverage Offerings and Evolving Regulation?

Reviewed by Simply Wall St

- In August 2025, Tilray Brands expanded its hemp-derived Delta-9 THC beverage offerings with new 10mg formats under the Fizzy Jane’s and Happy Flower brands, making these products available in more U.S. states and retail locations.

- This move highlights Tilray’s continued push to diversify its product portfolio and reach new consumers amidst growing regulatory discussions around cannabis in the United States.

- We’ll examine how Tilray’s broader U.S. beverage launch and shifting federal cannabis sentiment could influence the company’s growth outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tilray Brands Investment Narrative Recap

To be a Tilray Brands shareholder, you have to believe in the company’s ability to expand its U.S. addressable market as regulations and consumer demand evolve. The August launch of new hemp-derived Delta-9 drinks adds excitement, but any change in federal cannabis policy remains the primary short-term catalyst and risk, until federal reform truly materializes, the business impact is limited.

Among recent announcements, the July earnings report stands out: Tilray posted a much larger net loss and a sizeable impairment charge, further highlighting ongoing profitability challenges. For investors tracking regulatory developments, these financial results cement why potential U.S. reform could matter so much to the bottom line.

By contrast, investors should note unresolved issues around operating profitability, especially as recent impairment and net loss figures suggest…

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands' narrative projects $940.4 million revenue and $193.4 million earnings by 2028. This requires 4.6% yearly revenue growth and a $2.4 billion increase in earnings from -$2.2 billion.

Uncover how Tilray Brands' forecasts yield a $0.928 fair value, in line with its current price.

Exploring Other Perspectives

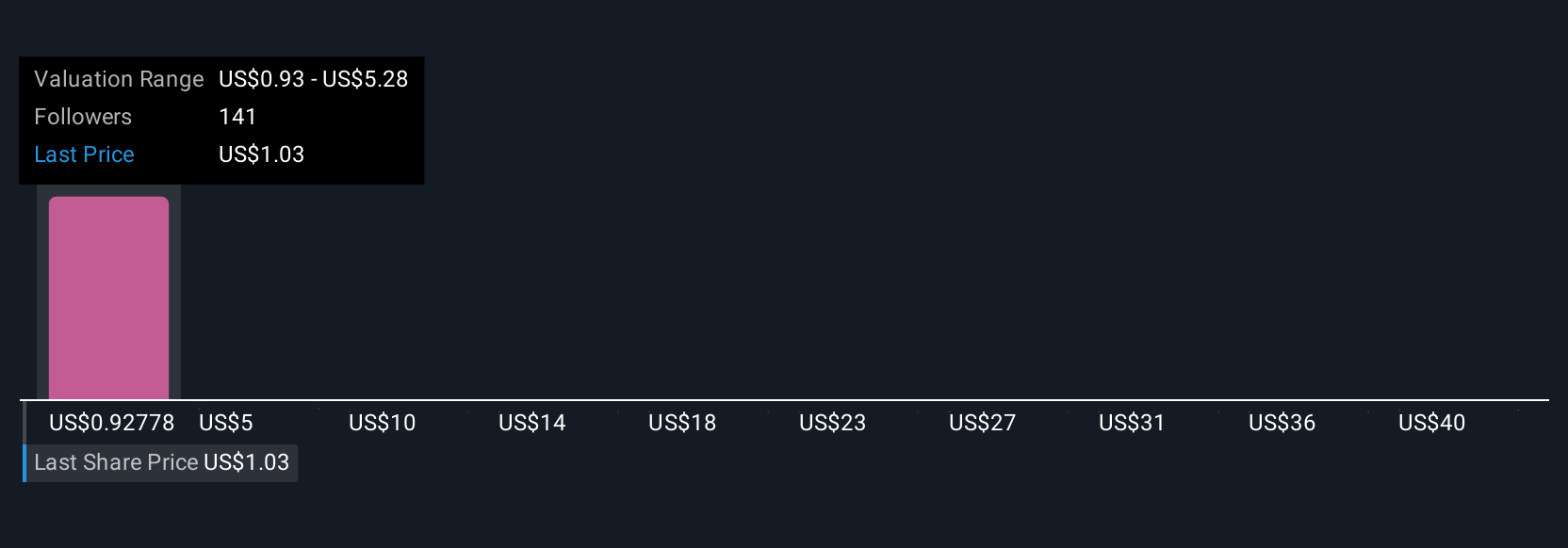

Simply Wall St Community members set fair values for Tilray Brands ranging from US$0.93 to US$44.45 based on 17 unique analyses. With persistent net losses and a shrinking addressable market still top of mind, you can see why opinions differ so widely.

Explore 17 other fair value estimates on Tilray Brands - why the stock might be worth just $0.928!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success