- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

A Fresh Look at TG Therapeutics (TGTX) Valuation Following Phase 3 ENHANCE Trial Enrollment Completion

Reviewed by Simply Wall St

TG Therapeutics (TGTX) has completed enrollment in the randomized cohort of its Phase 3 ENHANCE trial, which tests a consolidated BRIUMVI dosing schedule for people with relapsing multiple sclerosis. This step could pave the way for a more streamlined infusion process starting in 2027.

See our latest analysis for TG Therapeutics.

Shares of TG Therapeutics have demonstrated solid momentum this year, with an 8.8% year-to-date share price gain and a striking 34.4% total return for shareholders over the past 12 months. That growth builds on an impressive track record. Long-term holders have seen a remarkable 461% total return over three years, showing persistent confidence as new milestones like the latest BRIUMVI trial progress make headlines.

With the biotech landscape full of innovators bringing next-generation therapies to market, now is the perfect time to explore more standout opportunities. See the full list of emerging healthcare leaders on our See the full list for free..

Yet with shares still trading nearly 29% below analyst price targets, investors are left to ponder whether TG Therapeutics remains undervalued or if all the future growth has already been factored in.

Most Popular Narrative: 22.5% Undervalued

According to the most widely followed narrative, TG Therapeutics’ fair value estimate stands noticeably above the last close of $33.78 per share. This divergence sets the stage for a deeper look at the high-growth story powering the current valuation debate.

The planned launch of subcutaneous (subcu) BRIUMVI is a significant upcoming catalyst, as it could unlock access to 35 to 40% of the anti-CD20 MS market segment currently dominated by self-administered therapies, greatly increasing BRIUMVI's addressable market and supporting long-term revenue growth. Demographic changes, such as the aging population and the rising prevalence of chronic diseases like multiple sclerosis, are expected to drive sustained demand for advanced therapeutics. This supports both ongoing expansion of BRIUMVI sales and future pipeline potential, positively impacting both top-line revenue and long-term earnings visibility.

Is this valuation fueled by a bold bet on outsized sales, fatter profit margins, and relentless top-line momentum? The narrative’s key assumptions might surprise you. Uncover which dramatic projections are baked in and why some see room to run.

Result: Fair Value of $43.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected competition or setbacks with BRIUMVI’s rollout could challenge bullish assumptions and quickly change TG Therapeutics’ growth outlook.

Find out about the key risks to this TG Therapeutics narrative.

Another View: Is the Market Already Too Optimistic?

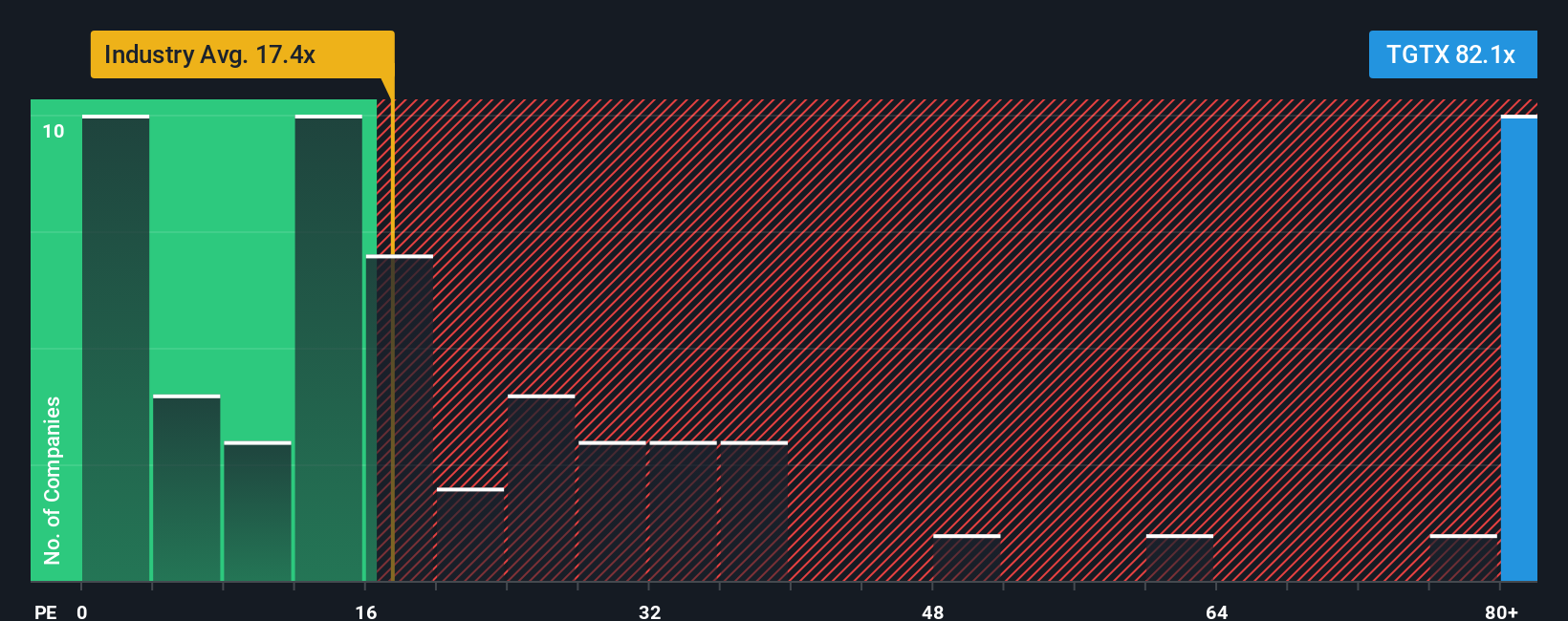

Looking through the lens of earnings multiples, TG Therapeutics currently trades at a price-to-earnings ratio of 81.5x, far above both its industry average of 17.4x and its fair ratio of 29.6x. This premium suggests investors are already paying up for big growth expectations. Could it create risks if future results fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TG Therapeutics Narrative

If you see the story differently, or want to test your own insights against the numbers, you can build a narrative in just a few minutes with our tools. Do it your way.

A great starting point for your TG Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself every advantage in today’s market. Curated stock lists can reveal opportunities you might never spot otherwise. Don’t let great finds pass you by.

- Tap into growth by reviewing these 856 undervalued stocks based on cash flows for companies trading below their intrinsic worth and positioned for stronger long-term returns.

- Unlock the potential of transformative artificial intelligence breakthroughs through these 26 AI penny stocks and get ahead of tomorrow’s key innovators.

- Capture reliable income streams when you scan these 21 dividend stocks with yields > 3%, spotlighting stocks that offer yields above 3% for consistent cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives